Cardano (ADA) Jumps 4% as Bullish Signals Emerge

Cardano (ADA) is up 4% on Monday, trying to reach $ 0.65, showing renewed bond signs. Technical indicators are starting to line up in favor of buyers, the BBTREND becoming positive for the first time in days and the DMI signaling strengthening upward pressure.

The ADA also approaches a potential gold crossing of gold on its EMA lines, which could further support a break if the resistance levels are eliminated. With the momentum and key levels in sight, Cardano enters a critical area that could define its short -term management.

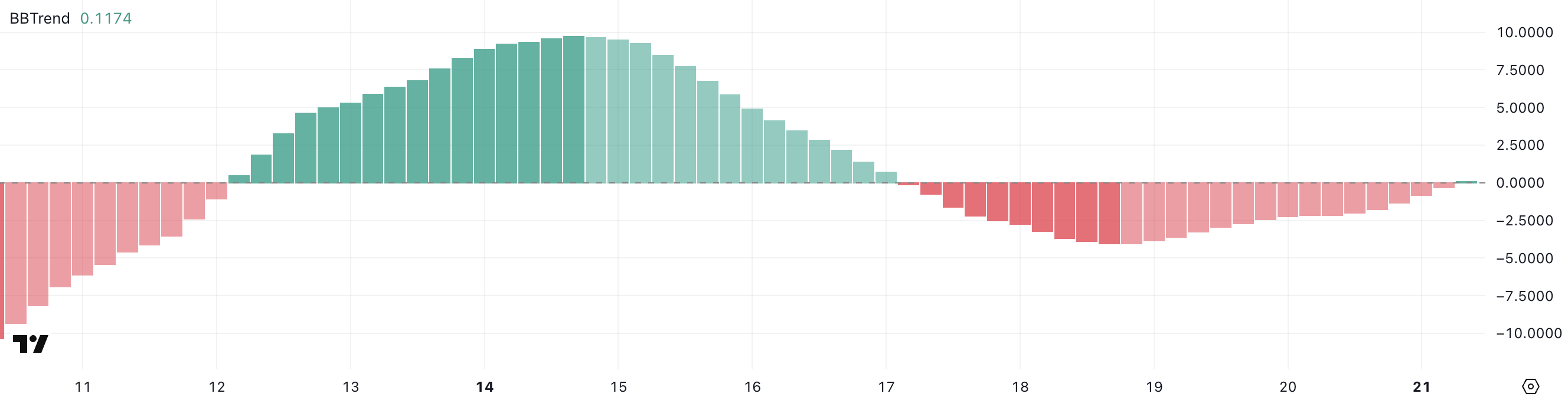

Cardano shows the first signs of recovery while Bbtrend becomes positive

Cardano Bbtrend has just returned to a positive territory at 0.11, after four consecutive days in the negative zone. This change, although subtle, can be the first sign of momentum stabilization after recent weakness.

Bbtrend, or the trend of Bollinger’s band, is a technical indicator that measures the strength and direction of a trend according to the large or narrow Bollinger strips.

When the bands start to develop and Bbtrend goes to positive values, this often suggests increasing volatility in favor of an emerging update. On the other hand, the prolonged negative readings generally signal discolorating impulse and a lack of directional force.

Although a bbtrend of 0.11 is still low and does not yet point out a strong upward trend, the fact that it has become positive marks a potential inflection point.

This suggests that the sales pressure can be discolored and that the price could enter a recovery phase if the purchase activity increases. This early increase in Bbtrend often precedes a broader decision.

Merchants will probably watch closely to see if this positive change is maintained in future sessions, because the continuous gains of BBTREND could indicate the start of a more defined rise for ADA.

Cardano buyers regain control while the upward trend shows early force

The Cardano Directional Movement Index (DMI) shows a notable change in the momentum, with its average directional index (ADX) climbing to 17.79, against 13.77 yesterday.

The ADX measures the strength of a trend, whatever its direction, on a scale of 0 to 100. The values below 20 suggest a weak or non -existent trend, while readings greater than 25 generally confirm that a trend is gaining strength.

ADA’s ADX is still below threshold 20 but on the rise regularly – indicating that this momentum is being built and a stronger directional movement could soon take shape.

By looking more deeply, the + DI (positive directional indicator) increased to 26.38 from 16.30 just one day, signaling an increase in the purchase pressure. Although it has slightly withdrawn from a peak prior to 29.57, it remains firmly above -DI (negative directional indicator), which fell considerably from 22.72 to 13.73.

This widening gap between the + DI and -DI suggests a clear change in favor of the bulls, the buyers containing control after a brief period of sales pressure.

If the ADX continues to increase alongside a dotolant + DI, it could confirm a strengthening of the upward trend for Cardano.

