Cardano (ADA) Price Struggles Below Resistance

- Cardano (ADA) is above $ 0.60, with $ 0.63 acting as a critical Fibonacci support area, while the increase remains capped by resistance near EMA group from $ 0.68 to 0.72.

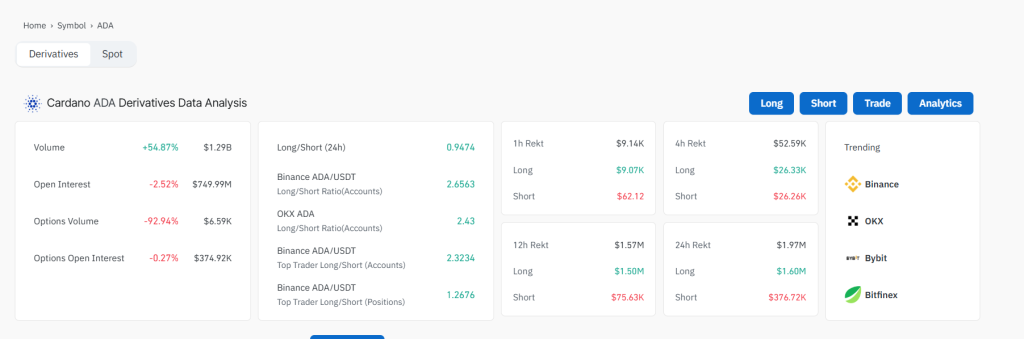

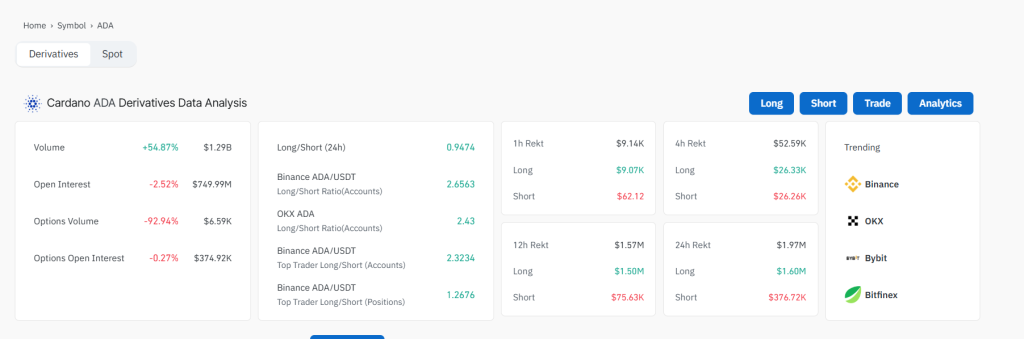

- The chain volume has been deleted since early June, but long / short ratios greater than 2.5 on Binance and OKX suggest that the traders are positioned for a bullish reversal.

- An escape greater than $ 0.72 is necessary to confirm a change of trend, while the failure to contain $ 0.60 could expose the ADA to a retest of the support range of 0.48 to 0.50 $.

Cardano in mind and updating governance

Cardano exceeded 1.3 million addresses of appearance this week, confirming his position as one of the most actively jealous blockchaines. The implementation activity should increase more with the upcoming launch of $ Night Token Rewards, which will be issued in parallel with regular ADA shuttle yields.

In the meantime, Charles Hoskinson 100 million dollars on the reallocation of the Treasury Ada continues to draw a debate. The proposal aims to mentor native stablecoins (USDM, USDA, IUSD), generate a yield of the treasury and strengthen DEFI liquidity.

This cardano treasure potentially transforming into a decentralized sovereign fund. Although ambitious, the plan sparked a division within the community.

ADA / USD technical view: price compression under resistance

- As of June 17, ADA was traded at $ 0.634 after rebounded by a local hollow of $ 0.62. The price action remains confined in a fork, with a key support found at the level of retracement of 0.618 Fibonacci ($ 0.60 to $ 0.63), which acted several times as a defensive zone during the previous corrections.

- Despite this support, ADA is negotiated below an EMA cluster stacked tight, including the mobile averages of 20, 50, 100 and 200 days, currently between $ 0.68 and $ 0.72. This multi-time confluence constitutes a strong resistance ceiling that the bulls must erase to validate a rupture structure.

