Cardano (ADA) Struggles Near $1 Amid US Reserve Concerns

Cardano (ADA) is down more than 6% on Thursday but remains up by almost 40% in the last seven days. After reaching $ 1.15 after its inclusion in the United States Strategic Reserve, Ada has struggled to stay above $ 1 in recent days.

Some users now question its inclusion in the reserve, which raises concerns about its price. With the accumulation of slowing whales and resistance to $ 1 proving to be difficult to break, the next ADA movement will depend on the question of whether the optimistic momentum can come back or if the sales pressure grows below.

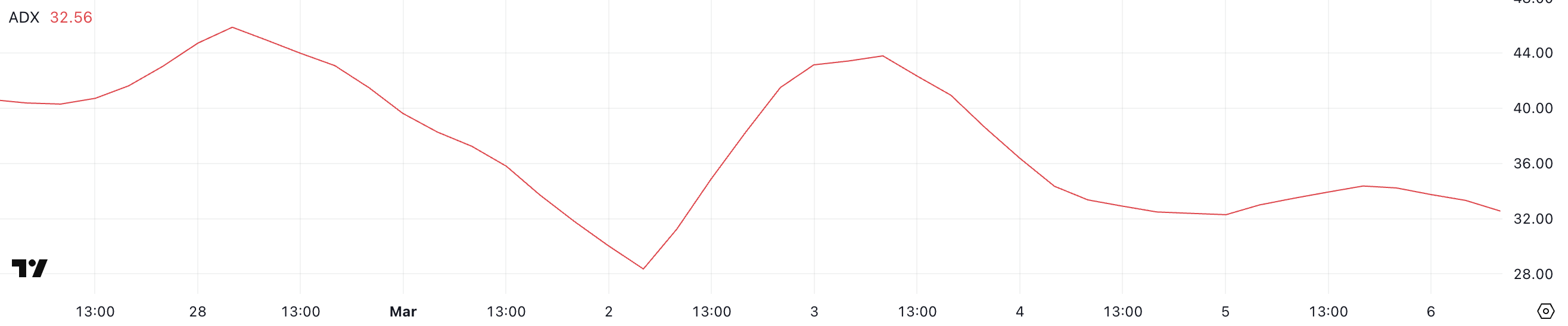

Ada Adx shows that the upward trend is always strong, but it is not as strong as before

Cardano has an ADX of 32.5, down compared to 43.7 three days ago, following an increase in prices caused by the inclusion of ADA in the strategic reserve of American cryptography.

Despite the decrease in the ADX, it remains above the 25 threshold, indicating that the current trend in progress still has strength, although the momentum has been slightly weakened.

The average directional index (ADX) measures resistance to the trend on a scale of 0 to 100, with readings above 25 indicating a strong trend and values less than 20 suggest a low or non -existent impulse.

With ADA in an upward trend and ADX at 32.5, the trend remains intact but may not be as strong as three days ago.

If ADX continues to lower, the trend could lose the momentum, resulting in potential slowdown or consolidation. However, if ADX stabilizes or increases again, ADA could maintain its ascending trajectory and push towards new levels of resistance.

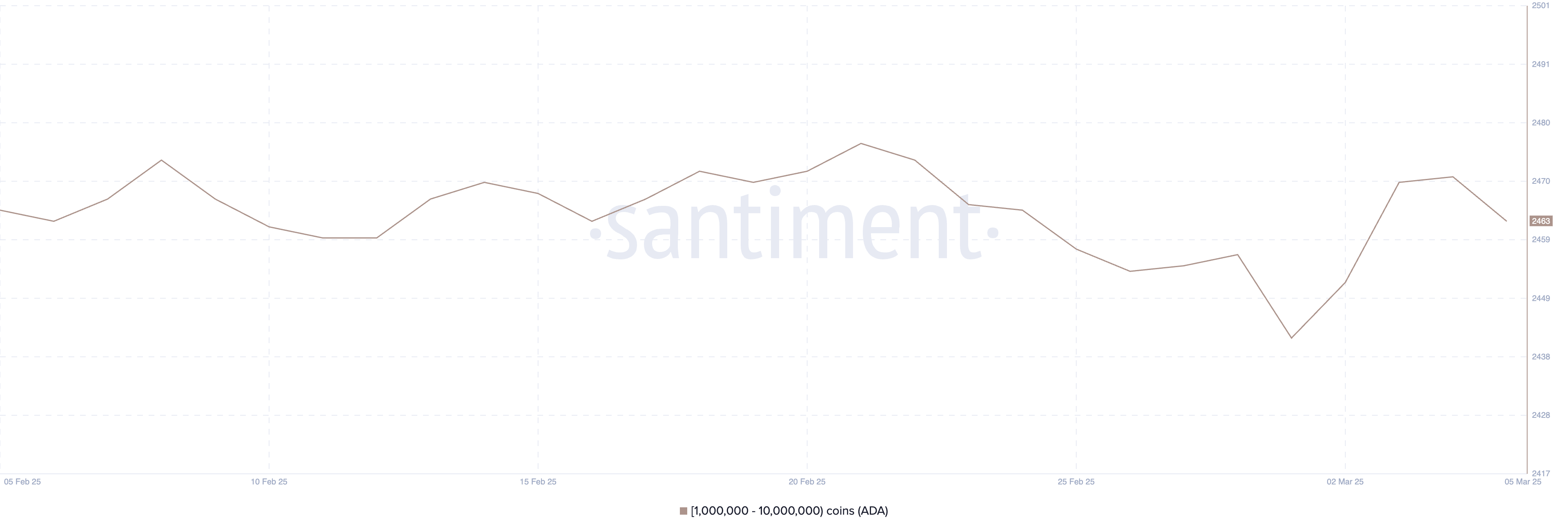

Cardano whales do not accumulate

The number of Cardano whales – address between 1 million and 10 million ADA – has decreased slightly in the past few days after a sharp increase between March 1 and 4, when it increased from 2442 to 2471.

