Cardano (ADA) Price Prediction for February 25

ADA, the native token of the Cardano blockchain, experienced a significant price drop in the last 24 hours, reaching a crucial level of support. To date, on February 25, 2025, ADA fell 13% and is currently negotiating almost $ 0.67, while its negotiation volume jumped 110%.

Cardano (ADA) Technical analysis and future level

According to an expert technical analysis, the recent drop in ADA prices brought it to a crucial level of support at $ 0.65. Historically, this level acted as a solid price reversal area. In addition, ADA’s daily graphic flashes a bullish signal, as technical indicators show a bullish divergence during the same period.

In addition to this upward divergence, Ada’s daily graph seems to form a two -low price action model on the daily time. These upward perspectives suggest that the ADA price could soon recover and discover an upward momentum.

Based on the action of recent prices and historical trends, if ADA holds above the level of $ 0.65, there is a strong possibility that the asset could rise by 20%, reaching the level of 0, $ 84 in the near future.

Mixed feeling by chain metrics

After a significant price drop and the ADA reaches a crucial level of support, whales and long -term holders accumulated Ada tokens, according to the Coiglass chain analysis company. The data from Spot Flow / OUT flows reveal that the exchanges have experienced a significant release of $ 22 million of Ada tokens.

This substantial exit from the exchanges suggests a potential accumulation, which could create a purchase pressure and lead to an upward momentum, a trend that the price has already started to live gradually.

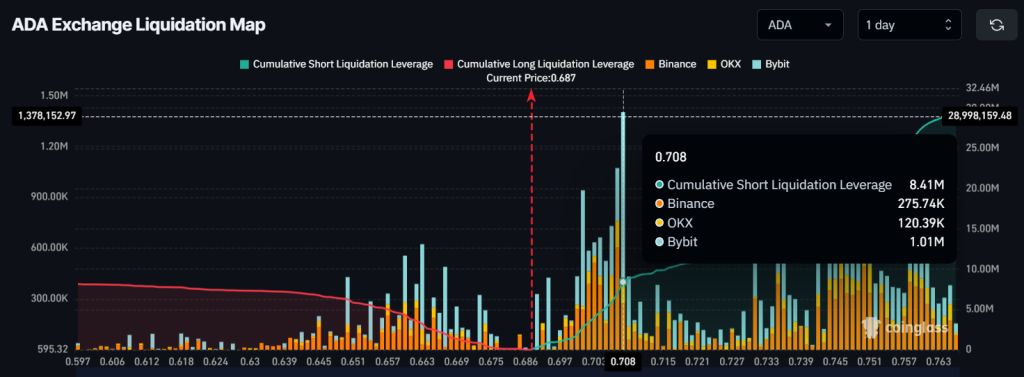

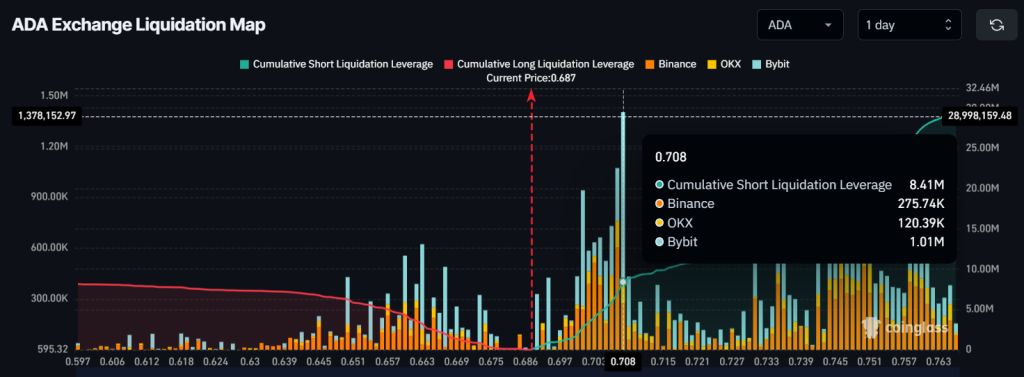

Despite the bullish feeling of the market among whales and long -term holders, traders seem to bet on the short side, expecting the price continues to drop in the coming days. At the time of the press, the main liquidation zones are $ 0.663 on the lower side and $ 0.708 on the upper side, traders being over-signed at these levels.

In addition, merchants owned a value of $ 3.25 million in long positions and $ 8.41 million in exposed positions at these levels. These data indicate that bears remain active and currently dominate the assets.