- The RSI (14) is nearly 39.5, indicating slightly occurred conditions. MacD remains below the signal line, with a flattening histogram showing a reduced drop pressure, but not yet optimistic crossing.

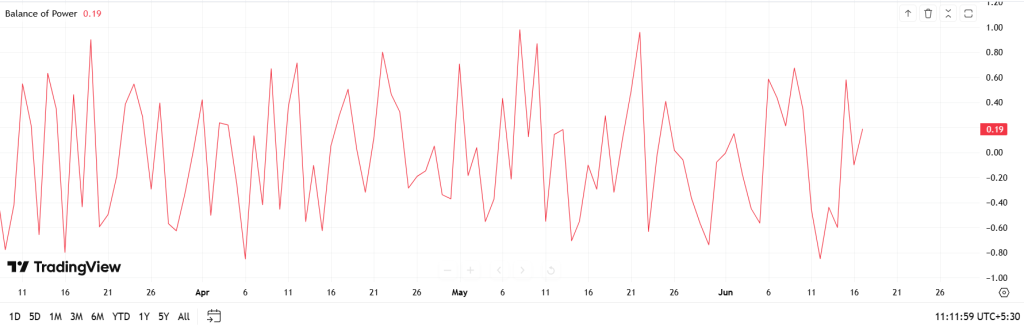

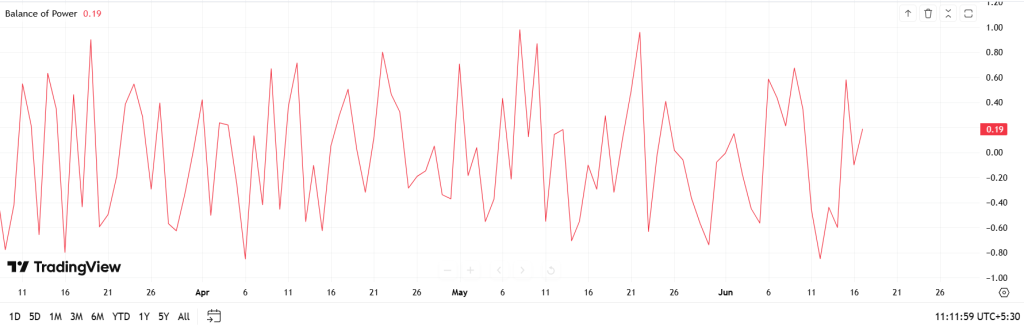

- The balance of powers balance measures the strength of buyers compared to the sellers on the market, helping to identify the changes in momentum. It is neutral to positive, reflecting attempts at accumulation but moderate.

