BlackRock’s IBIT ETF Could Hit $100 Billion in July

The FNB IBIT of BlackRock (Fund negotiated on the stock market) turns the head in the middle of sustained growth in its net assets, analysts claiming that it could reach $ 100 billion this month.

The financial instrument recently passed as the most profitable FNB of the asset manager, generating more income than the S&P 500 fund in BlackRock.

Can the Ibit of Blackrock reach $ 100 billion in assets in July? The analyst says yes

ETF analyst Eric Balchunas said that the ETF Ibit of Blackrock could reach $ 100 billion in net assets in July. Optimism occurs in the middle of the coherent positive flows in the financial instrument, because institutional investors are looking for an indirect exposure to the BTC via IBIT.

“I wrote last week that Ibit could reach $ 100 billion this summer, but hell could be this month. Thx with recholot + nights of the night, it’s already at 88 billion dollars,” Balchunas wrote.

Indeed, the data on the research tool on Sosovalue cryptographic investment corroborates these perspectives, showing sustained growth in the daily volume for the BlackRock FNB IBIT.

From July 14, the net assets of Ibit amounted to $ 85.96 billion after positive flows supported each day of negotiation since June 9.

The cases of negative flows, or outputs, are also isolated, without any in July, adding credibility to the supposition of Balchunas that the value of net assets Ibit could reach $ 100 billion this month.

Meanwhile, reports indicate that Ibit is the most profitable FNB in BlackRock. More closely, this is the fastest financial instrument of the asset manager on growth measures After breaking the $ 80 billion mark. He took this stage on July 11, only 374 days after its launch.

Beyond net assets, the Ibit of Blackrock is also the largest ETF of income metrics, exceeding the S&P 500 ETF (IVV) of the asset manager, because it generates $ 186 million per year. A notable reduction in the volatility of Ibit accentuates this traction, which makes it almost as stable as the S&P 500.

In addition, it is impossible to separate the growth of Ibit from Bitcoin’s overvoltage, the two active ingredients enjoying a symbiotic relationship. On the one hand, Ibit gives institutional investors indirect access to Bitcoin via a regulated vehicle, culminating in a BTC price thrust.

On the other hand, the growth in the price of Bitcoin benefits directly from the net assets of the asset manager, as the value of the IBIT increases in tandem.

This arouses more interest from investors, stimulating the assets of BlackRock under management (AUM), and therefore generating more costs. As its profitability increases, the same goes for its domination in the Bitcoin ETF breed.

Blackrock buys $ 386 million in Bitcoin

Elsewhere, BlackRock added to its stock Bitcoin, acquiring 3,294 additional BTC for $ 386 million.

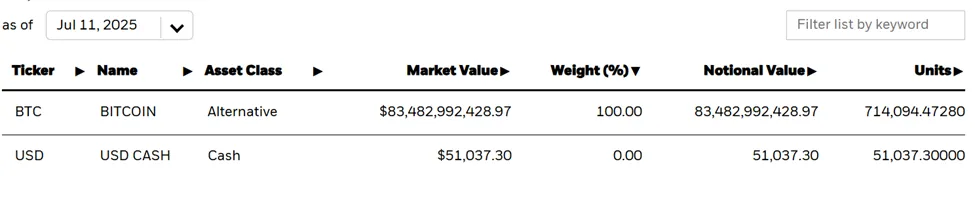

The asset manager now holds 717,388 BTC tokens, with a notional value of $ 83.86 billion.

In the context of the BlackRock Bitcoin accumulation frenzy, the asset manager regularly approaches BTC Stash from Satoshi Nakamoto, estimated at 1.1 million BTC.

At its current clip, swallowing around 40,000 BTC per month, or around 1,300 BTC per day, BlackRock’s Ibit is more than 65%.

According to Balchunas, BlackRock supporting this rhythm could see his ETF Ibit exceed Satoshi by May 2026, only two years after its launch.

“… Ibit has swallowed up 40k BTC per month (or 1.3k / day) at a rate to reach 1.2 m in May 26 (not bad for the 2 year old infant),” said Balchunas.

For the moment, however, this rapid growth makes Ibit the youngest member among the 25 best ETFs in the world by assets under management. It is not a bad feat given the establishment of Ibit 2.1 years ago or 1.6 years since he started to exchange.

Alongside Bitcoin, BlackRock accelerates on Ethereum (ETH), with reports indicating the last purchase at 50,970.08 ETH worth $ 150 million.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.