Blockchain Throughput is Overhyped, Claims Taraxa

A new Taraxa report says that many leading blockchain projects have considerably overestimated their flow. The study shows that the main blockchain networks like Sonic, Solana and the Aptos have a significant gap between the theoretical TPs (transaction per second) and the real TP Max on maintenance.

The results suggest a massive overestimation of network efficiency and speed for these networks.

Most blockchains overestimate the efficiency

Taraxa, a layer-1 blockchain, carried out an in-depth analysis of several leading blockchains. It is obvious that most networks publish new progress in the flow of their blockchain, but many of these tests are carried out under ideal conditions. This study wanted to observe how the most “upper” affirmations compare to regular operating conditions.

“Investors, developers and users deserve transparency. The blockchain industry has long been obsessed with theoretical performance figures, but the numbers generated in a laboratory do not mean little if they cannot be reproduced in real conditions, “said the co-founder of Taraxa, Steven PU, in an exclusive press release shared with Beincrypto.

This survey sought to assess these real world conditions through a metric called “TPS per dollar”. Taraxa compared the transactions of a blockchain per second at the real cost of the execution of a validator node and used it to determine the real flow.

It would be a more precise way to determine to what extent these companies can be up to expectations.

In case, the study examined the highest recorded speed on several blockchain projects, with some important warnings. Authorized and fragmented networks have been excluded, and certain specific transactions (such as voting transactions) have been rejected to avoid inflation of numbers.

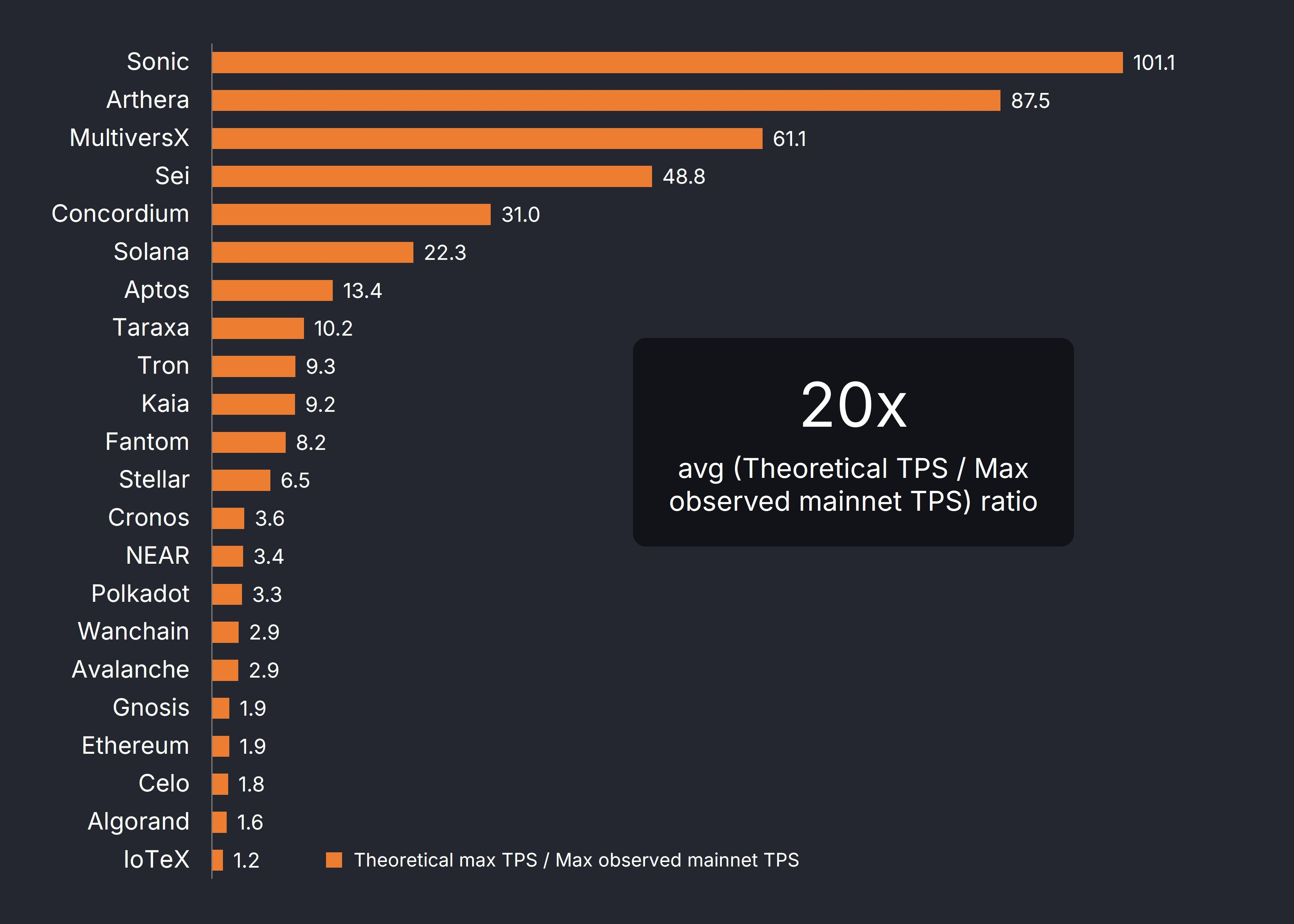

Then, these figures were compared to the TPS claims provided by the developers:

The results of this test revealed an extremely high exaggeration. Sonic (formerly Fantom) said that the blockchain started its real capacities more than 100 times, but the industry average was 20 times. The Espace de la Blockchain L1 is full of fierce competition, which gives clear incentive to this systematic inflation.

“Our research also shows that many networks require expensive equipment just to achieve modest transaction rates, which is neither technically impressive nor decentralized. By focusing on the verifiable data of live networks, we can move the conversation to significant performance measures, ”added PU.

Comparison of TPS at dollar costs has also provided interesting data. Solana had the highest costs by far, but he used these resources effectively to maintain a high blockchain flow. Taraxa also said that it had the best relationship throughout the industry by large margins, which can have an impact on its reasons to carry out the study and use this metric.

Whatever the company’s desire to market its own capacities, the blockchain flow estimates seem strongly swollen throughout the industry. Taraxa has analyzed several crucial web3 sectors, such as the AI industry, and its results seem precious.

Hopefully some difficult data here encourage the more realistic reports of these projects.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.