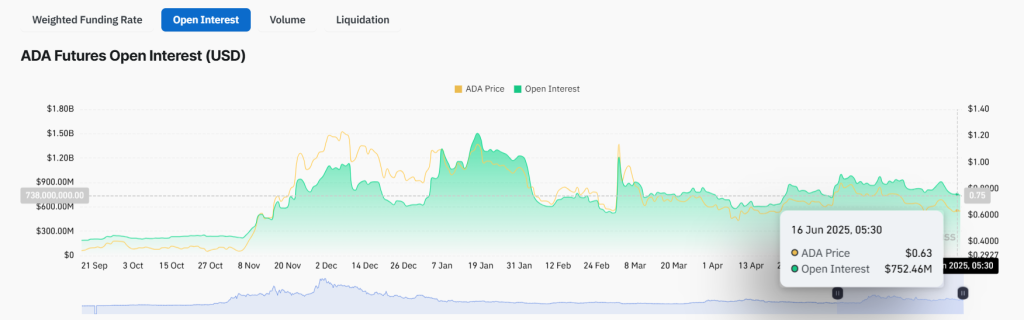

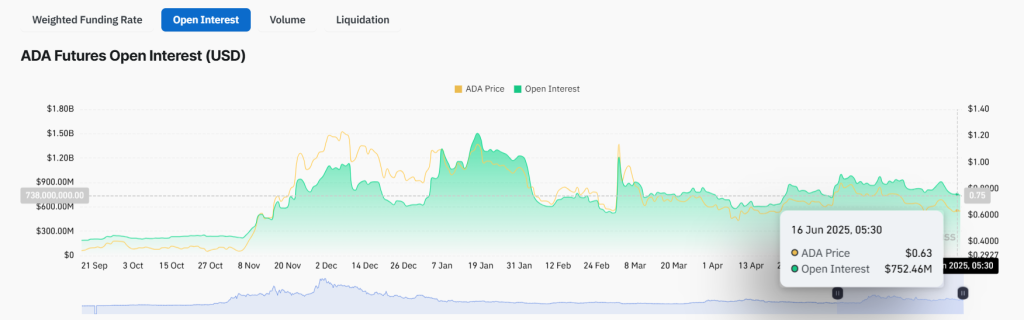

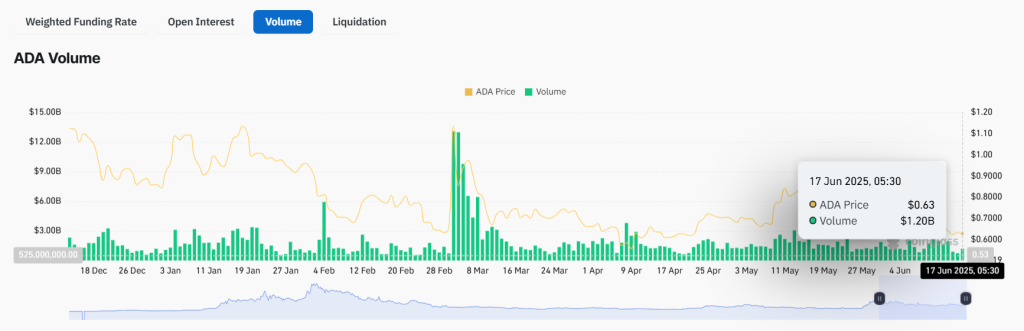

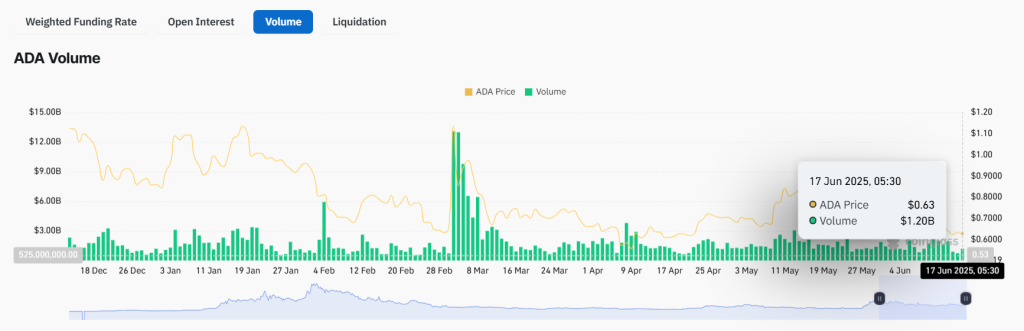

Chain activity and derivative feeling

The chain volume has dropped more than 45% since June 1, ADA from $ 0.69 to $ 0.63. This contraction reflects a possible phase of consolidation, especially since traders expect a macro or governance catalyst.

The derivative data shows that the interests open ADA holding around $ 752 million, while the long / short ratio remains high at 2.65 on Binance and 2.43 on OKX. This suggests that speculative traders expect a bullish result.

However, the volume of long -term contracts and stagnant punctuals point out that conviction remains low.

Coinbase saw minor entries (~ $ 367,000), while OKX and Kraken recorded outings exceeding $ 700,000 each.

Conclusion: upcoming accumulation or rupture?

The fundamental principles of Cardano – addressed to addressing growth, treasury innovation and challenge of challenge – are strengthened. But the techniques remain under pressure. A broken broken EMA cluster from $ 0.68 to $ 0.72 is necessary to confirm the reversal of trends and attract fresh liquidity.

Until then, ADA remains trapped between the long speculative bias and structural fragility. Merchants look at around $ 0.60. If he holds, the accumulation continues. If it breaks, downward targets drop to $ 0.50 and lower.