Could Bitcoin’s Rise Harm Corporate Holders?

Following the example of the strategy, companies are investing more and more in Bitcoin, a trend reinforced by the increase in the price of cryptocurrency. However, these massive acquisitions raise concerns about the collapse of the market if companies are forced to sell and questions about decentralized Bitcoin ethics.

Representatives of Bitwise, the Komodo and Sentora platform declare that the advantages largely prevail over risks. Although small overexclus companies could go bankrupt, their impact on the market would be minimal. They do not provide for any imminent risk, as prosperous companies like Microstrategy show no signs of asset liquidation.

The growing trend in the adoption of corporate bitcoin

The number of companies that join the business bitcoin acquisition trend increases. While Standard Charterd recently reported that at least 61 companies listed on the stock market had bought Crypto, Bitcoin Treasuries reports that the number reached 130.

While the strategy (formerly Microstrategy) continues to accumulate billions of unrealized gains from its aggressive Bitcoin acquisitions, reinforced by an increase in the price of Bitcoin, more companies are likely to follow.

“The Wilshire 5000 shares index literally includes 5,000 listed companies in the United States only. It is very likely that we will see an important acceleration in the adoption of the Bitcoins corporate treasury this year and in 2026, “said André Dragosch, head of research for ILO in Europe, told Beincrypto.

The reasons that fuel his belief are multiple.

How does Bitcoin volatility compare to other assets?

Although volatile, Bitcoin has historically demonstrated exceptionally high yields compared to traditional asset classes such as actions and gold.

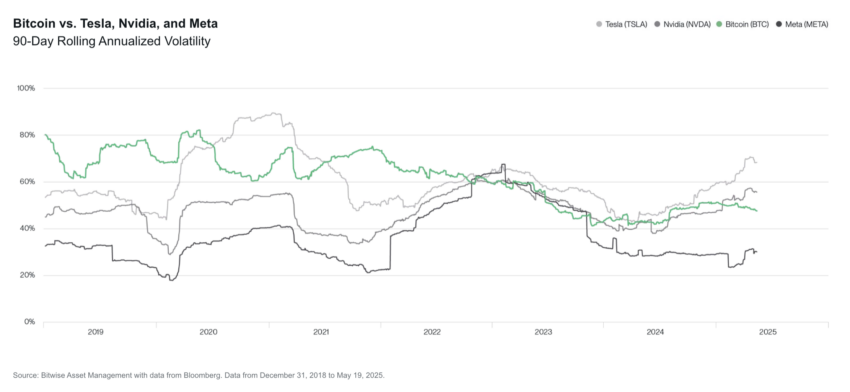

“A particularly interesting data point is the volatility of Bitcoin compared to the main technological actions, such as Tesla and Nvidia. Many investors say: “I would never invest in something as volatile as Bitcoin” Nasdaq-100). In recent months, Tesla and Nvidia have both been more volatile than Bitcoin. »»

Although past performance does not guarantee future yields, the current Bitcoin performance, which has been particularly stable, can motivate more companies to buy the assets.

