BNB Meme Coin Leads 23% Rise

The pieces even had a mixed day because their cumulative value was unchanged at 57.48 billion dollars. The parts that noted green were directed by Banana for Scale, a piece of BNB memes which recorded a 27%increase.

Beincryptto analyzed two other coins so that investors can look while they are trying to take over.

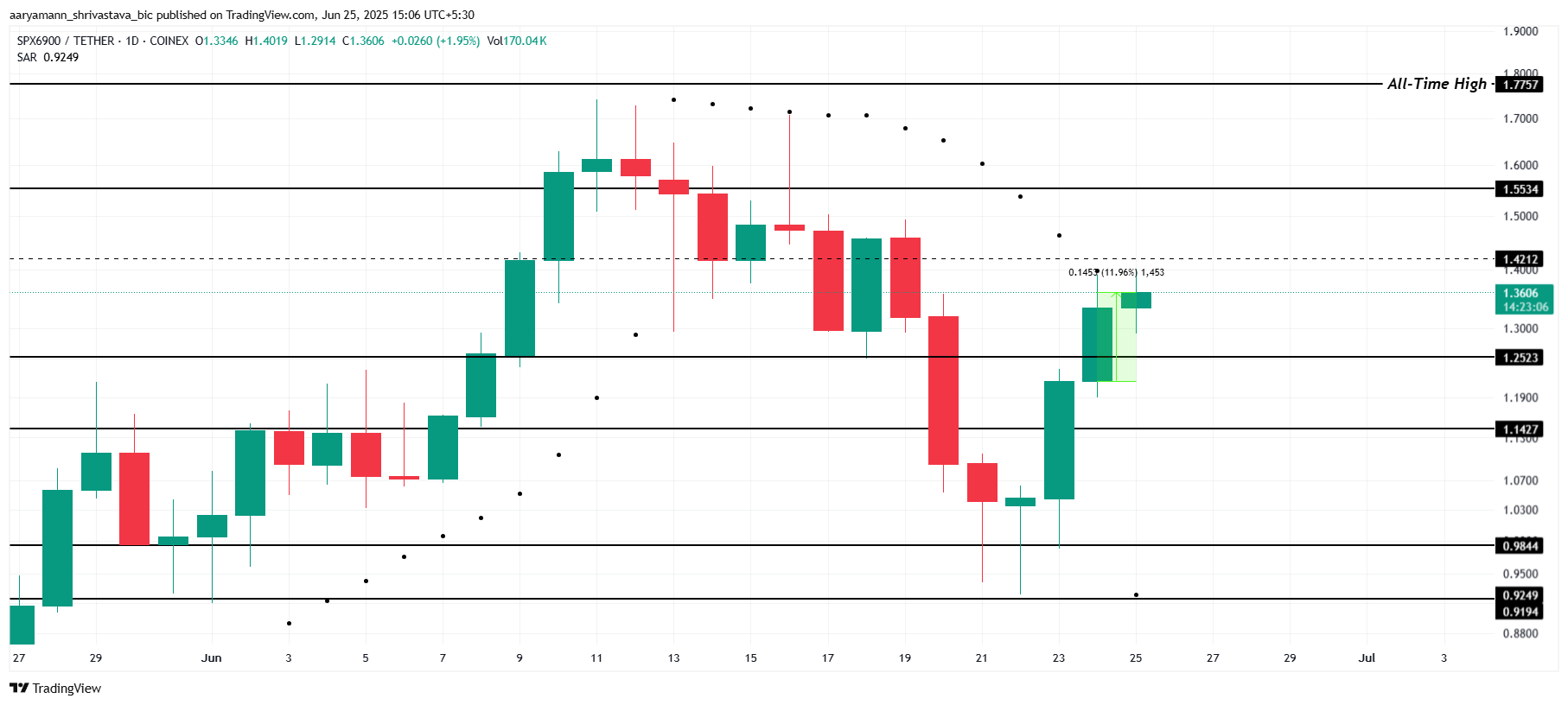

SPX6900 (SPX)

- Launch date – August 2023

- Power supply in total circulation – 930.99 million SPX

- Maximum power supply – 1 billion SPX

- Fully diluted evaluation (FDV) – $ 1.26 billion

- Contract address – 0xe0f63A424A44439CBE457D80E4F4B51AD25B2C56C

SPX remains one of the most efficient pieces of memes, increasing by almost 12% to $ 1.36. Currently faced with the resistance at $ 1.42, the play has shown a strong price movement. If he can unravel this level, SPX is ready to continue its upward trend, attracting more investors to the assets.

The parabolic SAR indicator under the candlesticks suggests a strong upward trend for SPX. This technical signal points to the price of the price to collect $ 1.42, reversing it in the support. With continuous momentum, SPX could reach $ 1.55, marking a key resistance level on the path of additional earnings.

However, if SPX fails to violate the resistance level of $ 1.42, it could face increased sales pressure. This would probably have a drop to $ 1.25 or less, invalidating current upward perspectives. A failure to break the levels of resistance of the keys can lead to a new lowering of the market.

Buildon (B)

- Launch date – May 2025

- Power supply in total circulation – 1 billion B

- Maximum power supply – 1 billion B

- Fully diluted evaluation (FDV) – $ 365.78 million

- Contract address – 0x6bdcce4a559076e37755a78ce06214e59e44444

Buildon saw an increase of 7.2% today, signaling upward momentum although it is not the most efficient. The play even now meets resistance at $ 0.364. The security of this level as a support is crucial for continuous price gains, helping to build in solidifying its recent rise on the market.

