BTCS to Invest $57.8 Million in Ethereum for Strategic Growth

BTCS, a blockchain infrastructure technology company, announced that it planned to acquire $ 57.8 million from Ethereum (ETH). He intends to take advantage of his increased ETH participations to expand his deployment of nodes, stimulate the rewards of implementation and optimize the economy of block production.

The company seeks to collect the funds necessary for this purchase by issuing convertible tickets under an agreement with the investment manager Atw Partners.

BTCS is $ 57.8 million daring Ethereum Bet

In the latest press release, BTCS revealed that he had published the first lot (or slice) of convertible tickets $ 7.8 million. There is also Scope to issue more tickets up to an additional $ 50 million.

However, this requires mutual approval of BTCS and ATW partners. Tickets are convertible into ordinary shares at a price of $ 5.85 per share, a 194% bonus during the BTCS action of $ 1.99 on May 13.

They have a maturity of two years, with a 5% discount on the original emission and an annual interest rate of 6%. Investors have also received mandates for the purchase of nearly 1.9 million ordinary shares at $ 2.75 per share.

The CEO of BTCS, Charles Allen, contributed $ 95,000 to the initial offer, with an additional $ 200,000 provided by a trust he benefits.

“Similar to the way in which microstrategy has exploited its assessment to accumulate bitcoin, we are carrying out a disciplined strategy to increase our exposure to ethereum and generate recurring income thanks to the implementation and our blocking operations – while positioning the BTC for a significant appreciation should continue to increase in value,” said Allen.

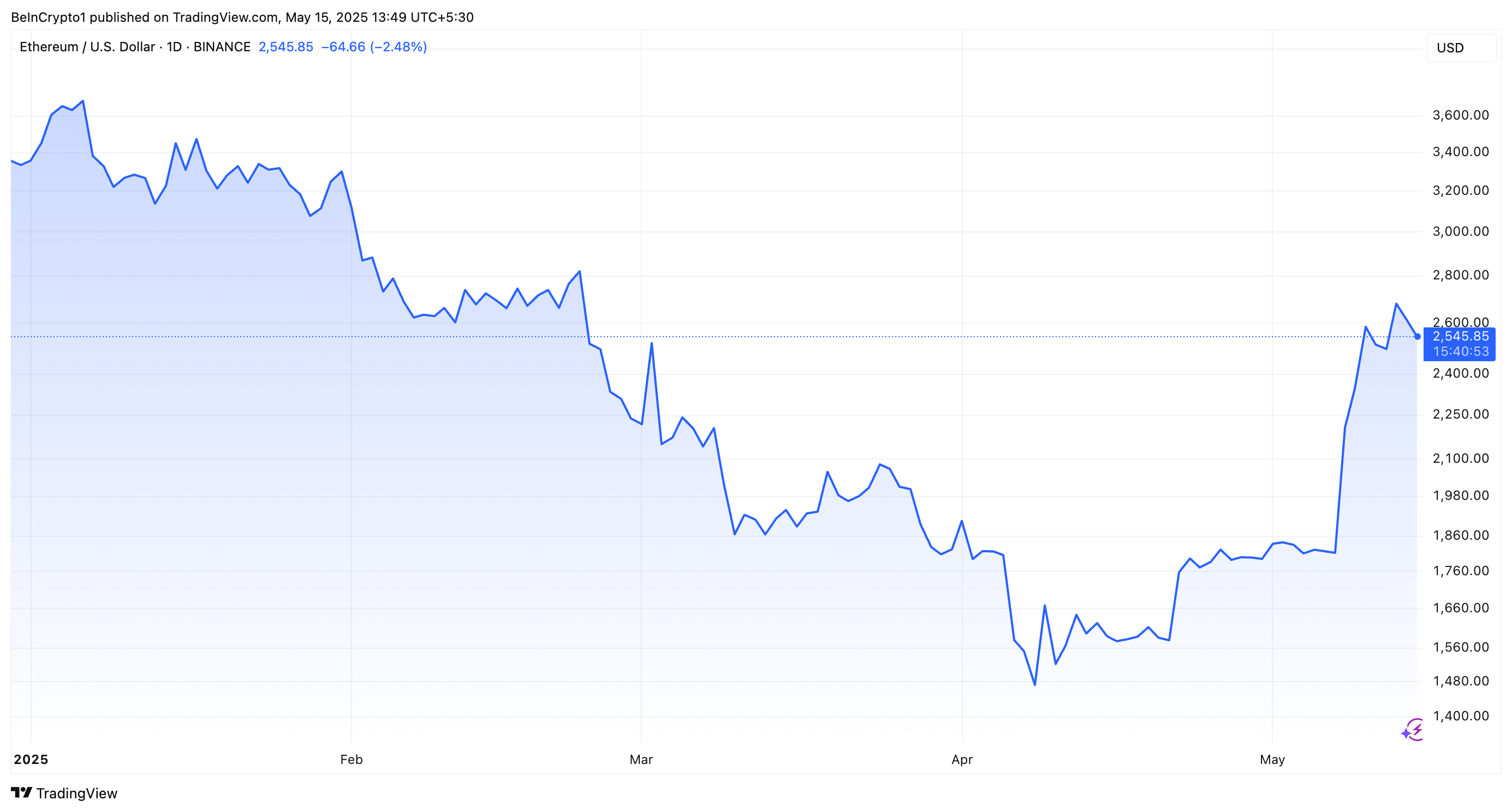

He thinks that this decision to acquire ETH arrives at a crucial moment in the growth of Altcoin. Beincryptto reported that the recent implementation of the Pectra upgrade has stimulated the Ethereum network, catalyzing an increase in the number of active addresses and the burning rate.

