BTC ETF Outflows Continue Amid Institutional Caution,

Even if cryptographic markets are trying to put a courageous face this week, institutional investors clearly do not buy it. Yesterday, Bitcoin Spot ETF recorded another series of outings, marking the sixth consecutive day of capital flight from these funds.

Despite the broader attempt at the market for a short -term rebound, continuous withdrawals suggest that institutional feeling remains cautious. Coherent outings paint a table of investors looking for security or perhaps simply sitting on the sidelines while volatility does its thing.

FNB bitcoin continues to lose the sequence

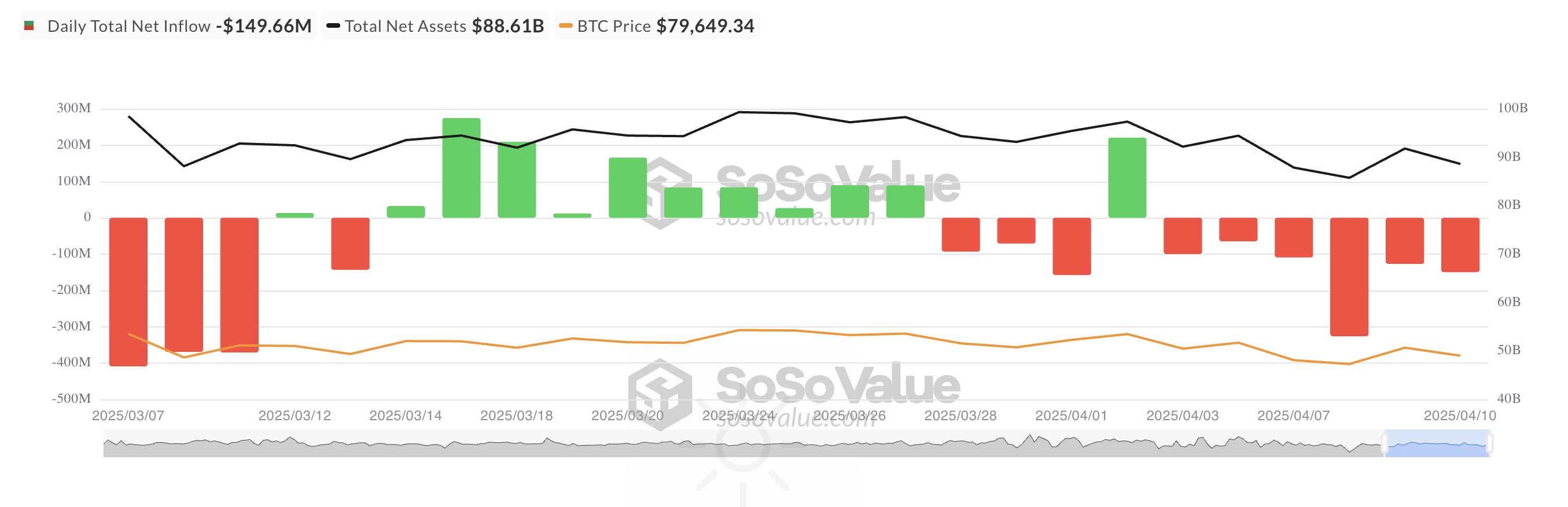

Thursday, the Nette Nets of the FNB BTC totaled 149.66 million dollars, reflecting an increase of 17% compared to the 127.12 million dollars in outings observed on Wednesday.

This marked the sixth day of consecutive withdrawal from the Spot Bitcoin ETF funds, highlighting increasing prudence and the weakening of the feeling among the institutional investors of the BTC.

According to Sosovalue, Grayscale Bitcoin Mini Trust ETF $ BTC recorded the highest net influx that day, totaling $ 9.87 million, bringing the Historic Fluux of the Fund to $ 1.15 billion.

On the other hand, the FBTC FNB FIDELITY was witnessing the highest net release on Wednesday, totaling $ 74.67 million. To date, its total historic net entry is $ 11.40 billion.

The derivative market remains optimistic

Meanwhile, BTC Futures Open Interest took a modest blow, in accordance with the wider drop in the market. At the time of the press, it amounts to $ 51.73 billion, down 7% in the last day. This comes in the middle of the drop in the wider activity of the cryptocurrency market in the last 24 hours, during which the BTC value fell by 2%.

A drop in interest opened during a drop in prices suggests that traders close positions rather than opening new ones. This indicates a possible bomb phase or reduced volatility to come.

But the story does not stop there.

