Cardano (ADA) Drops 39% After US Crypto Reserve Listing

Cardano (ADA) faces intense sales pressure, lowering almost 10% in the last 24 hours and almost 29% in last week. Since its inclusion in the United States Strategic Reserve, Ada has dropped by 39%, fighting to resume the bullish momentum.

Indicators like Bbtrend and DMI show that the lowering feeling remains strong, the sellers are still in control. If the current downward trend continues, ADA could test the key support levels, but a reversal could push it back to major resistance areas.

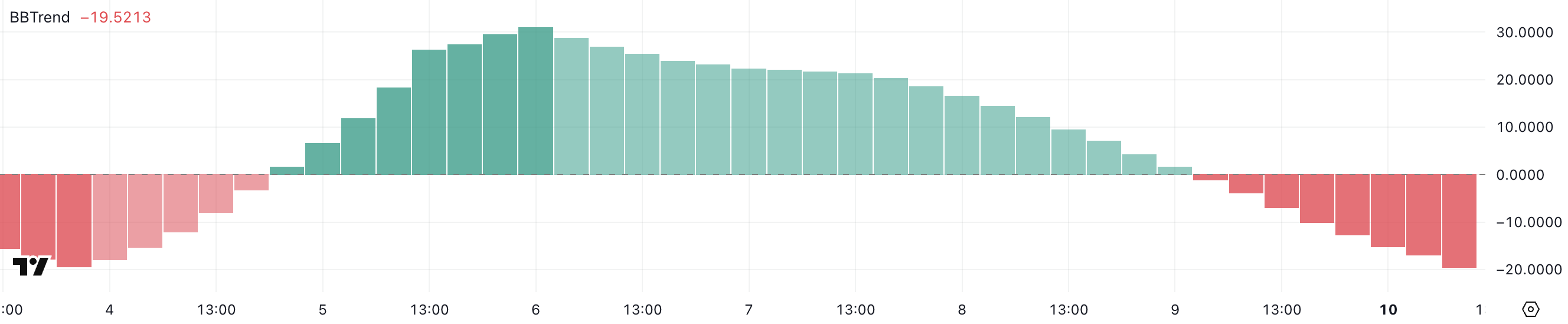

Ada Bbtrend shows that the sales pressure becomes stronger

The Cardano Bbtrend indicator is currently at -19.52, continuing its decline since yesterday. Earlier this month, from March 5 to 8, Bbtrend remained positive, reaching a peak of 31 on March 6.

This transition from a positive territory to a negative territory suggests an weakened optimistic trend, with increasing pressure on the price of ADA. Merchants are now looking at if this drop continues or if Ada can resume momentum.

Bbtrend, or Bollinger Band Trend, is an indicator that measures price trends based on Bollinger strips. It shows if an asset is in a strong phase, raised or lower. When Bbtrend is positive, he suggests a strong ascending impulse, while the negative values indicate an increasing sale pressure.

With Bbtrend d’ADA now at -19.52, he signals the increase in lowering feeling, which suggests that the price could continue to decrease unless buyers intervene. If the downward trend persists, ADA can test key support levels in the coming days.

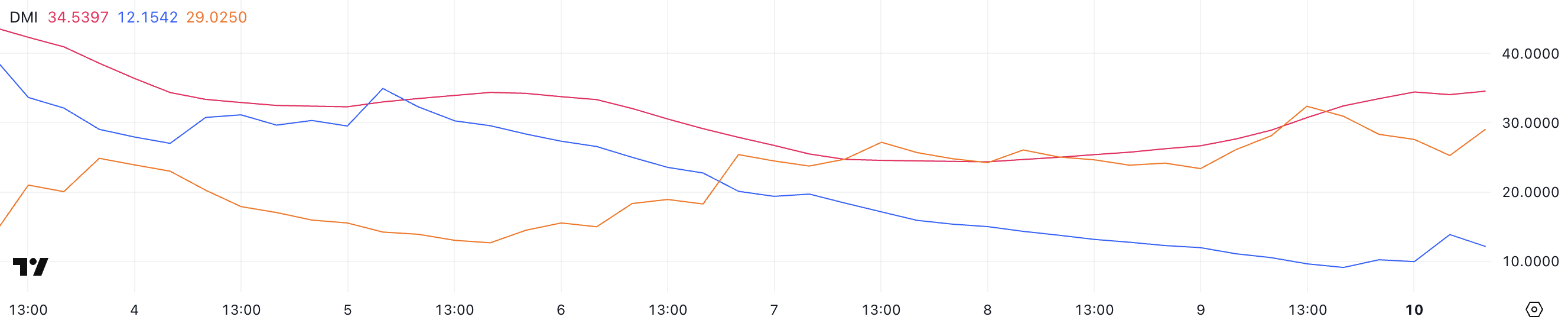

Cardano DMI shows that sellers still control

The graphic of the Cardano Directional Movement Index (DMI) shows that its average directional index (ADX) increased to 34.5, against 26.6 yesterday. This increase suggests that the current trend of ADA – whether optimistic or down – gains in force.

Since ADA is in a downward trend, ADX increasing indicates that the sales pressure is intensifying, which makes it more difficult for the price of reversing in the short term.

ADX measures the strength of a trend on a scale from 0 to 100, with values above 25 indicating a trend strongly and greater than 50 suggesting an extremely strong trend.

Meanwhile, the + DI of ADA (positive directional index) rose to 12 from 9.6 yesterday, but is slightly down compared to 13.8 a few hours ago, indicating low bullish attempts.

At the same time, -Di (negative directional index) is at 29 years old, less than 32.3 of yesterday but going from 25.2 a few hours ago.

This suggests that although sellers always control the trend, some short -term declines occur. If -Di remains dominant and that Adx continues to rise, the downward tendency of ADA could extend more.

Will Cardano fall below $ 0.60?

The Cardano EMA lines indicate that a potential death cross could be formed soon, signaling a bearish momentum.

A death cross occurs when a short -term EMA crosses an EMA in the longer term, often leading to increased sales pressure.

If this lowering crossing occurs, Ada Price could further decrease, the level of support of $ 0.58 becoming a key area to monitor. Ventilation below this level could trigger even deeper losses.

However, if buyers regain control and ADA can reverse its trend, the price can increase to the resistance level by $ 0.818. An above escape which could open the door to additional gains to $ 1.02 and even $ 1.17 if the momentum is strengthened.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.

![The Merger Option When Funding Stalls [podcast] The Merger Option When Funding Stalls [podcast]](https://i2.wp.com/tkcdn.tekedia.com/wp-content/uploads/2025/07/30183221/merger-2.jpg?w=390&resize=390,220&ssl=1)