BNB Price Climbs, Can It Break Its All-Time High?

BNB organized an impressive return, increasing 40% after reaching a five -month lower on February 3. The part is now negotiated at $ 698.40, adding 10% to its value during the last day.

Despite a broader consolidation of the market, BNB has challenged the trend, now a strong upward dynamics as accumulation increases.

BNB defies the market -contrary winds

The BNB plunged to a five -month $ 500 lower on February 3. However, despite the opposite of the recent market, the fifth cryptographic asset by market capitalization has put the general trend and recorded an upward trend. It is currently negotiated at $ 698.40, climbing 40% in the last ten days.

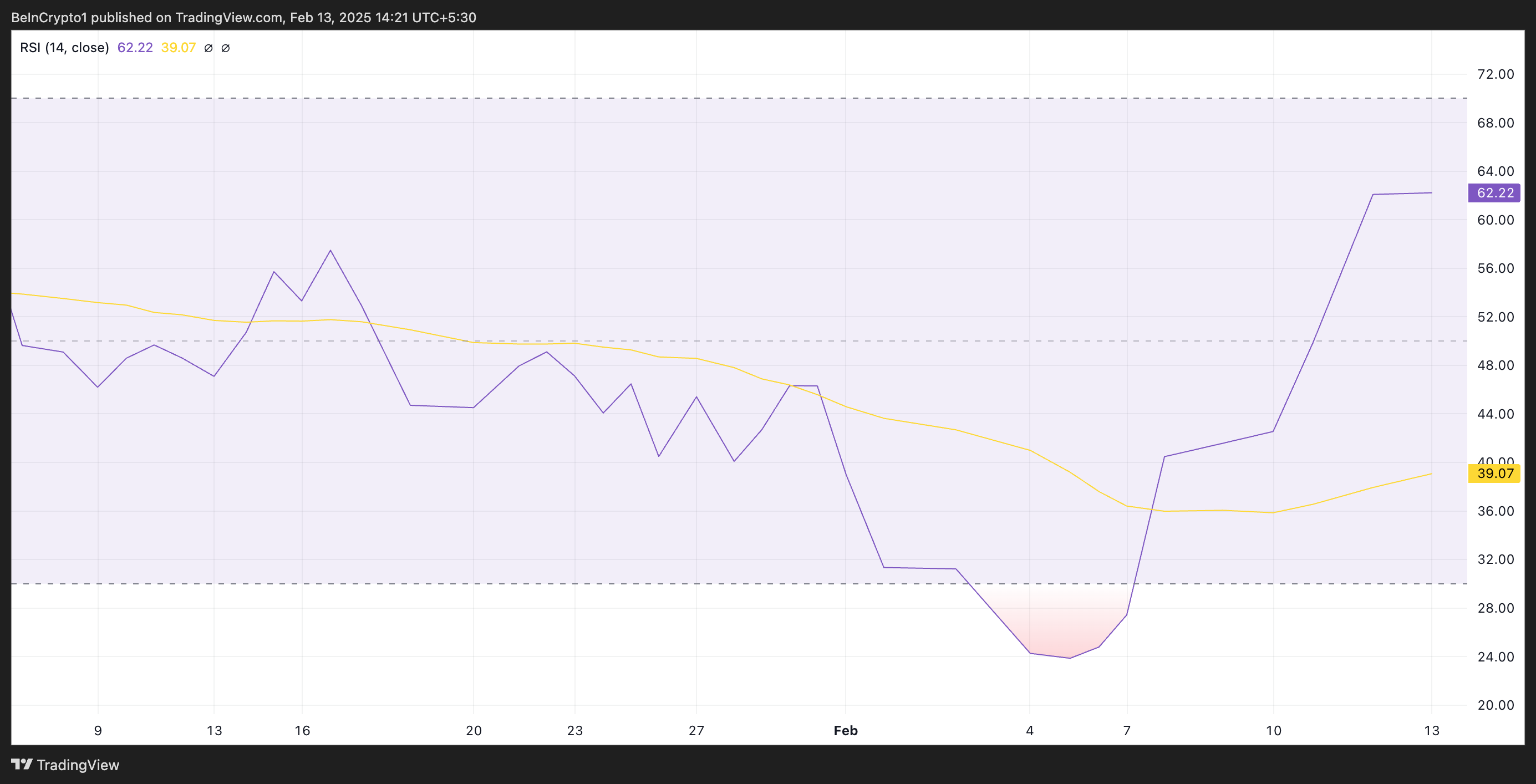

An assessment of the graph of a BNB / USD day reveals that this price increase is supported by the real demand of parts and not by speculative trades. For example, its relative force index (RSI) is in an upward trend above the 50 neutral line at 62.22, reflecting the purchase pressure on the market.

The RSI indicator measures excessive market conditions and occurs as an asset. It varies between 0 and 100, with values above 70 suggesting that the asset is exaggerated and due for a correction. On the other hand, the values less than 30 indicate that the asset is occurred and can attend a rebound.

