Cardano (ADA) Price Caught in Retail–Whale Crossfire: One Factor Could Decide Who Wins

Cardano Price is no exception to the sale of the larger market. Cardano’s price fell 7.6% in the last 24 hours, reducing a large part of its recent earnings. However, on a monthly scale, ADA is still up 28.6%, leaving traders taken between optimism and fear.

Behind the scenes, a greater battle takes place: the super whales sell, the retail holders remain optimistic and the open sellers accumulate in the derivative markets. The three forces shooting ADA in different directions, a factor could finally decide that comes out in mind.

Super Whales Trim Holdings as network activity decreases

The chain data show that the largest cardano portfolios, holding 1 billion ADA to infinity, reduced their assets from 5.43% at the end of June to 5.02% now, reporting a clear bearish tilt of the main players. Even if the percentage of diving does not read a lot, even a half-% drop is massive with regard to whale titles.

Adding to this pressure, the addresses active on the Cardano network slide, according to the monthly graph. Addresses are down more than 40% since the peak of July 18, with 42,000.

This drop coincided with the drop in ADA prices, because the peak preceded the local summit of $ 0.92. The drop in addresses could be one of the reasons for the apathy of the whale.

For TA tokens and market updates: Do you want more symbolic information like this? Register for the publisher Daily Crypto newsletter Harsh Notariya here.

The retail remains optimistic while the short pressure is built

Despite the whales that reduces their issues, retail traders remain confident, with Netflows, remaining negative exchanges for months, which means that more ADA is removed than deposited. Normally, it is bullish; He shows that holders accumulate, not sold.

But derivative traders slow down with whales. The 30 -day Bitget liquidation card shows $ 141.7 million in short positions against only $ 74 million long, a clear bet that Ada’s price has more room to fall. And these traders clearly become lower. This explains the battle to three: with whales, traders and lever traders.

If the dumping of the whales continues, the shorts could take control, lead to a drop in ADA and force more liquidations. But a short sudden pressure, led by the feeling of retail, could return the script, leaving optimism to win.

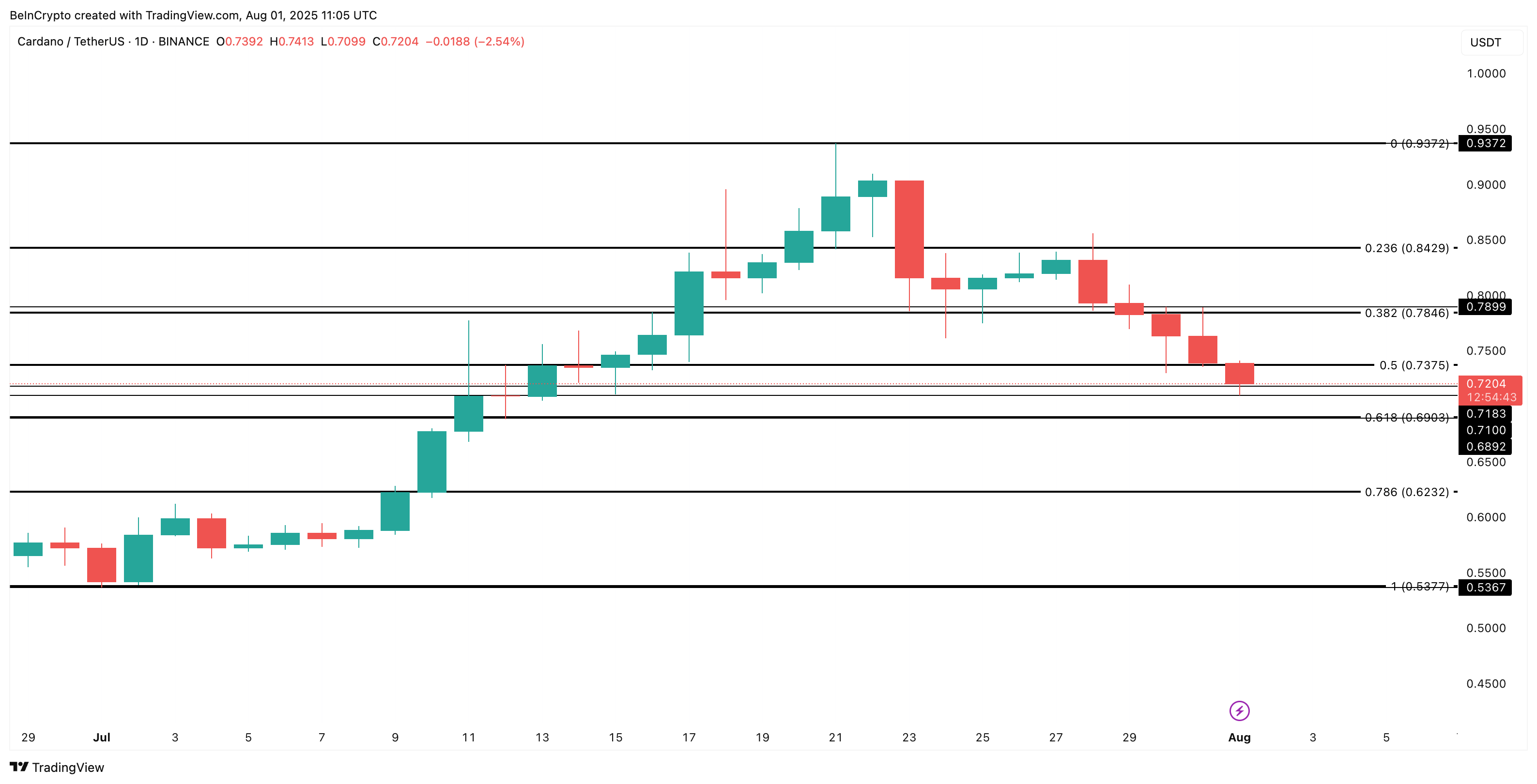

Cardano price key levels in Focus

ADA almost oscillates crucial support levels at $ 0.71 and $ 0.68. Ventilation could lead to prices at $ 0.62, corresponding to the whale whale and a short positioning. Based on the liquidation card, a drop to $ 0.62 will liquidate the long positions.

But if the bulls recover $ 0.73 and $ 0.78, the momentum could return to the rise, invalidating the downward hypothesis. This could then take a blow to $ 0.84 and $ 0.93, in favor of retail. In addition, it would liquidate the short positions.

For the moment, the market remains in a confrontation, with whales meeting, retail holders hanging on and merchants of derivatives awaiting ventilation to take advantage. A factor, that short -term positioning triggers pressure or adds pressure, could soon decide who wins this battle for the next big cardano.

The Post Cardano Prize (ADA) taken in retail – Whale Crossfire: a factor could decide who wins who appeared first on Beincrypto.