BTC Price Rebound Likely as Long-Term Holders Reenter Market

Bitcoin (BTC) is on the right track to finish the first quarter with its worst performance since 2019. Without an unexpected recovery, BTC could close the quarter with a 25% drop in its summit of all time (ATH).

Some analysts have noted that experienced bitcoin holders are moving in an accumulation phase, signaling the growth in potential prices in the medium term.

Signs that veteran investors accumulate again

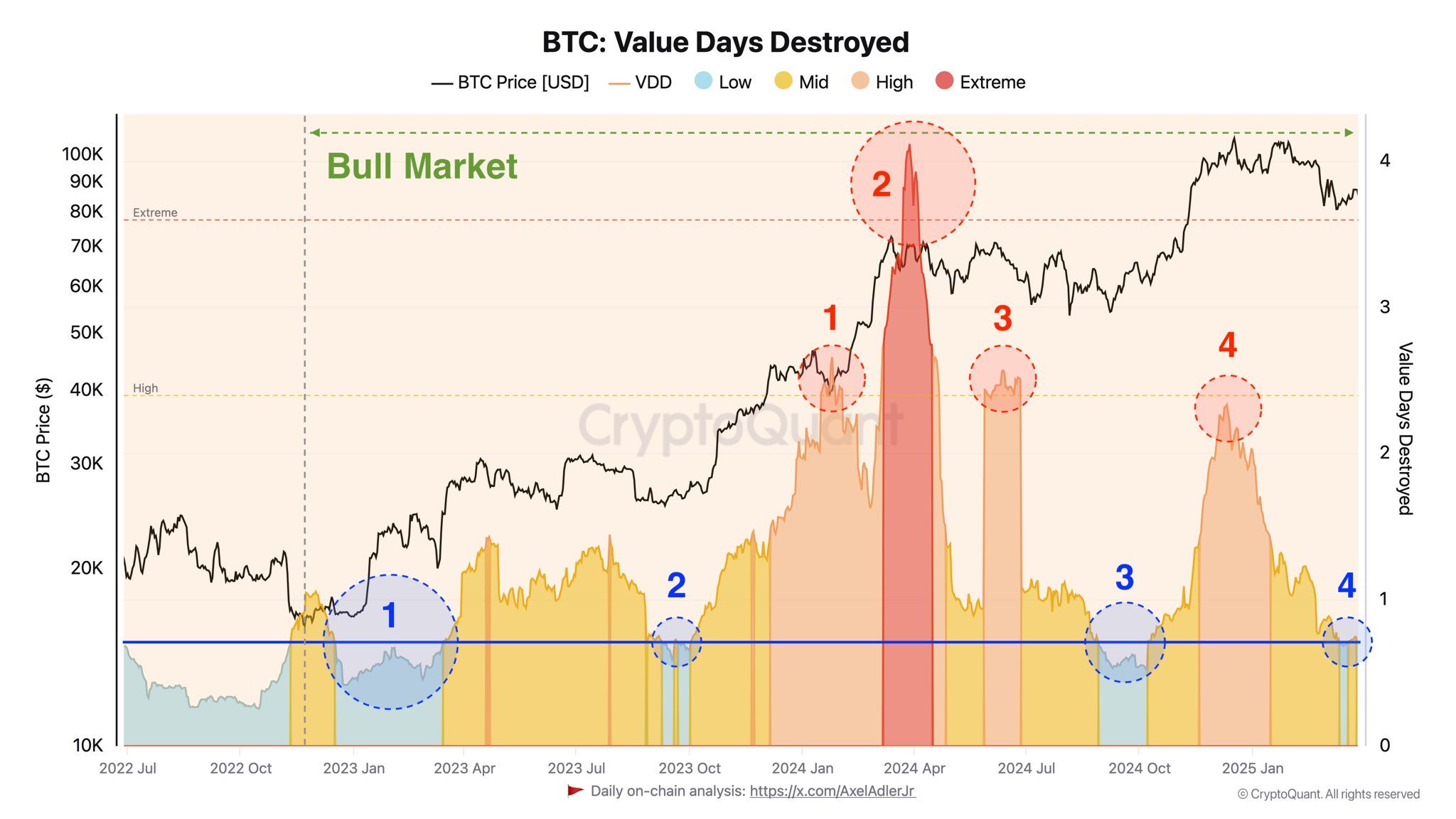

According to Axeladlerjr, March 2025 marks a transitional period when veterans investors go from sale to maintenance and accumulation. This change is reflected in the metric of the value of the destroyed value (VDD), which remains weak.

The VDD is a chain indicator that follows the behavior of investors by measuring the number of Bitcoin days remains insensitive before being treated.

A high VDD suggests that older bitcoin is moved, which may indicate the sales pressure of whales or long -term holders. A weak VDD suggests that most transactions involve short -term holders, who have a lower impact on the market.

Historically, the low periods of VDD often precede solid price gatherings. These phases suggest that investors accumulate bitcoin with expectations of future price increases. Axeladlerjr concludes that this change indicates the growth potential of Bitcoin in medium -term growth.

