BULLA Meme Coin Keeps Surging Despite Rug Pull Fears

Bulla has jumped almost 50% since Thursday, but many eminent community members think that Hasbulla manages another carpet shooting scam. Despite the trends concerning, Bulla has become one of the best winners in the BNB ecosystem this week.

Most blockchain analysts have struck this piece of meme as a scam due to the shady history of the influencer. However, an Alpha Binance list has helped the token to acquire a certain legitimacy.

Hasbulla and Bulla explained

Hasbulla, an influencer of Russian crypto, has a long period of launching memes parts, most of which ended with allegations of scam.

Therefore, when he started a presale for the new Bulla token, the community was very skeptical of a carpet traction. Hasbulla’s bulla token exchange for most of last month, but everything remains ambiguous.

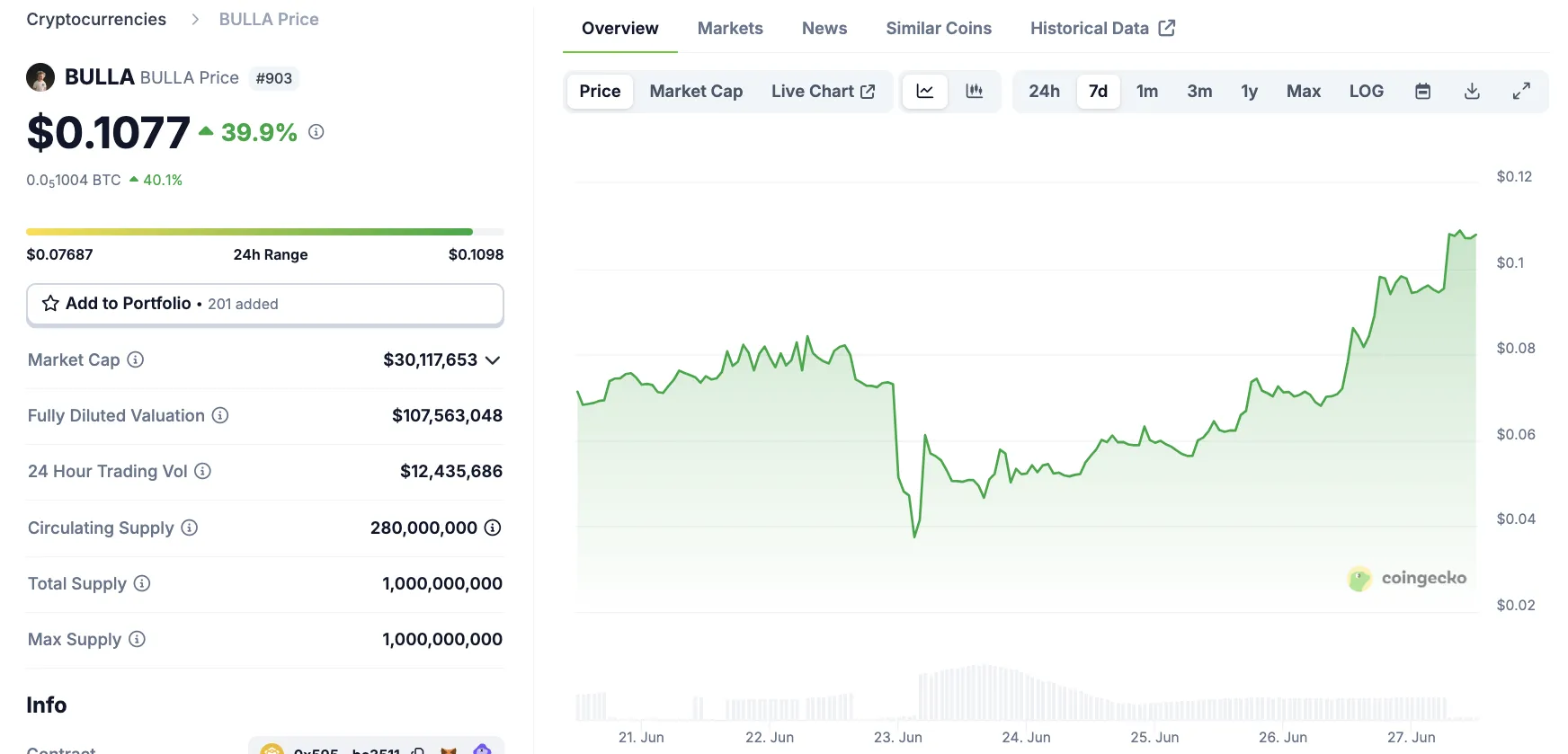

To be clear, the whole history of the asset has been punctuated by massive drops. When Hasbulla launched Bulla on June 8, he had a market capitalization of $ 100 million. Five days later, $ 70 million evaporated.

For the most part, Bulla has shown a constant decreased trend, but some events have continued to go up.

On June 22, Binance Alpha announced that it featured Hasbulla’s new asset, increasing Bulla’s prominence. This included a massive goalkeeper, for which the exchange is particularly notable.

This immediately attracted strong criticism, analysts fearing a carpet traction. Shortly after, the price of the token dropped 50%:

And yet, this drop does not seem to correspond fully to the theory of traction of the carpet. On the contrary, if there is a scam, it has not yet ended. Five days later, Bulla started again, which made Hasbulla boast the success of the token.

Compared to the drop in the list of binances, Bulla has recovered all these losses and displayed new gains, jumping 40% today.

So what happened? The community remains convinced that Bulla is a scam, especially given the history of Hasbulla. However, blockchain analysts have not yet clearly proven that.

For example, some skeptics have hypothesized that DWF laboratories may have fueled Bulla gains, while the company worked with Hasbulla before.

In addition, DWF Labs has been involved in several controversies, making it an easy scapegoat. To be clear, however, there is no concrete evidence.

Of course, the own Hasbulla team could have succeeded in pumping bulla without external help. The most direct problem seems clear: no serious analyst wants to disturb the tangible evidence of a pump and a dumping ground.

Experts have denounced Bulla since before its launch, but Hasbulla supporters continue to buy it anyway. Several analysts have argued for having allowed them to be ripped off.

This apathy and this contemptuous attitude will not produce any preliminary warning, but it can produce interesting post-mortes.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.