Breakout to $3,000 or Breakdown to $2,200?

Ethereum Price was linked to the range near the level of $ 2,650 after a solid monthly rally of 45%. At the time of the press, ETH is negotiated at $ 2,631, down 3.79% in the last 24 hours, which suggests short -term sales pressure. But below the surface is a classic technical configuration which could decide the next big movement towards its resistance between $ 2,700 and $ 2,800.

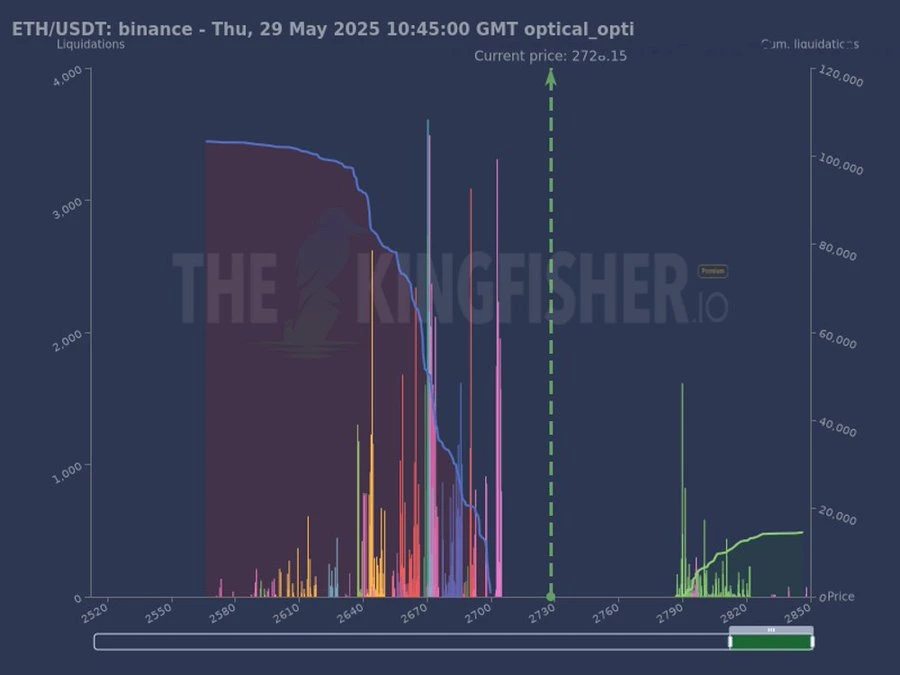

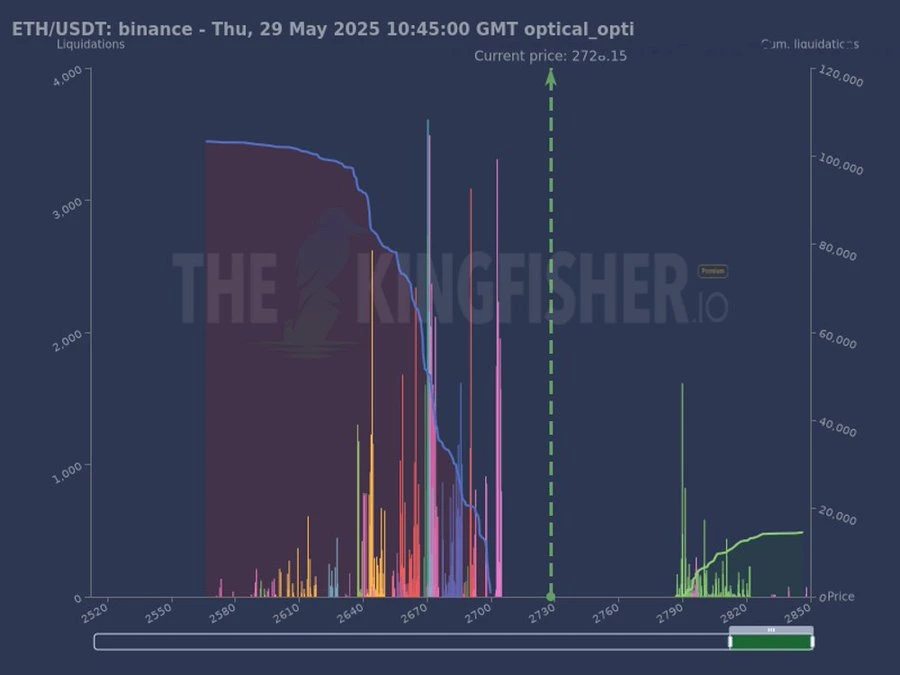

Liquidation cluster: a problem or an opportunity?

According to an analyst of the position, “the Martin-Pêcheur”, there is a significant concentration of long liquidations between $ 2,600 and $ 2,700. This creates a “loving” sense of liquidity, if eTh plunges into this area, we could see a domino effect of liquidations. With a price currently close to $ 2,631, the ETH is closer to the crucial area.

The thesis stresses that the short liquidations are relatively light. This asymmetry suggests a more abrupt drop risk, especially if the feeling of the market returns to the bearish. A shift could trigger a flush around $ 2,510, or even $ 2,319 if panic sets in.

Ethereum price analysis (ETH):

The 1-D of Ethereum graphic shows an ascending triangle, a bullish continuation model, with resistance holding nearly $ 2,800. A strong daily closure above $ 2,800 would confirm the rupture of the triangle. In this case, the ETH could exceed the psychological resistance of $ 3,000 to an increase to $ 3,100 to $ 3,300, supported by short compressions and a break in rupture.

Conversely, if ETH fails to break out and fall below $ 2,510, this would invalidate the Haussier model. A new ventilation less than $ 2,320 would open the doors to $ 2,200, where the next major support is.

Read our prices prediction Ethereum (ETH) 2025, 2026-2030 for long-term objectives!

Faq

Ethereum Price is today at $ 2,631.27 with a daily change of -3.79%.

Key levels include $ 2,800 for a bullish break, $ 2,510 for a lower bias and $ 2,319 for confirmation of a stronger correction.

If you are a long -term investor, the accumulation of drops in the range of $ 2,400 to $ 2,500 can offer value. Short -term traders should wait for an escape greater than $ 2,800 or a ventilation less than $ 2,510 for clearer signals.