BlackRock’s Ethereum Purchase is Fuelling ETF Staking Rumors

Blackrock bought large quantities of Ethereum, contributing to rumors that he plans to launch wicks on Son ETF. The SEC recently ruled that protocols to “mark out as a service” are not titles, which stimulates speculation more.

When the Commission modified this rule, it attracted the ardent conviction of current and former employees. Currently, Blackrock’s biggest obstacle could be to fight against a political battle.

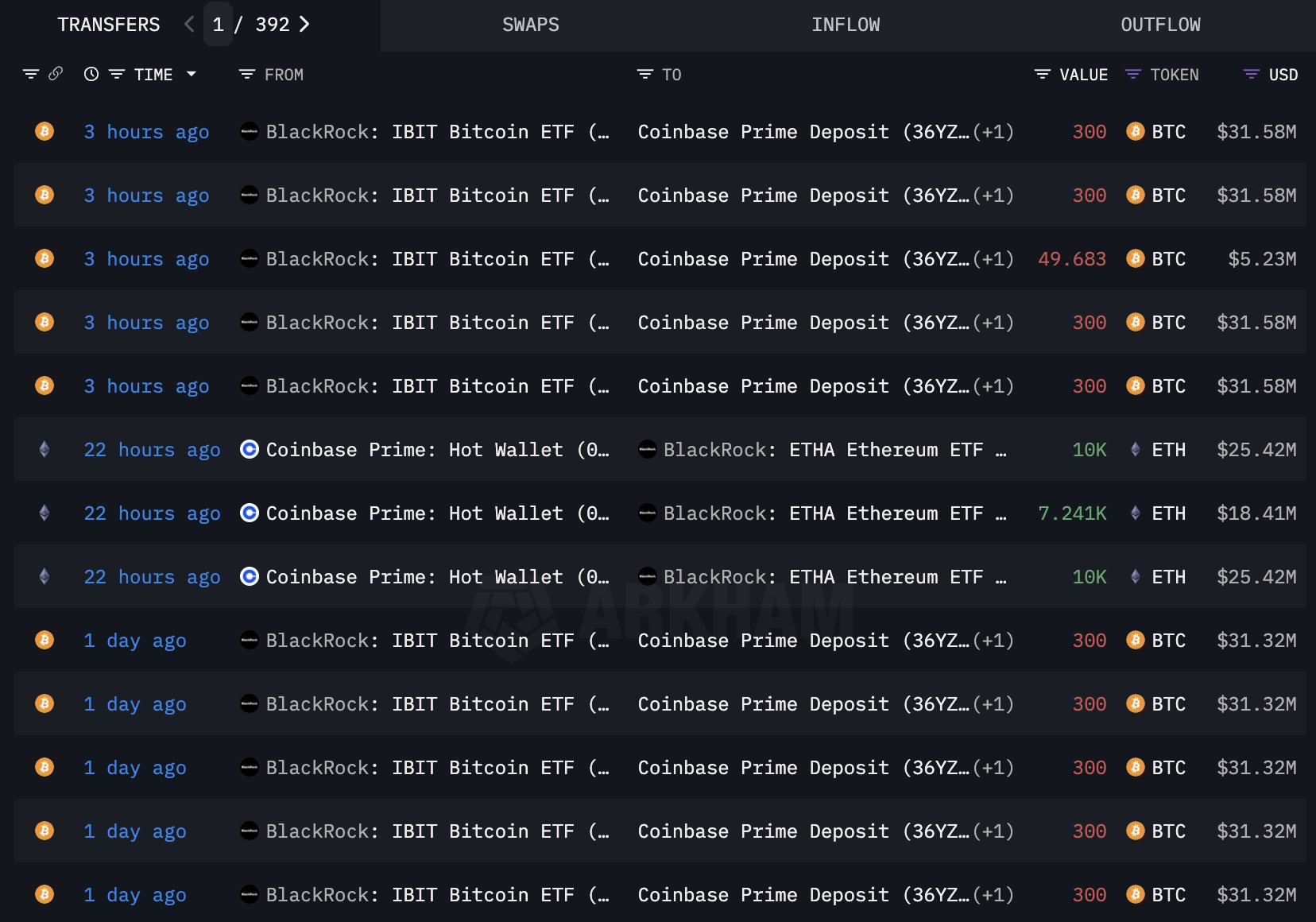

Blackrock sells Bitcoin for Ethereum

Blackrock is currently making the largest ETF ETF, and this market is doing particularly well at the moment. However, since the SEC has updated its policy on the stimulation of ETFs a few days ago, several asset managers have already submitted proposals to take advantage of it.

The data on the chain show that Blackrock buys a lot of Ethereum, leading to rumors that he targets an ETF of jealous:

More specifically, Blackrock sells huge amounts of bitcoin to pay for this Ethereum. This could, in all likelihood, be due to the growing demand of FNB Ethereum on the American market at the moment.

ETHEREUM ETHEREM have experienced 11 consecutive days of entries, and total net assets are approaching $ 10 billion. However, some key evidence support the rumors of implementation of the FNB.

Major issuers have constantly demanding the featured fee of ETFs, and the SEC kicked a decision in April. Now that the commission has judged that the protocols “ignition as a service” are not titles, it could open up to this new product.

It seems that Blackrock leaders put pressure on the dry to officially confirm this new change of rule.

So what is the problem? If the dry is ready and the industry wishes to greatly, why could the commission not officially approve the integration of jealous in the ETF Spot?

In a word, the main obstacles seem to be political. The SEC has already aroused controversy over its recent friendly political changes. His recent decision on the POS only condemned.

Caroline Crenshaw, an anti-Crypto commissioner, also attacked the decision to set the SEC ETF, affirming that her cryptographic policy is practically defined by a thought.

The whole cryptography industry receives increased hostility and a reduction in support in the political sphere. If this request becomes a big fight, it can be expensive. Is this the highest priority right now?

In addition, even if the milestone of cryptography is not the case with the current securities law, the SEC will always have to examine the way in which driving mechanics interact with the care and risk disclosure. It should be comfortable that retail investors are not faced with hidden reduction or liquidity constraints.

In simple terms, this hypothetical product offer is not the only lucrative opportunity that needs political support. The dry could still approve the feature of ETFs, but it is the biggest obstacle for the moment.

Blackrock’s internal logic is opaque; It may be to prepare a major effort or focus on other priorities. For the future, it could go in both directions.

The purchase of Post BlackRock Ethereum fuels the implementation rumors of the FNB appeared first on Beincrypto.