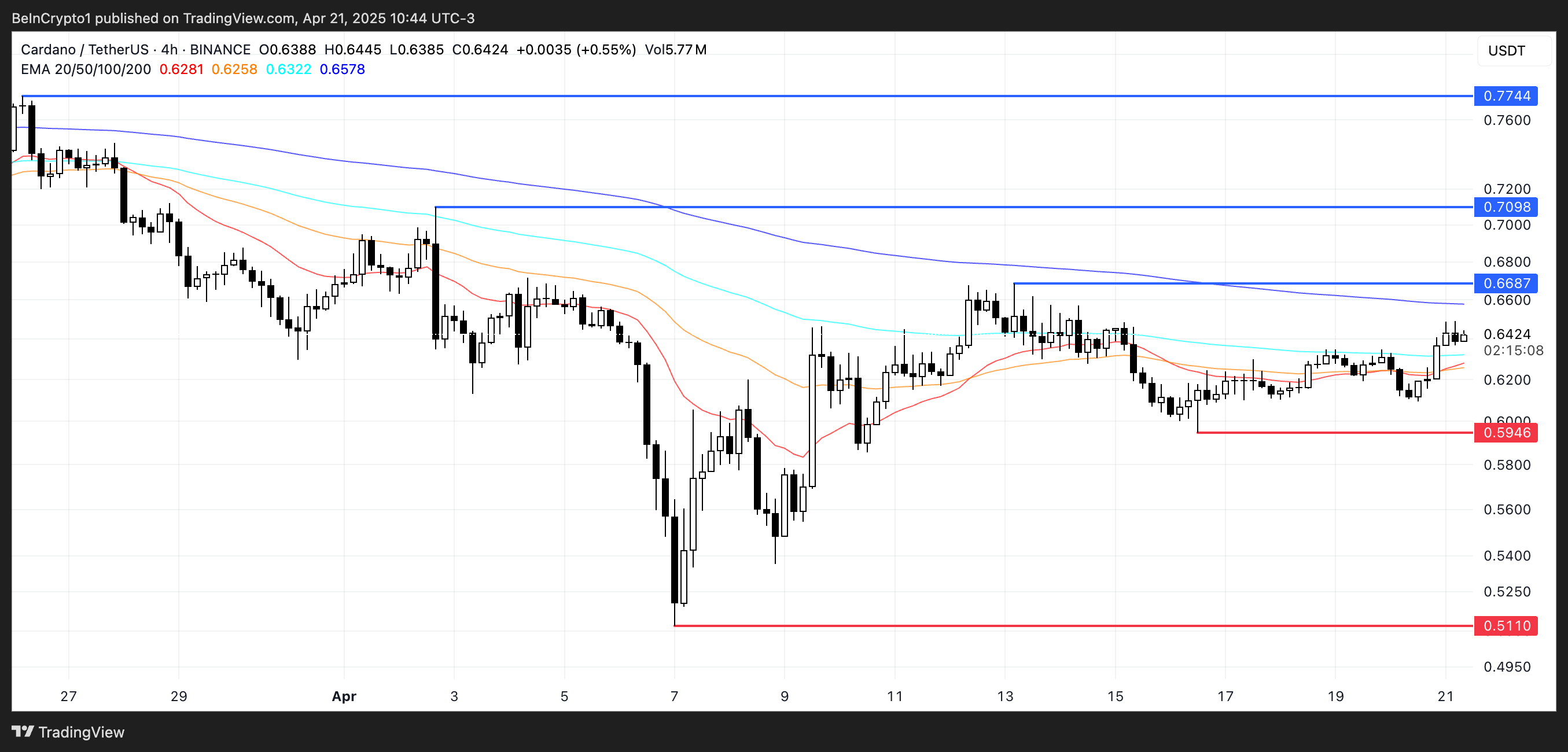

Cardano is getting closer to Golden Cross as Bulls Eye Breakout – but the key support still in play

Cardano Price is approaching potentially optimistic technical development, because its EMA lines suggest that a golden cross could train in future sessions.

A golden cross occurs when the short -term mobile average crosses the long -term mobile average, often signaling the start of a higher rise.

If this crossover is confirmed and ADA manages to exceed the resistance at $ 0.668, the next upwards is up to $ 0.709 and $ 0.77 – levels not seen since the end of March.

However, if Ada does not maintain its ascending trajectory and the momentum fades, downward risks remain at stake.

A drop to the $ 0.594 support would be the first sign of weakness, and a failure lower than this level could expose the asset to deeper losses, with $ 0.511 as the next key support area.

The price action around the resistance of $ 0.668 will probably be the decisive factor.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.