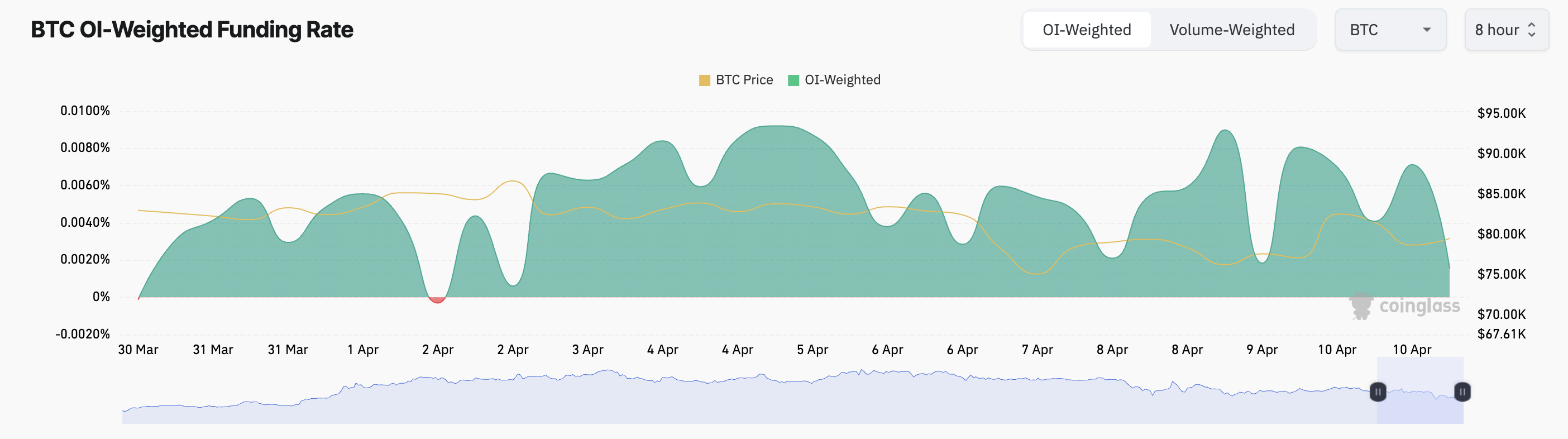

The funding rates remain positive and the purchase options are in great demand, both considered as bullish signals.

At the time of the press, the BTC financing rate is 0.0015%. The financing rate is a recurrent payment exchanged between long and short traders in perpetual term markets to maintain prices of contracts aligned on the cash market. A positive financing rate like this indicates that long traders pay open merchants, indicating that the bullish feeling is dominant.

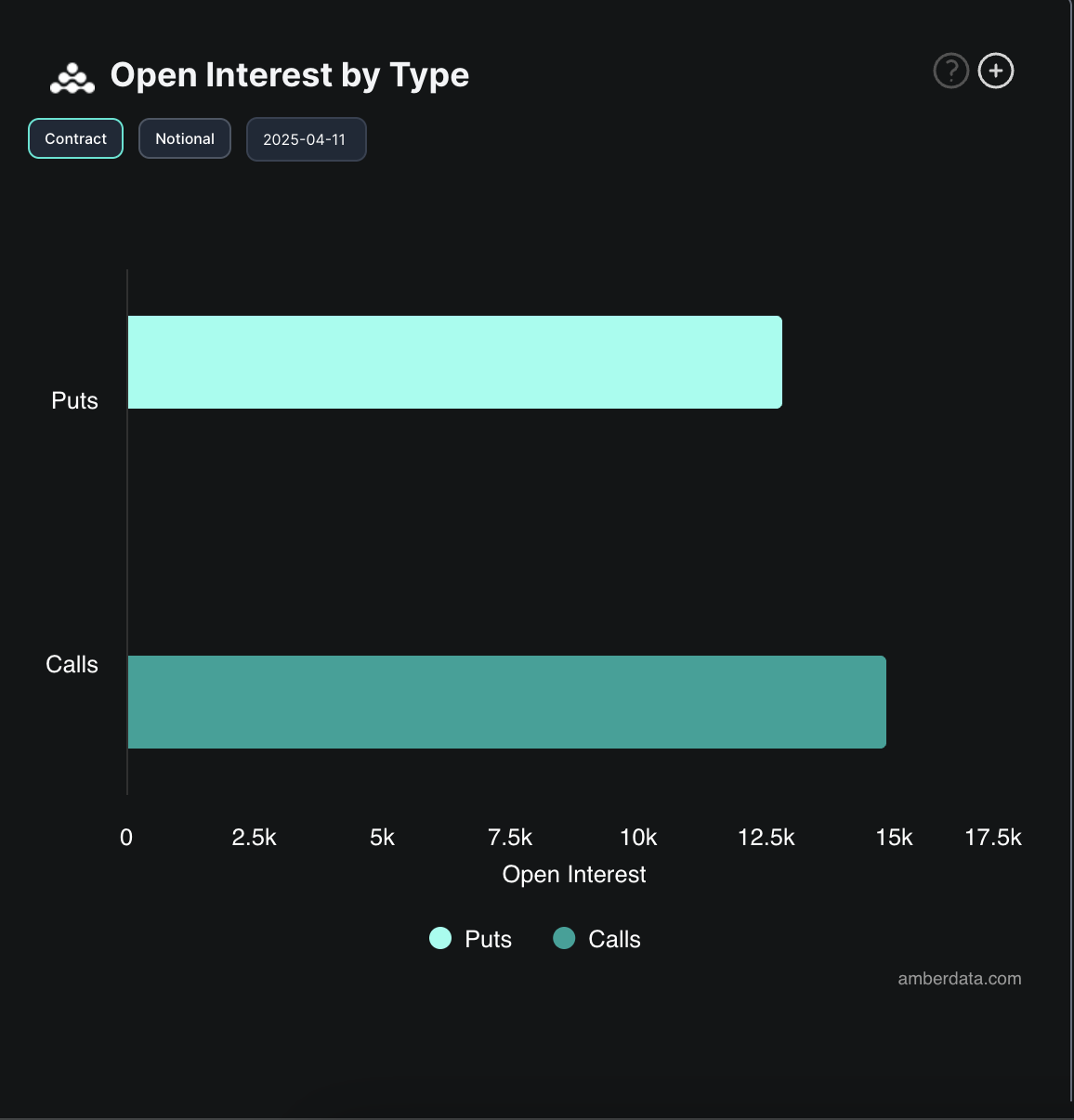

On the options market, there is a high demand for calls on put, more reflecting a bias bias towards the BTC.

The divergence between ETF flows and the activity of the derivatives recorded this week suggests that if traditional institutions can reduce exposure, retail and leverage traders continue to bet on rebounds.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.