BONK Rises 22% as ETF Excitement Sparks Fresh Rally

Even Coin Bonk, based in Solana, is the best winner of today, increasing by 22% in the last 24 hours. The rally comes while cryptographic markets bounce more widely.

However, Bonk’s earnings are mainly motivated by a renewal of investors’ interests before the possible launch of a Stock Exchange (ETF) fund linked to the assets.

The merchants have bet large on Bonk as the potential launch of ETF approaches

Tuttle Capital recently submitted a post-efficiency amendment to the Securities and Exchange Commission (SEC) of the United States for its LEVE FNB proposal, including a 2x long FNB. The deposit indicates that the product could be posted on July 16.

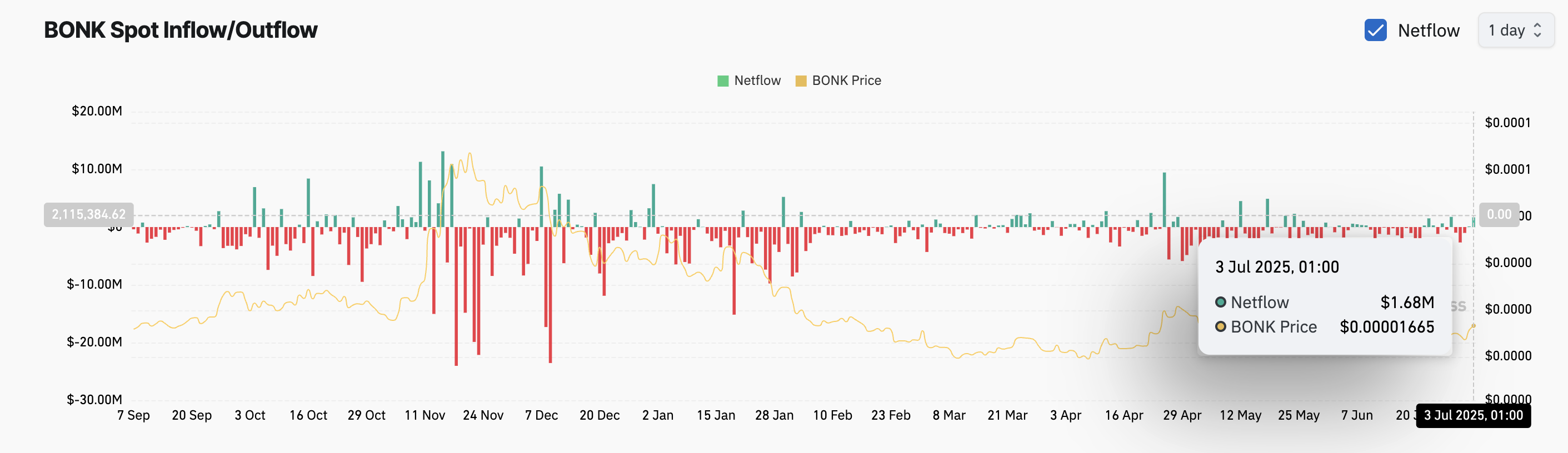

This has rekindled enthusiasm around Bonk, the traders based on speculations that the ETF could attract other entries and institutional attention. The interest is obvious in the Ilpouin upwards the increase in the token. To date, Netflow totals $ 1.68 million, climbing more than 100% during the last day.

The Net Spot influx follows the capital entering an asset through direct purchases, indicating growing interests and demand for investors. When net tickets of an asset climb, it signals a bullish feeling on the market.

Bonk’s net influx in net reflects the growing confidence of investors in the asset, and it could contribute to its prices upward pressure as more capital moves to the market.

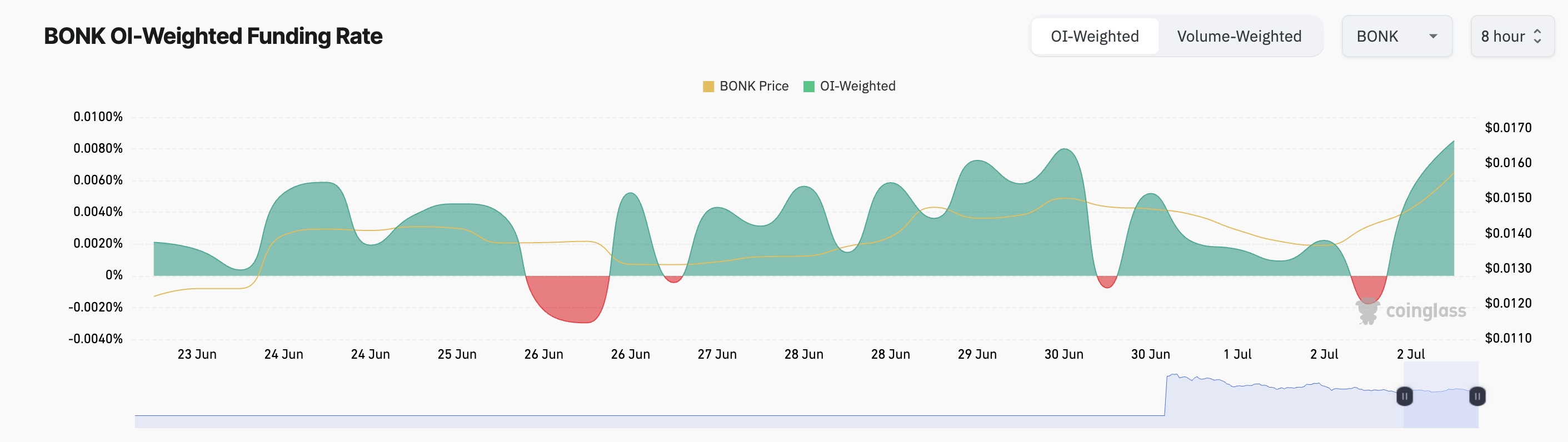

In addition, the positive funding rate of the same corner confirms this upward perspective. When writing these lines, it is 0.0085%, signaling a preference for Bonk longs compared to shorts among the players on the long -term market.

The financing rate is a periodic payment between traders in perpetual term contracts to maintain the price of the contract aligned with the cash price. When the financing rate is positive, there is a higher demand for long positions.

This means that more traders are betting on Bonk’s price extend its short -term earnings.

Bonk exceeds 20 -day EMA, signals a horrible freshness

The peak in Bonk’s price pushed it over its 20-day exponential mobile average (EMA), which now forms a dynamic support below $ 0.000014.

The 20 -day EMA measures the average price of an asset in the last 20 days of negotiation, which gives more weight at recent prices. When the price of an asset is negotiated above his 20-day EMA, he signals a short-term bullish momentum and continuous potential.

If the Bulls retain control, they could generate Bonk’s price to $ 0.000018.

Conversely, if the request plunges, the price of the Altcoin could receive $ 0,000016, falling at $ 0,0000,12.

The Post Bonk increases by 22% while the ETF Fresh excitement sparks appeared first on Beincrypto.