Can Fed’s Potential QE Push BTC Higher?

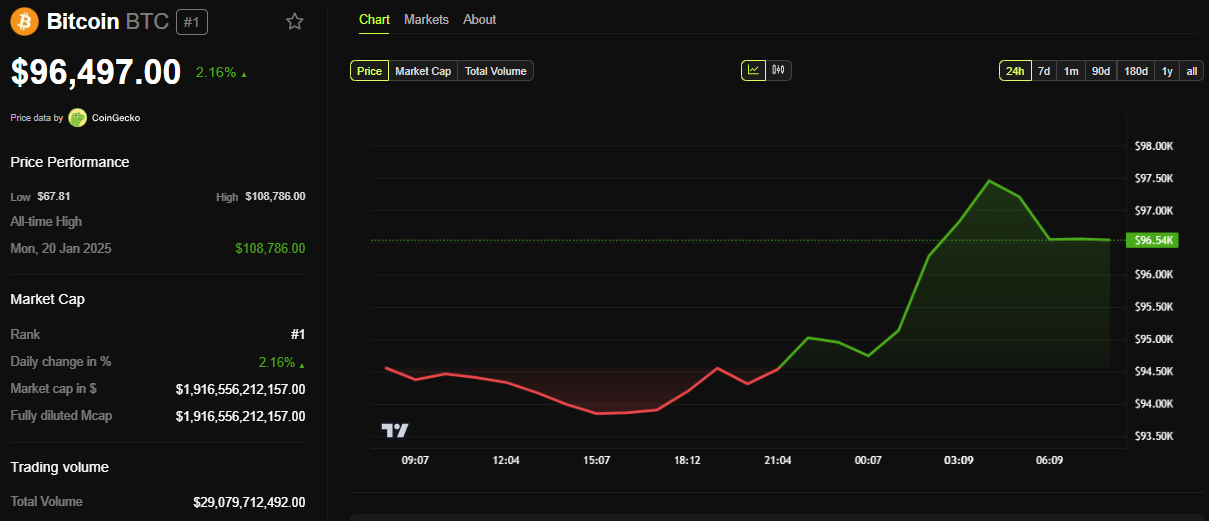

Bitcoin (BTC) jumped over $ 97,000 on Wednesday before retiring to the $ 96,000 range. The brief test came while the markets absorbed a wave of liquidity strengthening of China and increasing speculation according to which the American Federal Reserve (Fed) can be paid towards a return to quantitative relaxation (QE).

The timing of movements, a few hours before a crucial meeting of the FOMC (Federal Open Market Committee), sent merchants to reassess the global macro image.

China unleashes $ 138 billion in liquidity while commercial talks reign the feeling of risk

The Information Office of the Council of State organized a press conference. Presented, Governor Pan Gongsheng of Banque Populaire de China (PBOC) has announced interest rate drops.

The PBOC said that it would reduce the ratio of reserve needs of 0.5 percentage points, releasing around 1 Billion of Yuan (~ 138 billion dollars) of long -term liquidity and will reduce the interest rate of the policy by 10 basis.

“Pan Gongsheng, governor of the Popular Banque of China, announced during a press conference that the reserve needs ratio would be reduced by 0.5 percentage points, offering the market of around 1 long -term liquidity yuan and reducing the interest rate of the policy of 0.1 percentage point,” said local media.

The PBOC has reduced the reversed repo rate by seven days by 1.5% to 1.4%. This will reduce the loan rate by 10 other base points.

It also unveiled additional support measures, including a retaining tool of $ 500 billion for elderly care and consumption. In addition, it has reduced mortgage rates and reserve requirements for automotive financing companies.

The moment of recovery from China was not a coincidence. A few hours earlier, the Secretary in the United States of the Treasury, Scott Bessent, confirmed that he would meet the Chinese Deputy Prime Minister, He Lifeng in Switzerland, on May 10 and 11.

“Thanks to Potus, the world came to the United States, and China was the missing play – we will meet on Saturday and Sunday to discuss our common interests. Current prices and commercial barriers are not durable, but we do not want to decoup. What we want is a fair trade,” said Bessent.

The markets reacted quickly. According to Kobeissi’s letter, the term contracts on S&P 500 have survived + 1% on this news. Bitcoin has followed suit, increasing above $ 97,000 before sliding back.

When writing these lines, BTC was traded at $ 96,497, up 2.16% in the last 24 hours. This retraction At the fork of $ 96,000 is in the middle of the uncertainty of the market, while the merchants are preparing for the FOMC Later in the day.

The purchase of nour bonds increases quantitative softening flags

Meanwhile, the activity of the Fed’s balance sheet this week raises the eyebrows. On May 6, the Fed bought $ 14.8 billion in cash tickets at 10 years, following a purchase of $ 20 billion in 3 -year tickets on May 5, totaling $ 34.8 billion in two days.

“The Fed bought obligations of $ 14.8 billion today.

Without an official announcement, these purchases suggest that the Fed quietly injects liquidity into a subtle quantitative relief movement.

Arthur Hayes, former CEO of Bitmex, considers a quarter of work as a little optimistic for the crypto. In a recent column, Hayes argued that Bitcoin was worth $ 250,000 by the end of 2025 if the Fed restarted QE. He sees the liquidity of the Fed move as the beginning of this process.

Beincryptto also explored the chances that the return of the QE and its implications. Any fresh qe wave could reduce real yields, devalue the Fiat and potentially lead to significant entries in cryptographic assets.

However, not everyone is convinced that QE is necessary. In a counterpoint report, macro-experts argue that quantitative relaxation is not necessary in the middle of the current agitation on the market. They argue that the financial system has not yet shown signs of systemic distress.

Meanwhile, gold has reached almost recorded heights of $ 3,437.60 per 28.84% year, reflecting the discomfort of investors.

The gold wave suggests a fear of trade while investors maneuver continuous economic instability.

Investors are preparing for clarity or new ambiguity while the president of the Fed, Jerome Powell, is preparing to address the markets later during the day. The brief Bitcoin rally above $ 97,000 Signals Optimism, but the wider market of cryptography can remain linked to the beach until the Fed shows its cards.

Bitcoin could soon be supported over the $ 97,000 threshold if Powell reports a subtle pivot. Otherwise, traders can be faced with greater volatility.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.