“The transition of experienced players in the maintenance phase (accumulation) signals the BTC growth potential in the medium term”, predicted Axelladlerjr.

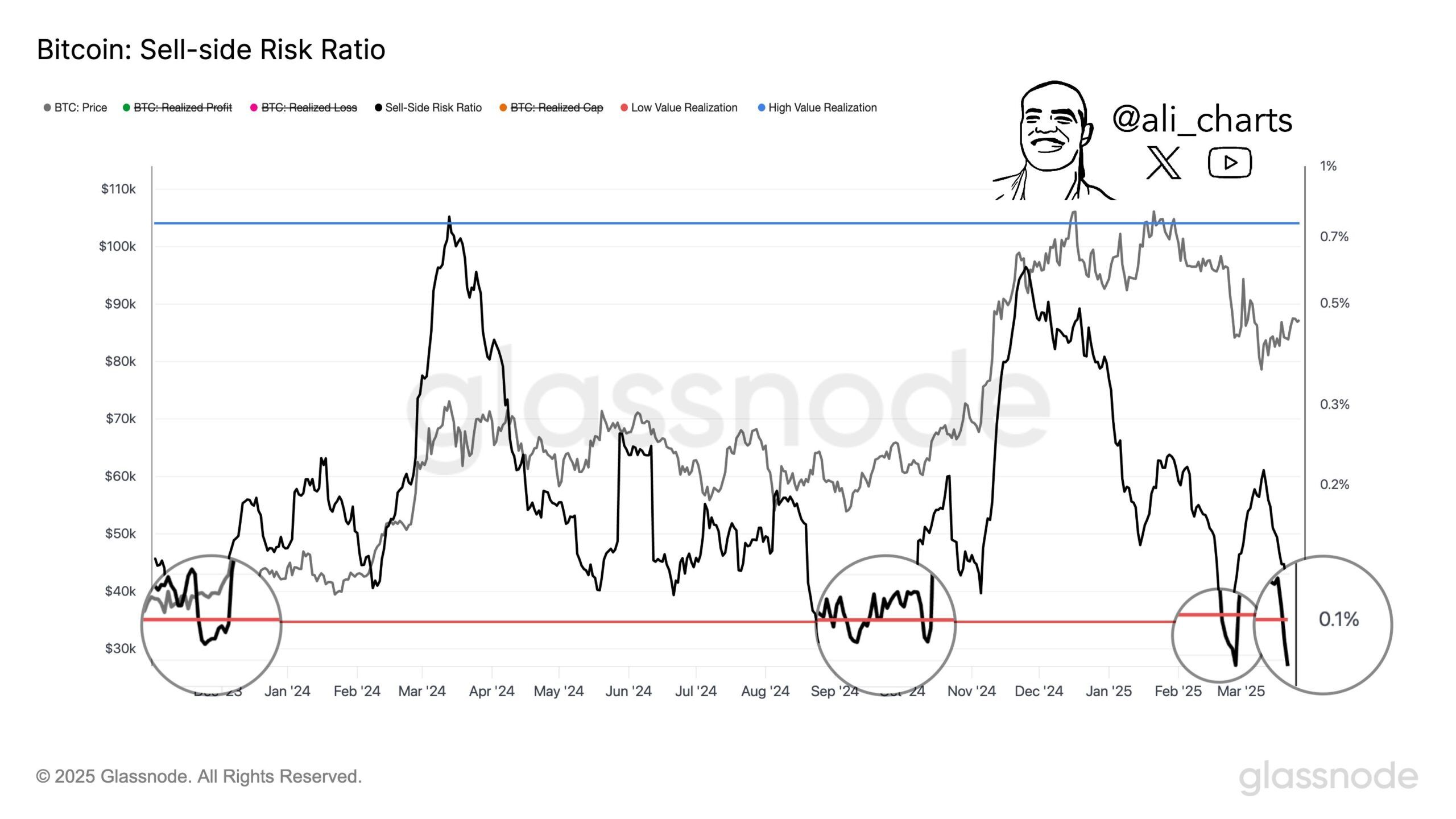

The Bitcoin sales risk ratio is hitting low

At the same time, analyst Ali has highlighted another bullish indicator: the Bitcoin sales risk ratio fell to 0.086%.

According to Ali, in the past two years, each time, this ratio was below 0.1%, Bitcoin experienced a solid price rebound. For example, in January 2024, Bitcoin reached a summit of $ 73,800 then after the risk rate on the sale below 0.1%.

Likewise, in September 2024, Bitcoin struck a new peak after this metric reached a low level.

The combination of veteran investors accumulating Bitcoin and a sharp drop in the risk -on -sale ratio are positive signals for the market. However, a recent Beincrypto analysis warns against technical models, with a death cross that started to train.

In addition, investors remain cautious about the potential market volatility in early April. The uncertainty comes from the upcoming announcement of President Trump concerning a major reprisal rate.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.