The count is now 2,463, which indicates that some major holders have reduced their positions after the recent wave. This may have been influenced by the cryptographic community questioning the inclusion of ADA and XRP in the American crypto strategic reserve.

Monitoring these whales is important because major holders can influence market liquidity, volatility and price trends. An increasing number of whales often signals accumulation, which can increase prices, while a decrease suggests taking advantage or potential reduced confidence.

With the current number of whales slightly lower than its recent increase, the recent upward trend of ADA could slow down if larger holders are starting to sell. However, if the accumulation resumes, it could support continuous price gains.

Will Cardano soon test $ 1?

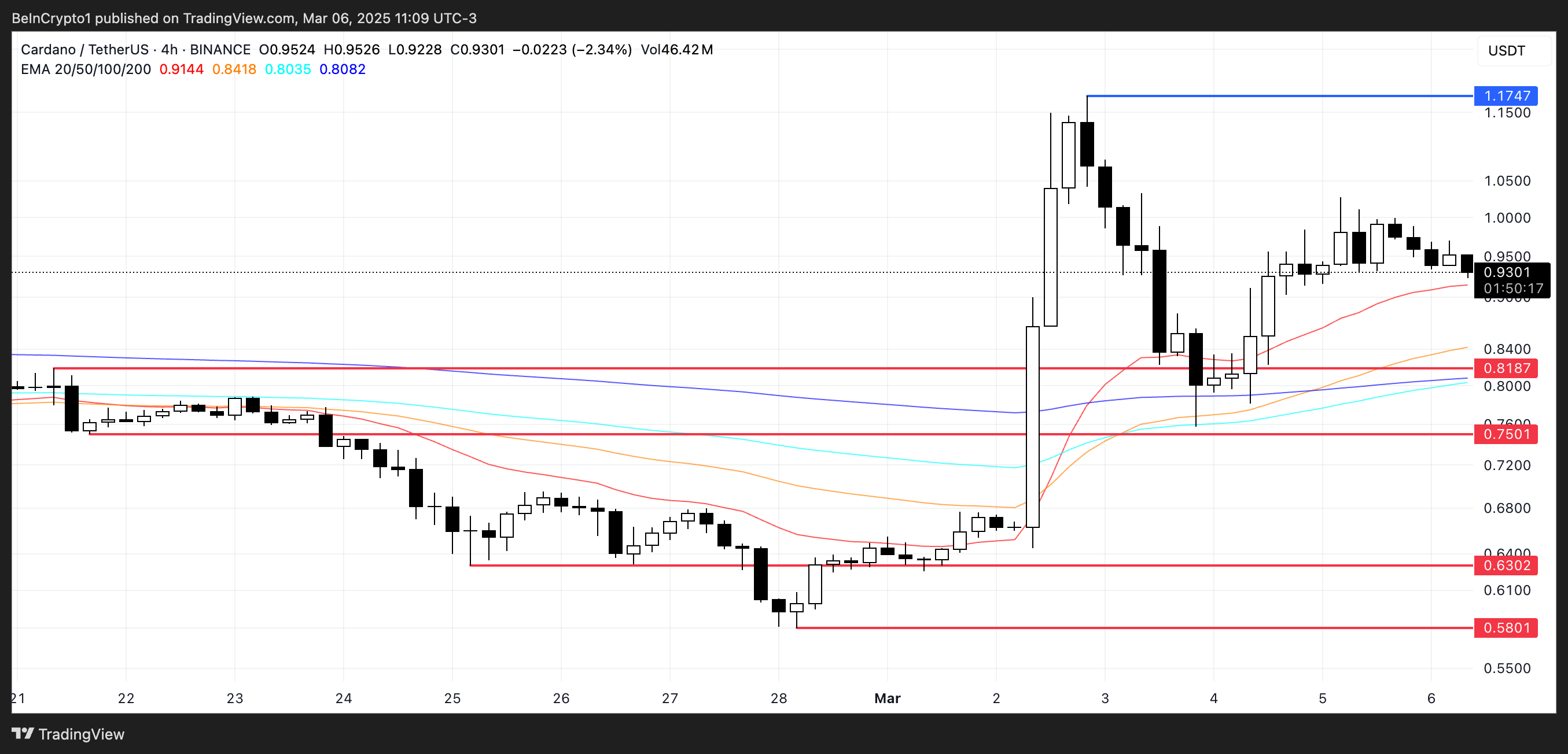

The EMA lines of Cardano indicate an upward trend, with short-term EMAs positioned above those in the long term.

However, despite this positive configuration, Cardano Price has struggled to exceed $ 1 in recent days after a strong correction after its 71% increase on March 2. This suggests that if the momentum remains intact, resistance to $ 1 is difficult to overcome.

If the current current trend in a downward trend, ADA could test the support at $ 0.818, with a breakdown lower than this level potentially leading to $ 0.75. A higher sale could push the price as low as $ 0.63, or even $ 0.58.

On the other hand, if Ada takes up the momentum, it could test again $ 1, and an escape above this key resistance could send the price to $ 1.17, a level which he almost reached during the overvoltage of March 2.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.