BTC ETFs Experience Largest Net Inflows Since May

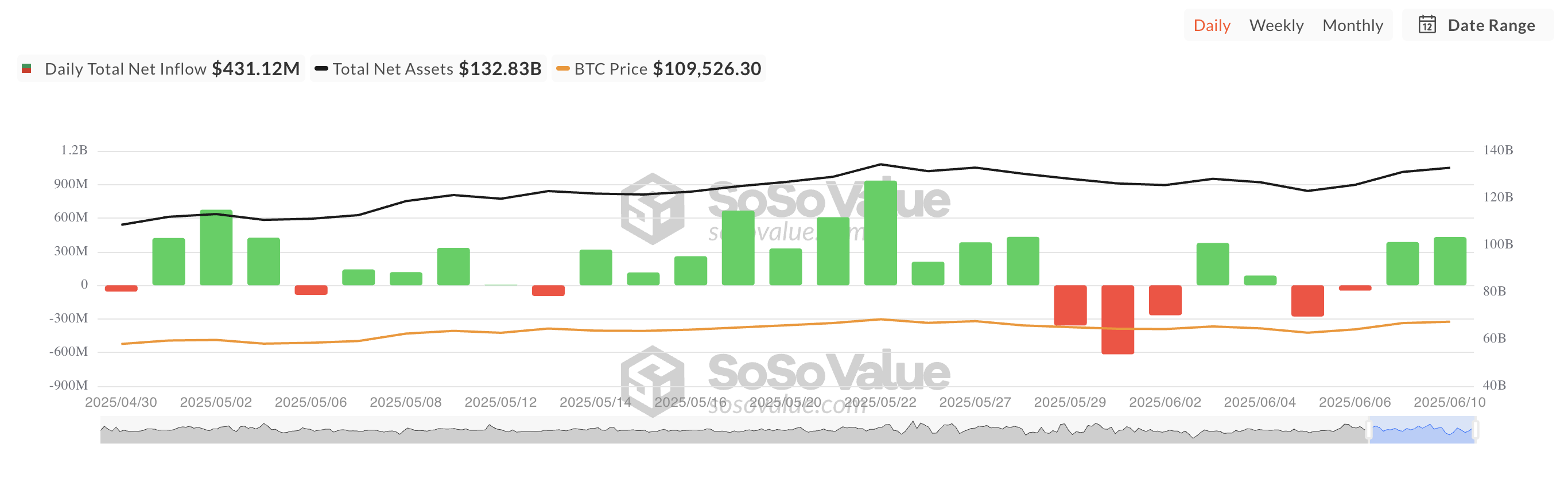

The funds negotiated in exchange for Bitcoin (ETF) recorded more than $ 400 million in net entries yesterday. This has marked the largest net influx in one day that these funds have recorded since May 28.

The entries highlight the renewed confidence among institutional investors, reviving the bullish feeling in the cryptographic markets.

Bitcoin ETF demand significantly increases

On Tuesday, Tuesday, on Tuesday increased demand for the Bitcoin ETF in the United States US list, with net entries climbing $ 431.12 million, up 12% compared to $ 386 million from the previous day.

The influx of capital in the ETF is a leading indicator of larger market appetite, suggesting that institutional actors are positioned for more increase. The sharp increase in ETF demand occurs in the middle of an increasing optimism that the main room, BTC, could soon recover the level of $ 110,000, some traders looking at a potential return to its top of all time.

Yesterday, the Ibit of Blackrock led with the highest daily entries, totaling $ 337 million, bringing its total historical entry to $ 49.11 billion.

The FBTC of Fidelity recorded the second highest daily entry to $ 67.07 million, bringing its total historical net entries to $ 11.68 billion.

The BTC price is stable, but future and options report caution

With a profit activity that was gradually gaining momentum, the price of the BTC point has remained largely stable in the last 24 hours. When writing these lines, the King part is negotiated at $ 109,601, noting a modest gain of 0.11%.

