Cardano (ADA) Price Holds Ground Amid EU Tariff Threat, Analysts Eye $1 Breakout

During the last 48 hours, Cardano Price has faced a rejection to the upper border of the canal, coinciding with renewed commercial pressures. As, the announcement by Donald Trump of a 50% rate on the European Union, from June 1, has rekindled concerns.

Despite this imminent threat, Ada’s price has remained stable, indicating that the market has adapted to such feelings, investors showing less volatility. Some experts even suggest that ADA’s current consolidation scheme can throw a healthier base for a potential escape to the $ 1 range.

In addition, this week, Messari published his Q1 report, highlighting certain positive measures despite Cardano’s financial challenges. The report indicates that the community remains resilient, focusing on long -term growth and stability. Continue to read to find out more.

The analyst says that Cardano Price targets $ 1

Cardano’s price has been taken in a long phase of consolidation within a fall in canal, largely influenced by the current commercial tensions between the United States and other countries. This commercial climate lowered the ADA price to $ 0.50 in April.

However, a turning point arrived in mid-April when ADA began to recover, climbing at the upper limit of the canal and reaching $ 0.85 in May. This rebound was fueled by a decrease in trade tensions, especially after the United Kingdom has signed a significant agreement.

However, recent tensions with EU resurfacing have left many worried investors, but knowing that the Ada Price threat has not dropped under the EMA keys, and until it breaks key supports, optimistic opinions remain intact.

In addition, this week’s in -depth analysis was at the center of the attraction. According to Dan Gambardello’s technical analysis, the Cardano price action displays a much different model from its previous Haussier market cycle.

He says that, unlike the last cycle where ADA experienced a single drop after leaving the bear market before becoming parabolic, current consolidation shows a more methodical approach with repeated pump and consolidation phases.

This prolonged consolidation period is a “rolled” effect. He believes that Cardano Price could crush $ 1, if he fulfills all the bullish conditions.

Gambardello notes that this coiled behavior is not limited to the price of Cardano. The movement laterally extended has allowed healthy prices support levels, also in other Altcoin.

In addition, analyst Dan Gambardello uses Ethereum as a roadmap for Altcoin’s performance. He noted that ETH is currently testing a multi-cycle trend line which is of historical importance for the entire Altcoin sector.

Ethereum Breakout would cause a movement of Altcoin. It would be a more favorable period for tokens like Cardano Crypto who consolidated and formed technical bases in this extensive construction phase.

- Read also:

- Why is the price Bitcoin Ethereum and XRP is down today? What merchants should know now

- ,,

Cardano report by Messari: Total Stablecoin Stable Caplette and ADA Treasury Balance Increases

In a recent report, by Messari said that Cardano’s performance during T1 2025 was difficult. He revealed that his neighborhood was filled with challenges. Like his native token, Ada Price, took a hit, which led to a drop in her market capitalization in circulation.

Despite these obstacles, Cardano has always made significant progress in governance, such as the activation of the Plomin Hard fork was the greatest achievement.

Interestingly, the report has also stressed that, although the VOLTHY ADA prices has mostly affected its feeling of the market, but the commitment to mark was remarkably stable.

Statistics have shown that Total ADA has had a slight decrease of 1%, adjusting to 21.6 billion ADA.

