3 US Crypto Stocks to Watch Today: CRCL, GME, COIN

US crypto actions suddenly move this week, with Circle (CRCL), Gamesop (GME) and Coinbase (Coin) which make all the headlines. The CRCL jumped more than 10% after expanding the USDC to the world channel, but now faces a key resistance at $ 123.

GME is under pressure following low profits and an announcement of convertible tickets of $ 1.75 billion, negotiating near a critical medium of $ 28.35. Meanwhile, Coin is changing political strategy, adding high -level advisers because it tests support at $ 240.

Circle Internet Group (CRCL)

Circle’s shares (CRCL) jumped more than 10% yesterday after the USDC announced that it natively extended to the world channel of Sam Altman.

This decision follows a strong IPO last week, where Circle raised $ 1.1 billion and saw its shares increase by almost 280%.

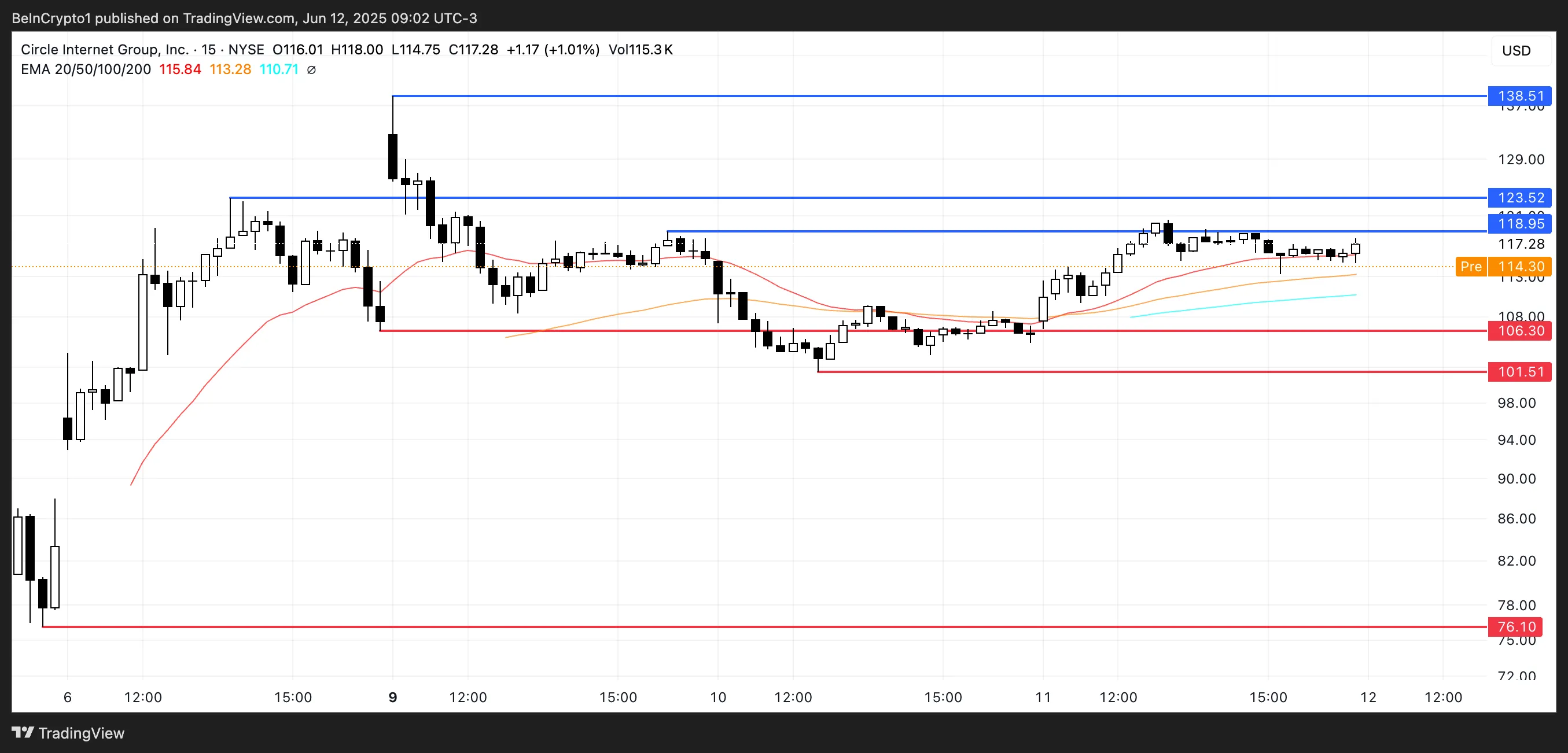

Technically, the CRCL closed yesterday at $ 116.33, up more than 10.6%, but is negotiated 2% in pre-commercialization. The action recently failed to exceed two resistance levels at $ 118.95 and $ 123.

If these levels are again tested and broken and the dynamics come back, the CRCL could aim for a summit of its summit at $ 138.57.

However, if the support of $ 106.30 is violated, the action may slide around $ 101.51.

GameStop Corp. (GME)

GAMESTOP (GME) declared a drop in revenues of 17% on the other in the first quarter, because the transition to digital downloads erodes its brick and mortar activity.

Despite efforts to expand electronic commerce operations and rationalize, sales of equipment and accessories dropped by 32%, and store closings continued in 2025 after almost 600 stops last year.

