Bitcoin ETFs’ $1.8 Billion Inflows To Drive Price To $95,000

The recent Bitcoin rally has confirmed a key bullish model, offering additional optimism for the price trajectory of the room.

The whales are actively accumulating, and the demand for Bitcoin negotiated funds (ETF) has increased, which feed the rise in Bitcoin. With major ETF market entries, Bitcoin is ready to reach new heights in the near future.

Bitcoin whales accumulate strongly

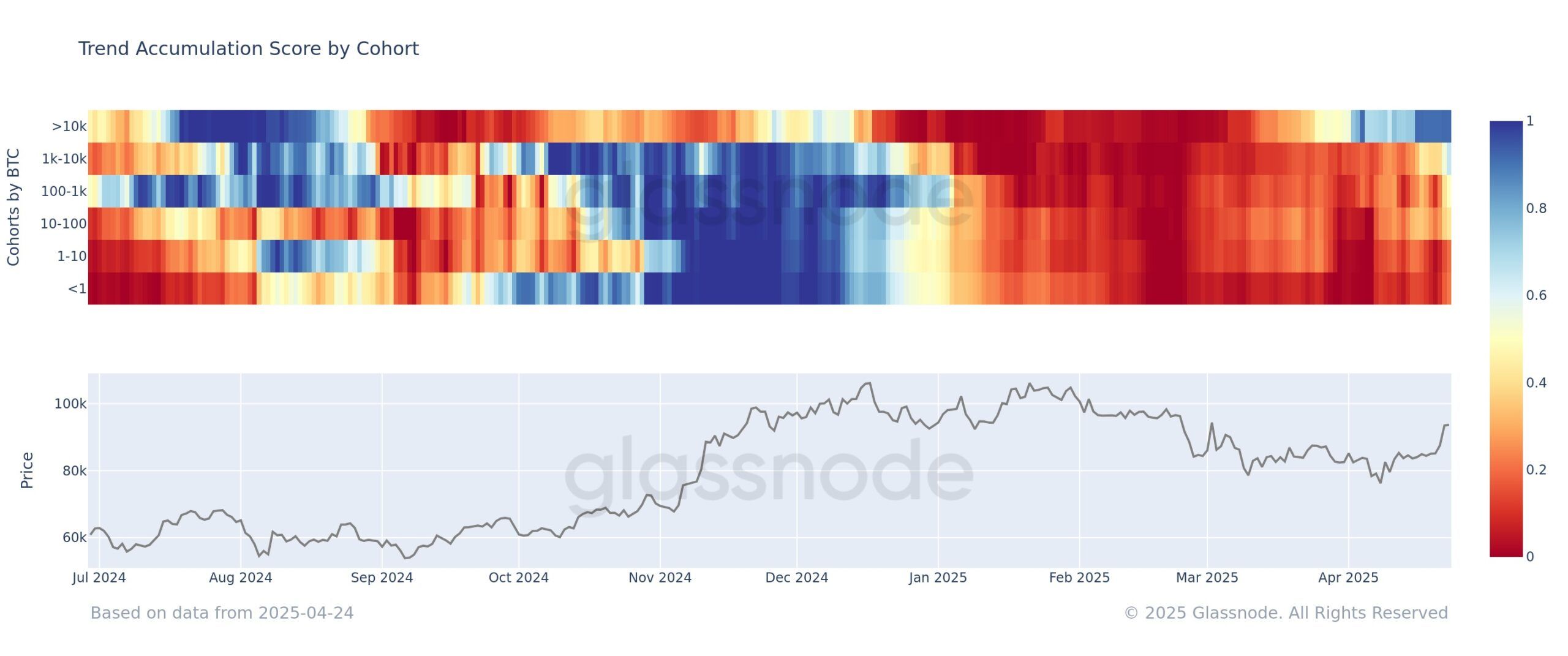

Whale activity remains a key driving force in the rise in bitcoin prices. According to the trend accumulation score, investors with more than 10,000 BTC show an almost perfect accumulation score of 0.9, signaling a strong optimism among major investors.

This accumulation suggests that whales expect a continuous upward impulse and position themselves for new gains.

In addition, investors holding between 1,000 and 10,000 BTC also actively participate, with a slightly lower accumulation score by 0.7. This indicates that the smaller but always important players follow the example of whales, contributing to the global positive feeling surrounding Bitcoin.

The confidence exposed by these major investors suggests that Bitcoin demand will continue to increase, which has potentially increased prices.

The macro momentum for Bitcoin is more and more favorable, in particular due to recent FNB flows. In the past two days, Bitcoin has experienced $ 1.8 billion entries. On April 22, $ 912 million flocked to Bitcoin ETF, followed by $ 917 million on April 23, marking the highest day entries in more than five months.

