Powell Turned Hawkish: Internal Fed Discord and Crypto Market Reaction

The president of the United States Federal Reserve (Fed), Jerome Powell, the surprisingly restrictive tone sent shock waves through the markets. The Fed held a meeting of the Federal Open Market Committee (FOMC) on the 30th and decided to maintain the interest rates unchanged at 4.25-4.50%.

The Fed has held stable interest rates for five consecutive meetings since January. This decision comes in the middle of President Donald Trump’s continuous pressure to reduce increasing rates and calls within the Fed itself.

Powell assessment moves market expectations

Although the decision to maintain unchanged rates has been repeated, the underlying economic assessment has changed somewhat. The Fed said: “Recent indicators suggest that the growth in economic activity has moderate. GDP increased at a rate of 1.2% in the first half of this year, compared to 2.5% last year. ” This evaluation was more cautious than the FOMC Declaration of June. Previously, the economy was described as “developing at a solid pace”.

During the press conference, President Powell mentioned “the downward risks for the labor market” twice.

Powell explained: “We see a risk of decline in the labor market. I mean that our two mandate variables are on the right of inflation and maximum employment and maximum employment prices and not so much growth.

This suggests that economic momentum has weakened as consumers have started to reduce expenses due to tariff concerns.

However, Powell stressed: “The unemployment rate remains low and the labor market is almost maximum employment. In particular, he explained: “Despite high uncertainty, the economy is in a solid position.”

Bitcoin falls below $ 116,000 in the midst of uncertainty compared to the drop in the September rate

The atmosphere of the press conference underwent a dramatic change. When Powell was held for the first time in front of the microphone, the market reaction was very calm. The market expected the Fed to maintain the interest rates unchanged in July, and a drop in rate in September seemed likely.

However, as the press conference progressed, economic indicators have deteriorated in real time. The three main American stock market indices – NASDAQ, S&P 500 and Dow Jones – Fell and Bond Rose Rose. The Bitcoin price, which had oscillated around $ 117,800, briefly dropped below $ 116,000. Indeed, Powell referred to a negative position towards the drop in the rate of September. Something that the market had already taken for granted.

Asked about a possible rate reduction in September, Powell stressed that “we did not make any decision about September. We don’t do it in advance. We will take into account this information and all the other information that we obtain when we make our decision at the September meeting. ”

The Fed is an institution that pursues two objectives: the stability of employment and price stability. Given that he mentioned the risks on the labor market in his declaration of decision of previous rate, a drop in rates in September would be a natural response from the Fed point of view.

Powell has constantly maintained the uncertainty about inflation on the same day. He explained: “I think you have to consider this as still early enough” concerning the pricing impacts, adding: “We expect to see more. And we know by surveys that companies believe that they intend to put this to the consumer, but you know, the truth is that they may not be able to do so in many cases.

This explanation seems reasonable at first glance. However, this also implies that the Fed may be unable to adjust politics for the coming months. The Fed is concerned with inflation. But for the moment, we do not know how long it will take the prices to fuel inflation.

Fed rate policy: internal dissent emerges while Powell maintains the bellicist position

The notable point of this day was that two members of the Fed board of directors disagreed with the chair.

When the Fed decides interest rates, the participants in the meeting generally make a unanimous decision. It was the first time in 32 years that two members have expressed a different opinion in the history of the FOMC. This indirectly shows that there are different opinions within the Fed on the current economic situation.

The two members who pleaded for a rate drop are Christopher Waller and Michelle Bowman. The two were appointed by Trump in his first mandate, Bowman being promoted vice-president during his second term.

They share Trump’s point of view that a rapid drop in interest rates is necessary, but differ in detail. Trump maintains that the American economy is strong and that interest rates should be reduced to achieving greater growth. Waller, on the other hand, argues that interest rates should be reduced before the labor market weakens.

Waller stressed that, although non -agricultural jobs increased by 147,000 in June, exceeding expert expectations, the increase was largely in the public sector. Given that the Fed is an institution which aims not only to “price stability” but also to “maximum employment”, it must fully consider that the fact that the time of interest rate reductions could harm the labor market.

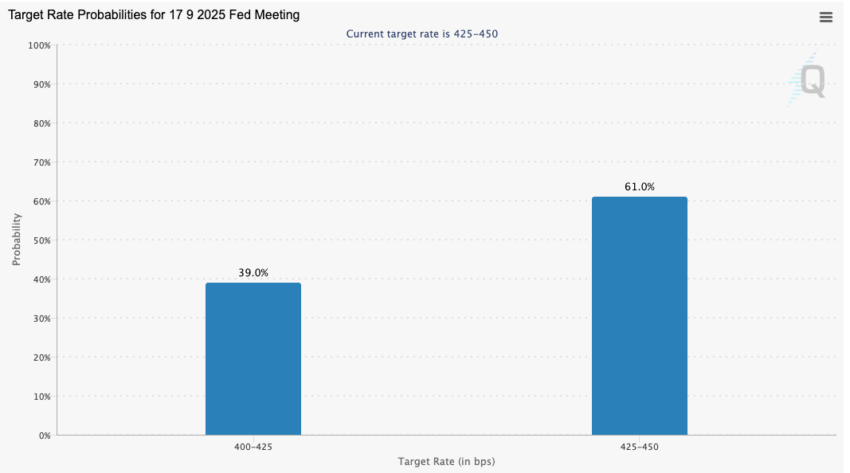

Following Powell’s beautiful remarks at the press conference, the Fedwatch tool of the CME, which predicts interest rates, completely reversed its forecasts for the September reference rate. The probability of a rate drop, which amounted to 63.3% in the 29th, the day before, dropped to 43.0% immediately after the FOMC meeting.

The post Powell has become a fellowshipman: the internal reaction of discord and crypto appeared first on Beincrypto.