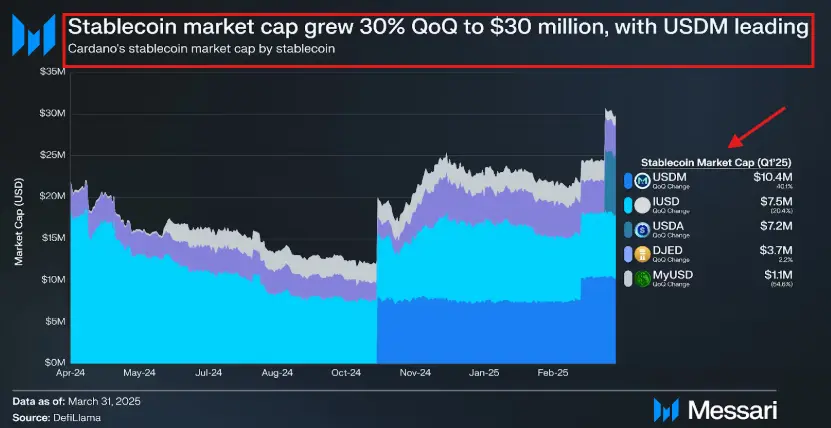

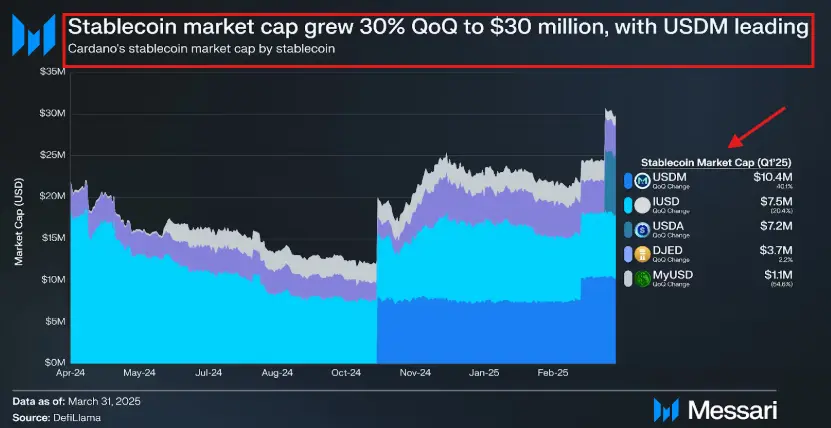

On the other hand, certain measures were exceptionally efficient such as the Stablescoin market, Messari said that it laid 30% to reach a market capitalization of $ 30.1 million. This increase was largely motivated by the popularity of the options supported by Fiat such as the USDM, Iusd, USDA and others.

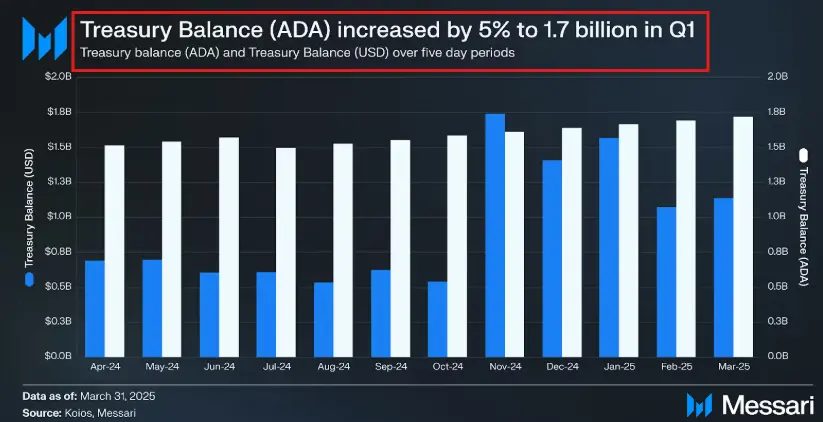

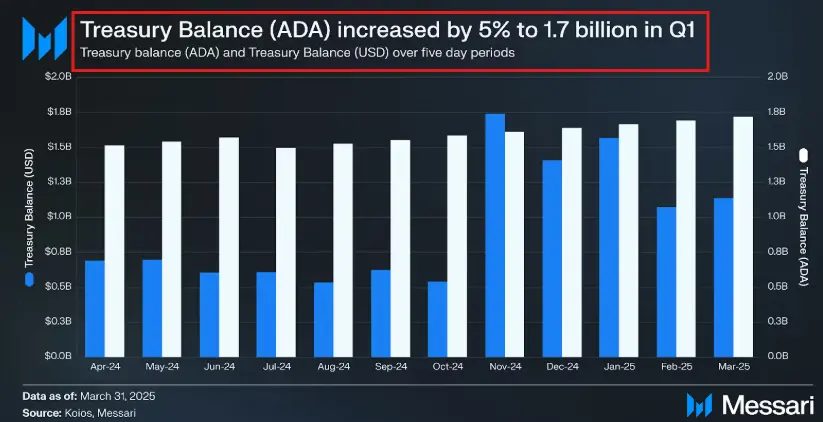

In addition, the Cardano Treasury balance has shown resilience, increasing by 5% in a quarter to 1.7 billion ADA. However, the value of the US Treasury dollar took a hit, lowering around 19% to around 1.1 billion dollars.

Overall, while Cardano was faced with financial challenges, his progress in governance and his commitment to stable markup highlight the continuous dedication of the community in the future of the platform.

Never miss a beat in the world of cryptography!

Stay in advance with the news, expert analysis and real -time updates on the latest Bitcoin, Altcoins, DEFI, NFTS, etc. trends

Faq

Maybe. Analysts like Dan Gambardello suggest that ADA is in a “winding phase” – bullish consolidation that could lead to an escape. However, a movement confirmed above $ 0.85 with a strong volume is essential before targeting $ 1.

A break is possible if the upper conditions align, potentially leading to a $ 1 bar. Although the exact timing is uncertain, some analyzes indicate that this happens in the coming days or weeks.

Renewed trade tensions can increase market volatility, as seen with the recent drop in bitcoin. Cryptographic markets often react to such macroeconomic events, acting as risk assets.

Some analysts consider current consolidation as a healthy foundation of growth, suggesting accumulation. However, it is wise to consider tolerance for personal risks and market indicators for confirmation. Sources