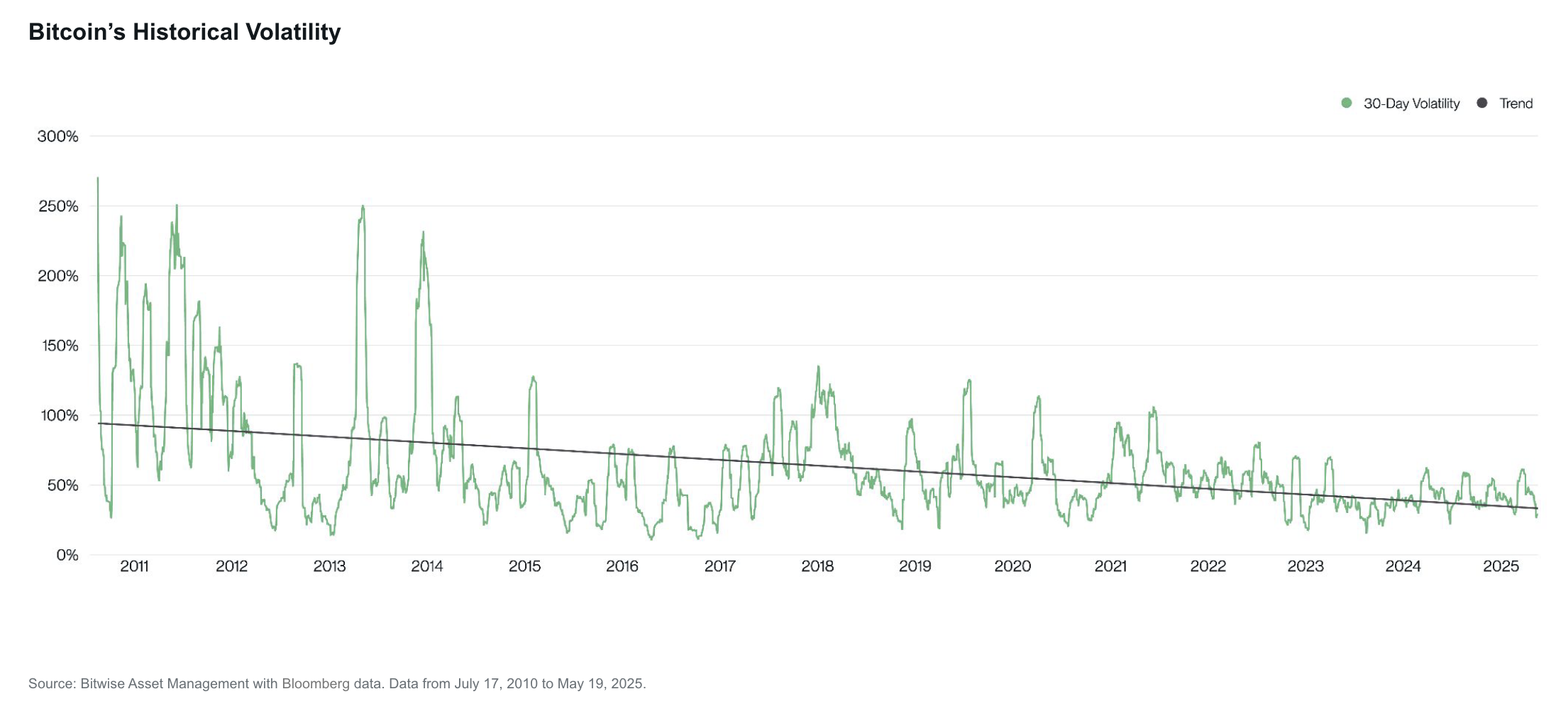

“Bitcoin volatility has decreased over time – a trend that will be maintained in the foreseeable future. While Bitcoin discovers its actual price, volatility will be reduced to almost zero, and it is probably increasingly increasingly increased on a long -term horizon, if the past is a Kadan indicative, in the long term, to timing, if the past is a Kadan indicative, in the long term, to timing, if the past is an indicative Kadan, in the long term, if the chronometer is an indicative Kadan, in the long term, if the chief of technology is a Kadan indicative, in the long term, to timing, if the past is a Kadan indicative, in the long term, to timing, if the past is an indicative “The komodo platform, told Beincrypto.

Meanwhile, while global markets are struggling with economic challenges, Bitcoin could become an attractive option to improve weak financial assessments.

Will Bitcoin go beyond traditional shelters?

The United States and the largest world economy have undergone geopolitical tensions, an increase in inflation rates and disturbing tax deficits. Considered “digital gold” and a sovereign neutral value store, Bitcoin has bitten the interest of the various shareholders, in particular after the triumph of the strategy.

“The pressure of existing shareholders will certainly increase over time because more and more companies adopt such a business policy, in particular if the inflation rates should start to refellence due to the increase in geopolitical risks and the increase in the monetization of tax debt by central banks.

He predicted that the day when Bitcoin has outperformed traditional shelters such as cash tickets and gold would eventually arrive. As the adoption increases, the volatility of Bitcoin falls, which makes it a full competitive asset.

“The volatility of Bitcoin has been on a structural decrease trend from the very beginning. The main reasons for this structural decline are an increasing rarity due to halvery and increasing adoption, which tends to alleviate volatility. Our expectation is that the volatility of Bitcoin will finally converge towards the volatility of gold and will become a first -rate levy for another reduction and reference store.

Meanwhile, Bitcoin’s technological backdrop would also give it a competitive advantage over other asset classes.