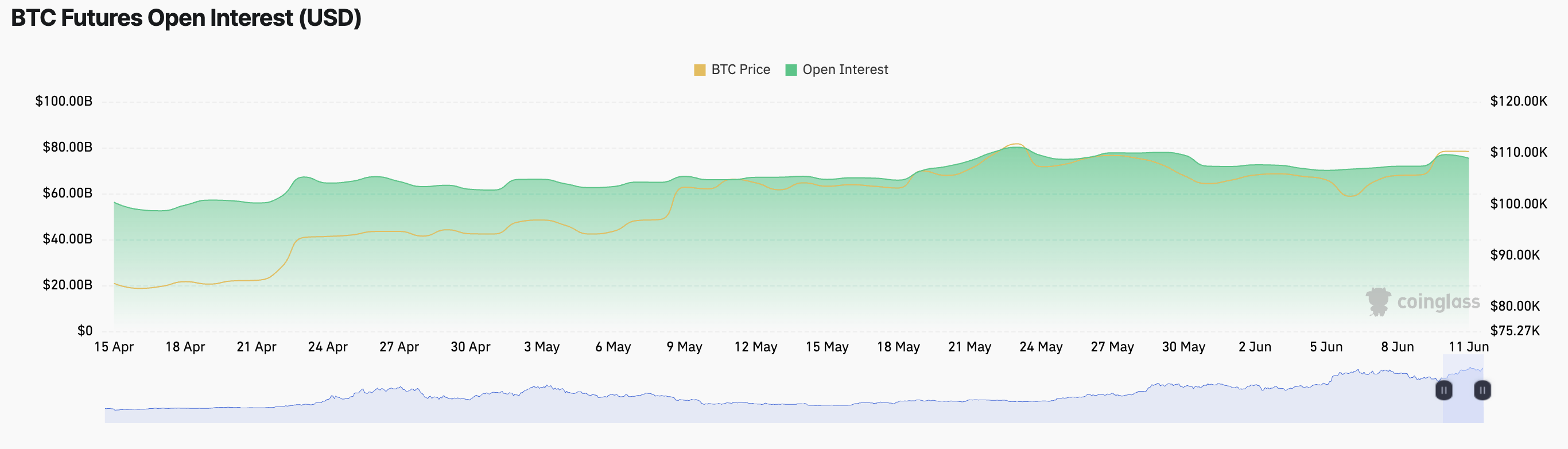

Meanwhile, an open interest in the parts of the room has decreased, reporting a withdrawal in the commercial activity. At the time of the press, it was $ 75.33 billion, down 1% in the last day.

The open interest refers to the total number of current derivative contracts, such as term contracts or options, which have not been settled. A decrease in signals of open interests has reduced negotiation activity or profits, because traders conclude the existing positions.

In the case of the BTC, the slight decrease in long -term open interests indicates early stage benefits among the traders who had long placed themselves during the recent gathering. If this trend persists, the pressure downwards on the medal will strengthen.

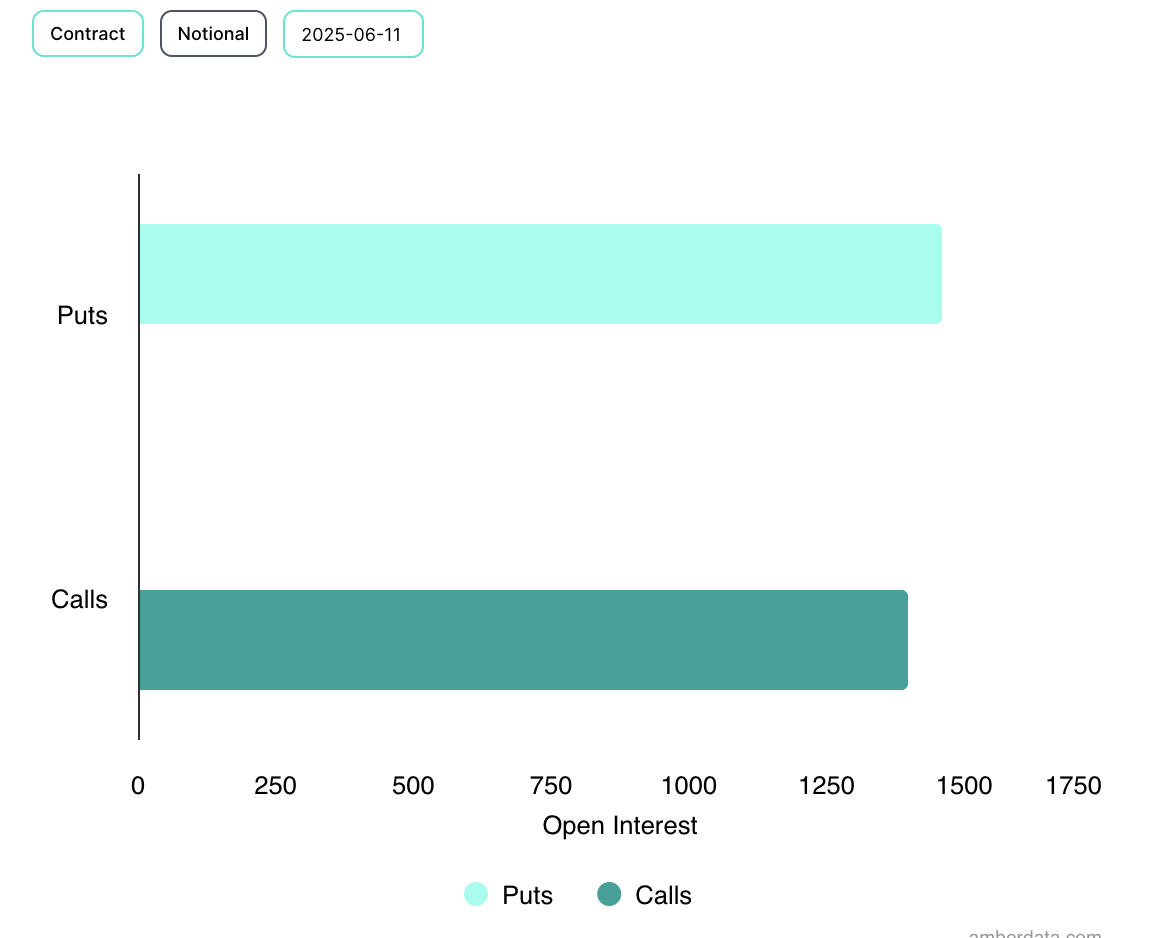

In addition, feeling is also cautious on the options market. The request for put options has increased, suggesting a subtle resurgence of lowering expectations.

Consequently, while the ETF inputs comb an upward macro image, the action of short -term prices and the positioning of derivatives indicate a potential cooling period as investors benefit.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.