In addition, the price has also jumped at peaks of two months, but a modest correction followed. According to Beincrypto data, during the last day, ETH fell 3.8%. At the time of writing this document, he exchanged $ 2,545.

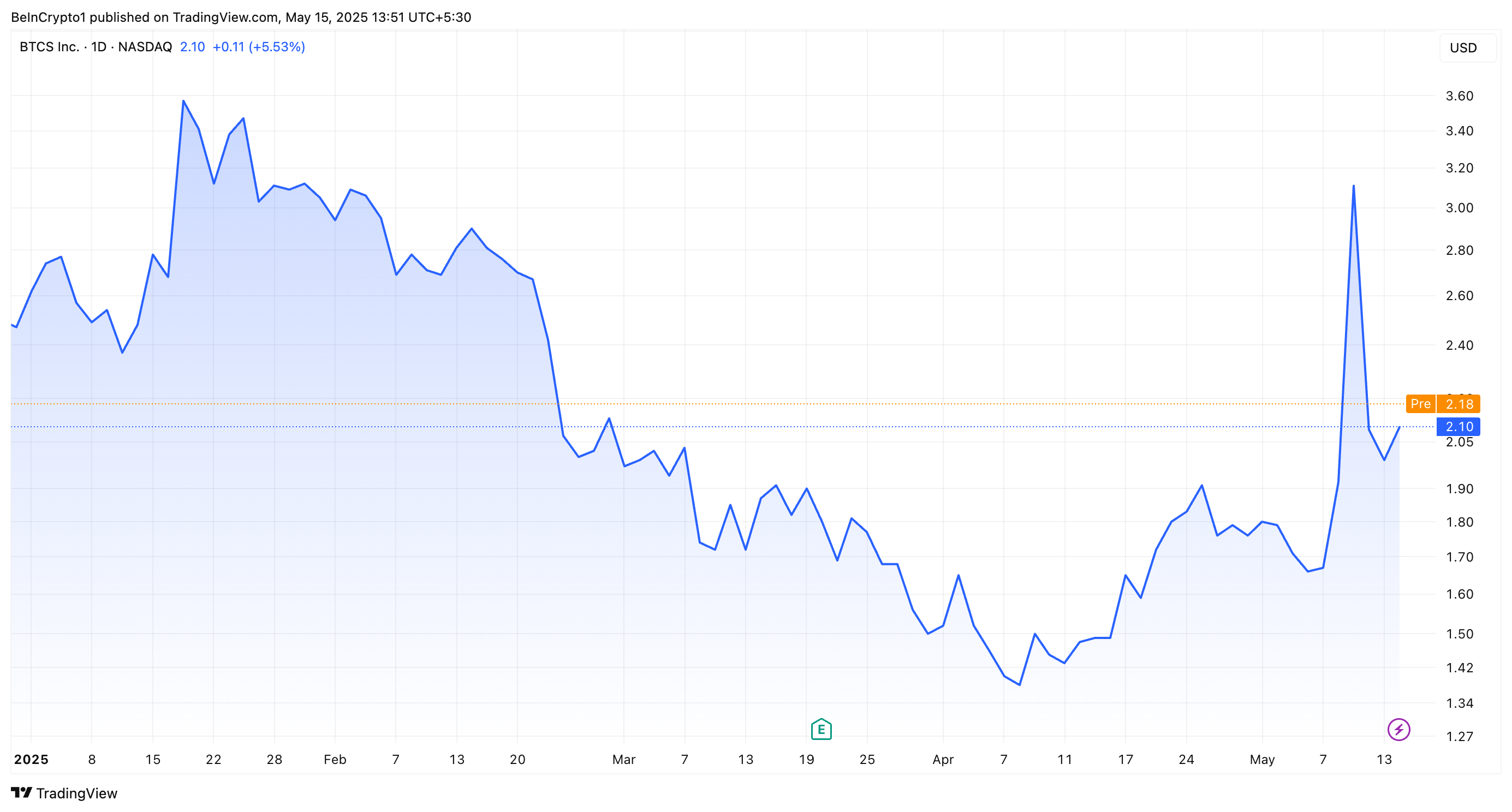

While Ethereum did not benefit from BTCS news, its own stock did. This reflected the confidence of investors in the company’s strategic pivot.

Google Finance Data showed that the share price had jumped by 5.5%. However, the year at the start, its value decreased by 14.9%.

In the meantime, The announcement comes in the middle of a broader trend of listed companies diversifying their balance sheets with digital assets. However, BTCS’s approach positions it as an actor contrary in space, diverging focused Bitcoin (BTC) strategies adopted by companies such as strategy (formerly Microstrategy), Metaplanet and 21 capital.

Although these companies have benefited from BTC Holdings, the BTCS initiative, in the event of success, could influence other companies to explore alternative digital assets beyond Bitcoin. This could potentially reshape business treasury strategies.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.