“Because of its technical superiority in relation to gold, we believe that there is a high probability that bitcoin can ultimately disturb gold and other value reserves such as long -term American cash obligations. This will become more and more relevant in [the] Face of the rise in the risk of sovereign debt on a global scale, “added Dragosch.

However, not all companies are created equal. While some benefit from it, others do not do so.

Differentiating business bitcoin strategies

According to Rasmussen, there are two types of Bitcoin cash companies.

These are either profitable companies that invest spare money, such as Coinbase or Square, or companies that guarantee debt or equity to buy bitcoin. Whatever the type, their accumulation increases Bitcoin demand, increasing its short -term price.

Profitable companies that buy bitcoin using an excess of liquidity are rare and have no systemic risk. Rasmussen plans that these companies will continue to accumulate long -term bitcoin.

Companies that use debt or equity could face a different fate.

“Bitcoin financing companies only exist because public procurement is willing to pay more than $ 1 for $ 1 of Bitcoin. It is not durable in the long term, unless these companies can increase their bitcoin by action. Capital emission to buy Bitcoin does not increase Bitcoin by action, ”explained Rasmussen.

The success rates of these companies depend on the amount of profits they have to repay their debts.

Reduce the risk of corporate bitcoin

Larger and established companies always have more resources than the smallest to manage their debt.

“Large Bitcoin cash companies, such as Strategy, Metaplanet and Gamesop, should be able to refinance their debt or issue equity to collect funds to repay their debt with relative ease.

According to Dragosch, the key to avoid such a scenario for small businesses is to prevent oozing. In other words, borrow what you can afford to reimburse.

“Their key element which often breaks any type of commercial strategy is the effect of overexraction … The potential risks are rather with other companies which copy the Bitcoin acquisition strategy of MSTR and start with a higher cost base.

However, these liquidations would have a minimum of market effects.

“This would create short -term volatility for Bitcoin and harm the stock prices of these companies, but it is not a risk of blowing for the wider cryptography ecosystem. This will probably be a relatively low number of small businesses which must sell a relatively immaterial number of Bitcoin to repay their debt. If this is the case, the market is barely blinked,” said Rasmussen.

The real problem emerges when the big players decide to sell their assets.

Are large assets a systemic risk?

More companies adding bitcoin to their balance sheets create decentralization, at least at the market level. The strategy is no longer the only company to use this strategy.

That said, the strategy assets are enormous. Today, it holds nearly 600,000 bitcoins – 3% of the total offer. This type of centralization indeed includes risks of liquidation.

“More than 10% of all bitcoins are now held in portfolios and corporate treasury of ETF;

Some experts think that such a scenario is unlikely. If this should happen, Stadelmann predicts that the initial negative results would eventually stabilize.

“If Microstrategy had to sell a large part of his bitcoins, he will develop a plan to do so without affecting the market at the start. Finally, people will realize what is going on, and this will lead to a larger sale and at depressed bitcoin prices. However, the lower prices combined with other Bitcoin companies will only lead 21 million pieces, “he said.

However, the significant quantity of bitcoin owned by a few large companies raises renewed concerns concerning the centralization of assets itself rather than competition.

Centralization as compromise for adoption

The accumulation of large companies raises concerns about the concentrated property of the limited Bitcoin offer. This questions a basic basic principle and generates anxiety concerning the disturbance of its fundamental structure.

According to Dragosch, this is not the case. No one can modify Bitcoin rules by having most of the offer.

“The beauty of the Bitcoin work proof consensus algorithm is that you cannot change the Bitcoin rules by having the majority of the offer that is different from other cryptocurrency like Ethereum.

In turn, Pellicer sees a certain truth in these concerns. However, he considers them as a compromise for the other advantages of generalized adoption.

“While this centralization is conflict with the Bitcoin ethics of individual and self-televised property, institutional guard could always be the most practical path to generalized adoption, providing regulatory clarity, liquidity and ease of use that many new participants expect,” he said.

With companies increasingly pulling Bitcoin for strategic financial benefits, its path to become a largely accepted reserve asset is accelerating. For the moment, the risk of collapse in the market seems to be contained.

Non-liability clause

Following the directives of the Trust project, this operating article presents opinions and prospects of experts or individuals in the industry. Beincrypto is dedicated to transparent relationships, but the opinions expressed in this article do not necessarily reflect those of Beincrypto or its staff. Readers must check the information independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.