Substantial entries are a clear indication of the increase in demand and reflect the confidence of investors in the long -term potential of Bitcoin.

These massive entries of institutional and detail investors indicate a broader change in the feeling of the Bitcoin market. As the demand for ETF Bitcoin increases, the same goes for the rise in the Bitcoin price. The growing investment in Bitcoin ETF creates a positive feedback loop, which has probably increased the higher price in the short term.

BTC Price aims $ 95,000

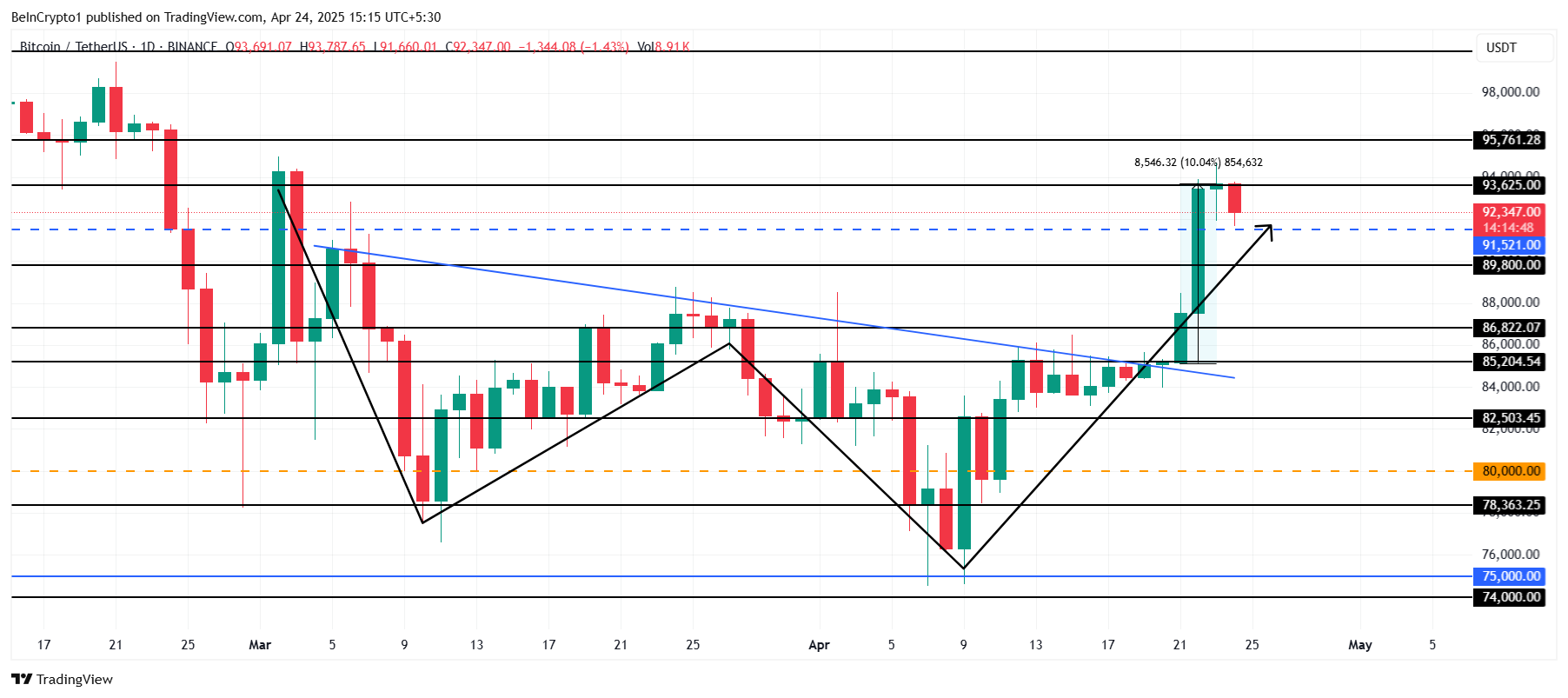

Currently, Bitcoin is traded at $ 92,347, a little less from the resistance of $ 93,625. Despite recent attempts, Bitcoin has not yet violated this key level. However, with the recent escape and favorable market conditions, Bitcoin is on the right track to unravel this resistance in the near future.

The cryptocurrency validated a double background model earlier this week, increasing by 10% in just two days. This escape strengthens upward perspectives, and the combination of the accumulation of whales and ETF entrances could help bitcoin to brow the resistance of $ 93,625.

A successful break could push Bitcoin to the range of $ 95,000 and potentially the resistance of $ 95,761.

However, if Bitcoin does not maintain its momentum upwards and falls below the support of $ 89,800, it could trigger a downward reversal.

A drop below this level of support would invalidate upward perspectives, potentially sending the price of Bitcoin to $ 86,822, erasing recent gains.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.