Can ETH Price Hit $3,000 by February’s End? Market Outlook

Ethereum (ETH) price has remained in a consolidation phase, negotiating below $ 3,000 since February 2. In recent weeks, indicators such as RSI, DMI and EMA suggest that ETH has no strong momentum, buyers or sellers fully taking control.

The narrowing gap between its EMA lines suggests a potential change, but the ETH must overcome the key resistance levels to use the bullish momentum. Meanwhile, if the support levels do not hold, a deeper correction to $ 2,160 could be on the table.

Ethereum RSI has been neutral for two weeks

The Ethereum relative force index (RSI) is currently 54.2, remaining neutral since February 3. RSI measures the time of the price, with values between 30 and 70 indicating a balanced market.

Ethereum has remained in this range, which suggests that neither buyers nor the sellers took control. This means that ETH has not yet entered an excessive area greater than 70 or an occurrence zone of less than 30.

RSI varies from 0 to 100, with key levels at 30 and 70. Reading greater than 70 signals of the surachat conditions, while less than 30 suggest levels of occurrence. At 54.2, the ETH is in neutral territory, which means that the action of prices lacks strong momentum.

For the ETH price to reach $ 3,000, the RSI should probably move around 60 or more, indicating an increase in purchase pressure. A thrust above 70 could point out a strong bullish dynamic, helping the ETH break the levels of resistance of the keys.

Eth DMI shows the absence of a clear direction

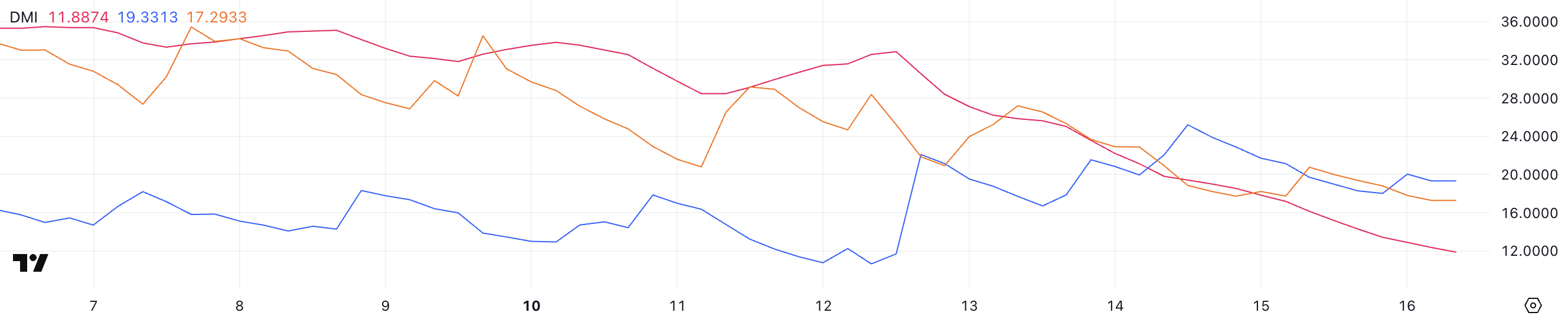

The directional movement index of Ethereum (DMI) shows its average directional index (ADX) to 11.8, regularly decreasing since February 12, while it was 32.8.

ADX measures resistance to trend, with values above 25 indicating a strong trend lower than 20 suggesting a low trend or without trend. Constant decline indicates the discoloration of the momentum, which means that ETH lacks a clear directional thrust.

ADX is part of the DMI, which also includes the + DI (positive directional indicator) and -DI (negative directional indicator). + DI is 19.3, against 25.2 two days ago, while -Di is 17.2, down compared to 18.8.

This suggests that optimistic and lowering pressures are weakening. For the ETH to find $ 3,000, ADX should exceed 20, signaling a stronger trend dynamic, while + DI should climb above -I with a wider gap, indicating a renewal of bullish force.

Eth prices prediction: Will Ethereum come back to $ 3,000 in February?

Ethereum The price has been negotiated between $ 2,800 and $ 2,550 since February 7. Its EMA lines always show a lower perspective, because the short -term lines remain below those in the long term.

However, the gap between them is shrinking, suggesting a potential change in the momentum. For the ETH to reach $ 3,000 in February, it must first break the resistance by $ 2,800, then maintain a decision more than $ 3,020. If the momentum is strengthened, ETH could even test $ 3,442, a level given for the last time at the end of January.

Lower, if Ethereum retains the support of $ 2,551 and does not hold, additional declines could follow.

The loss of this key level can open the door to a drop to $ 2,160, a significantly lower support.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.