The company has displayed a net profit of $ 44.8 million – increased by cost reductions and the sale of its Canadian subsidiary, but has always declared an operating loss of $ 10.8 million due to restructuring costs.

In a separate ad, GameStop plans to raise $ 1.75 billion thanks to convertible tickets with zero interest planned in 2032, taking advantage of its high liquidity position to explore new investments and potential acquisitions.

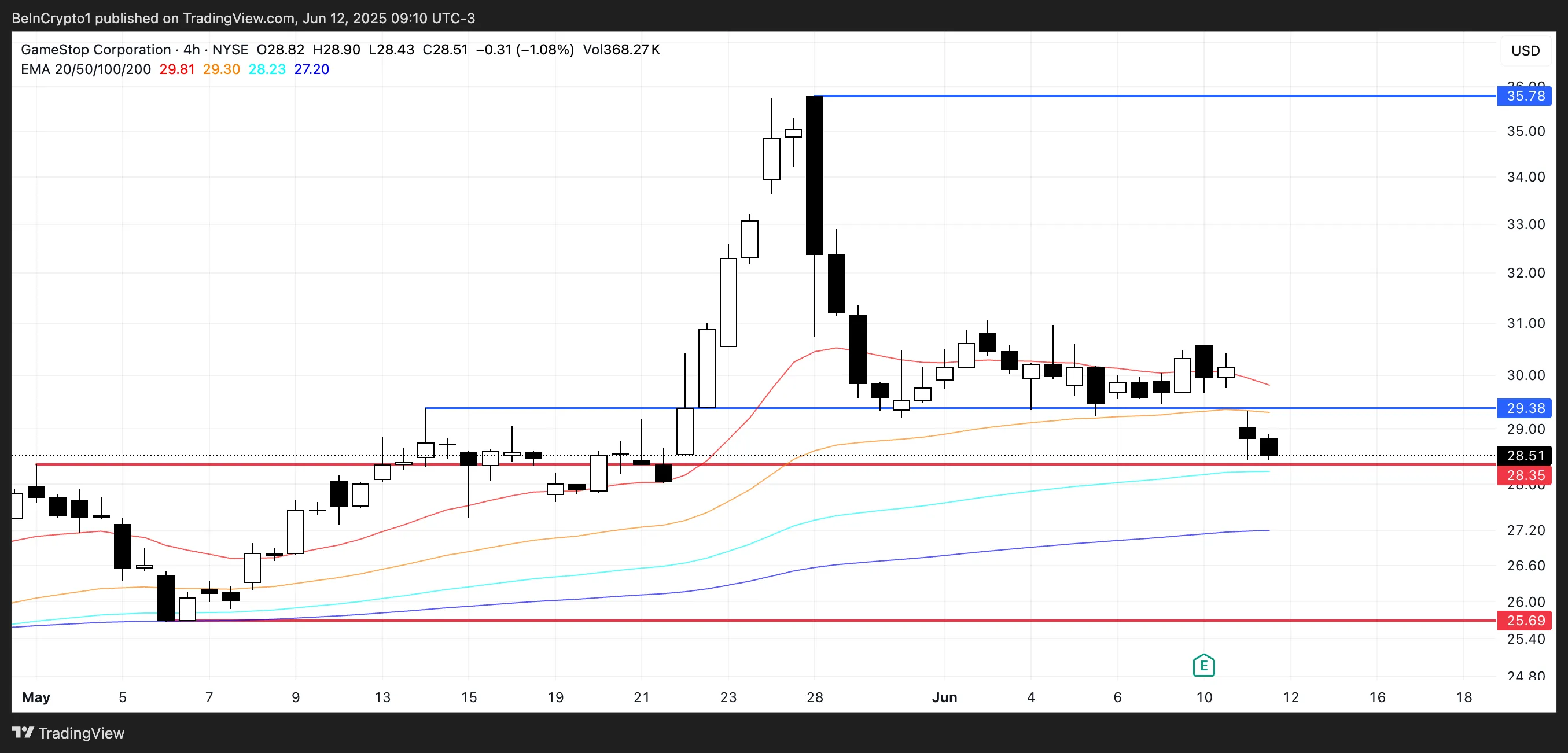

GME shares closed yesterday down 5.31% and are now dropped by an additional 16% in pre-commercial trade. The stock oscillates just above a level of key support at $ 28.35; If this level fails, it could quickly slide at $ 25.69, with another risk down to $ 23.

An open open nearly $ 24 would indicate that the lowering feeling is accelerating, potentially triggering another wave of sales pressure.

It remains to be seen whether the offer of convertible notes and investment in Bitcoin can stabilize the confidence of investors in the midst of increasing volatility.

Coinbase Global (Coin)

Coinbase expanded its political advisory council by adding David Plouffe, one of the main democratic strategists known to lead the presidential campaign of Barack Obama in 2008 and advisor Kamala Harris in 2024.

Plouffe joins an increasing list of bipartite figures, notably the former Trump campaign director, Chris Lacivita, and the ex-Snator Kyrsten Sinema, because Coinbase aims to strengthen his influence in the shaping of American regulation of cryptography.

Coin closed yesterday down 1.62% and is down an additional 2% in pre-commercial trade. The action is currently close to a level of key support around $ 240.

If he manages to maintain this support and recover the resistance to $ 257, an upward trend could bring the part to the level of $ 270. However, not holding over $ 240 could trigger additional short-term drop.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.