At 62.22, the BNB RSI indicates that it is in bullish territory but not yet too hidden. This suggests a strong purchasing momentum with space for more upwards.

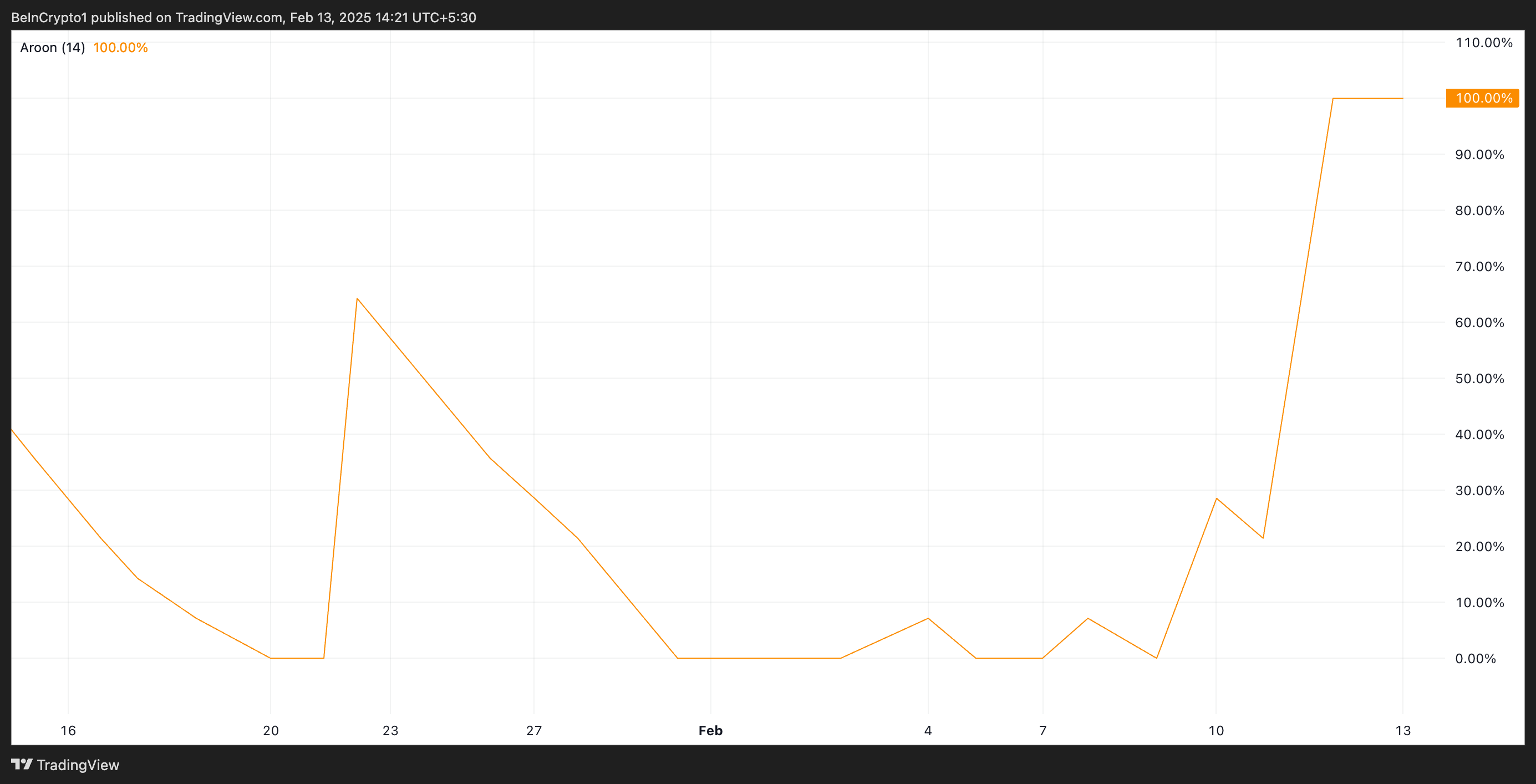

In addition, the coil line of the room is 100%, highlighting the strength of the current trend.

The Aroon indicator measures the trend force of an asset. It identifies the potential inversions by following the time elapsed from the highest level (AROON UP) and the lowest (AROON DOWN) over an adjustment period. When the Aroon Up line is 100%, it signals a strong upward trend, which indicates that a new summit has been recently reached and that the bullish momentum is dominant.

Price prediction BNB: all upper times then?

According to the readings of the Fibonacci of BNB Fibonacci’s retracement tool, if BNB demand is strengthened, its next price target is its $ 793.86 summit, for the last time on December 4.

However, a reversal of the current trend will invalidate this bullish prediction. In this scenario, BNB could lose recent gains and fall to $ 685.55. If the Bulls do not defend this level of support, its price could fall to $ 610.98.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.