Buildon benefits from a strong correlation with Bitcoin, with a correlation coefficient of 0.62. This connection suggests that Buildon could increase as the BTC fact, supporting a potential price increase. The reversal of the resistance at $ 0.364 in support could propel Buildon around $ 0.413, marking a resumption of recent losses and strengthening positive feeling.

However, if the wider market indices do not remain bruise, a reversal at $ 0.364 could lead to a drop in the price of builds. Falling below this resistance would open the door to a drop at $ 0.310, invalidating current upward perspectives and signaling additional losses possible.

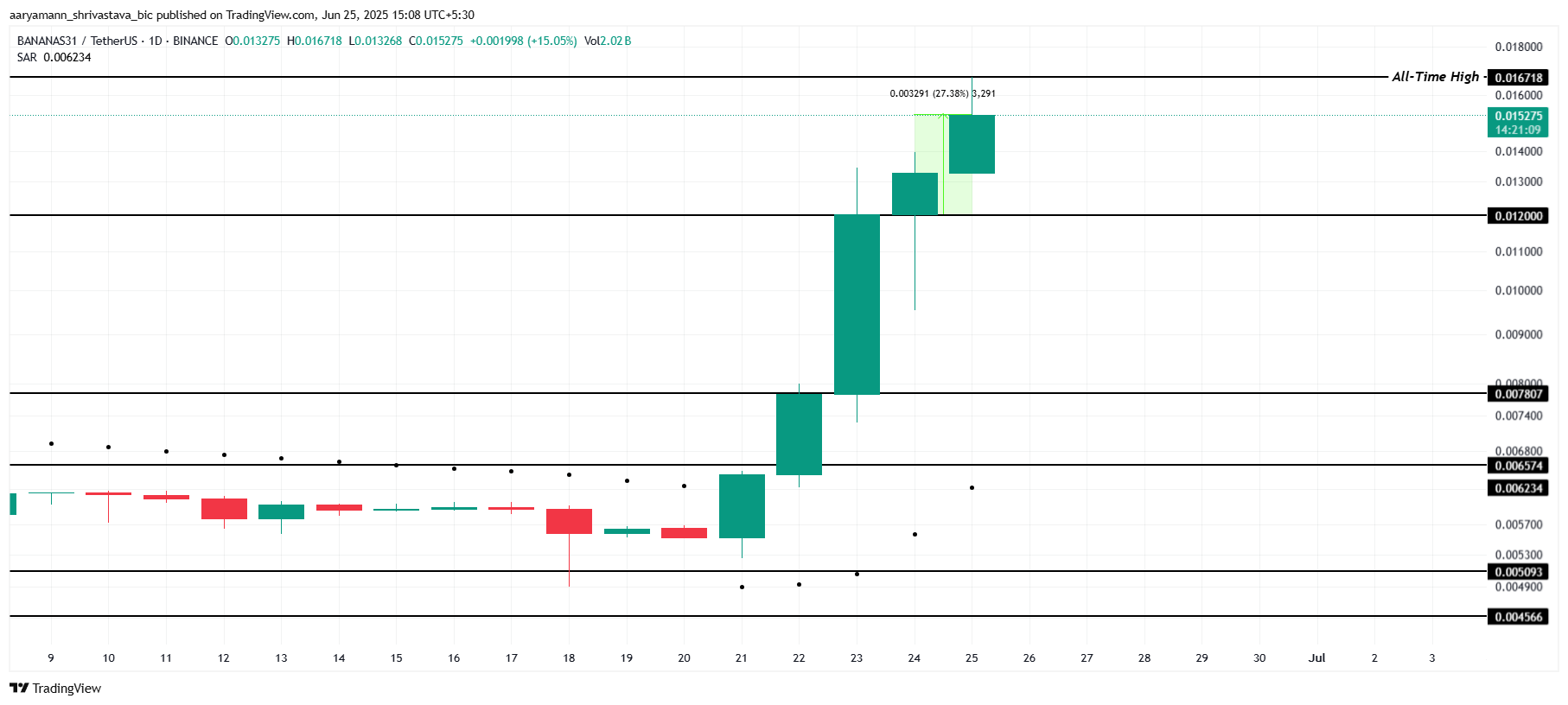

Corner of Petit Cap – Banana for the scale (Bananas31)

- Launch date – November 2024

- Power supply in total circulation – 10 billion bananas31

- Maximum power supply – 10 billion bananas31

- Fully diluted evaluation (FDV) – $ 155.33 million

- Contract address – 0x3d4f0513e8a29669b960f9dbca61861548a9a760

Bananas31 jumped 27% in the past 24 hours, reaching a new summit of $ 0.0167. The piece even bnb has rebounded on the level of support of 0.0120 to reach its current price. This strong performance highlights an increased interest and confidence in Altcoin despite the volatility of the market.

With 124,000 holders supporting Bananas31, the memes play has solid support that could propel its price more. Community support is crucial for the growth of the token, and if the momentum continues, it could push Bananas31 to $ 0.0180. The in progress bullish feeling suggests the potential for continuous price gains.

However, if investors start to sell large volumes, Bananas31 can face a slowdown. A drop by the support of $ 0.0120 would point out greater low, which could reduce the price to $ 0.0078. This would invalidate current optimistic perspectives and erase recent gains, indicating a change in feeling of the market.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.