5 Reasons Why Bitcoin Could Hit a New All-Time High in May

Bitcoin climb (BTC) above $ 100,000 has strengthened confidence in the predictions that he will soon establish a new top of all time (ATH).

Based on the chain data, accumulation trends and the feeling of the market, there are several imperative reasons to believe that Bitcoin could reach a new peak. This article analyzes five key reasons in support of this prediction.

5 reasons to lead Bitcoin to a new ATH in May

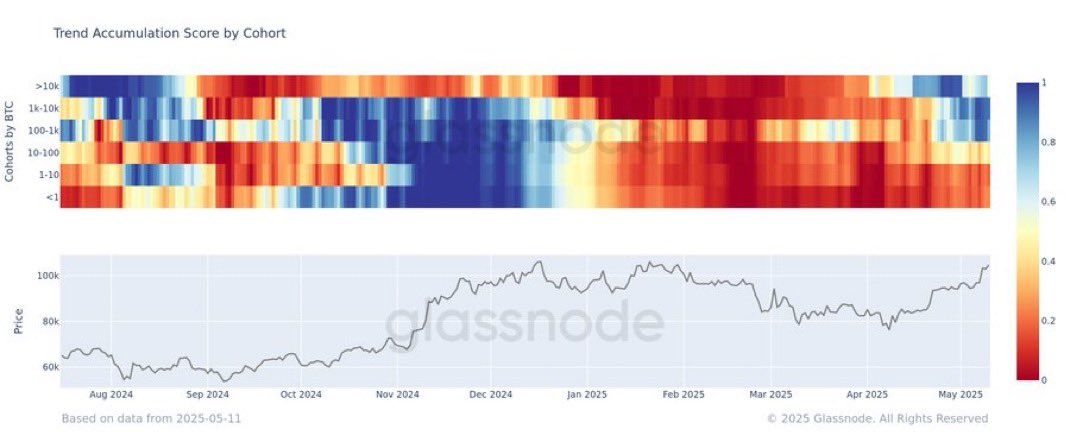

The first reason is the accumulation of whales in May. Glassnode data show that wallets of all sizes actively accumulate the BTC. The graph of “Cohort Glassnod tendency accumulation score illustrates this trend.

In early April, accumulation was mainly limited to large whale wallets containing more than 10,000 BTC. But in May, the accumulation trend had spread to smaller wallets holding between 100 and 1,000 BTC. Meanwhile, portfolios containing less than 100 BTC have also shown an increasing accumulation activity, reflected in reddish red colors of the graphic throughout May.

In addition, Santiment reports that during the last 30 days, whale wallets have accumulated 83,105 BTC. This accumulation helped to reverse the volume of delta spot in a positive territory, which gives Bitcoin the momentum to push higher.

“The aggressive accumulation of these large portfolios – this can be a question of time until the high coveted Bitcoin level of $ 110,000 is violated, in particular after the American price break and in China,” predicted healthy.

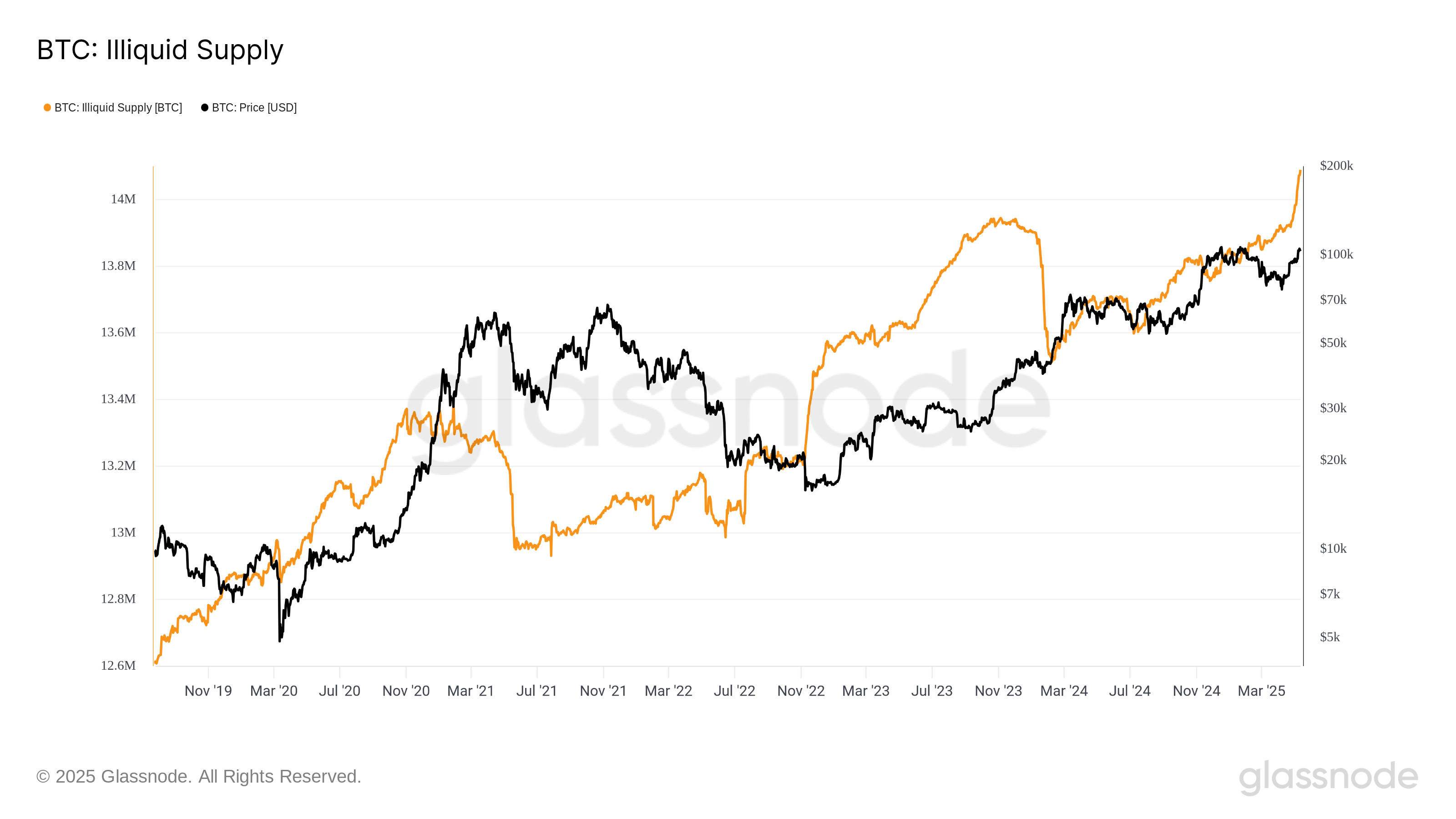

The second reason is that the non -liquid supply of Bitcoin has reached a record of 14 million BTC, which is worth more than $ 1.4 billion.

The increase in the non -liquid supply indicates that long -term investors (Hodlers) firmly hold their bitcoin. They have no intention of selling in the short term. Consequently, this reduces the supply in circulation and as demand increases, the price of bitcoin can break out more easily.

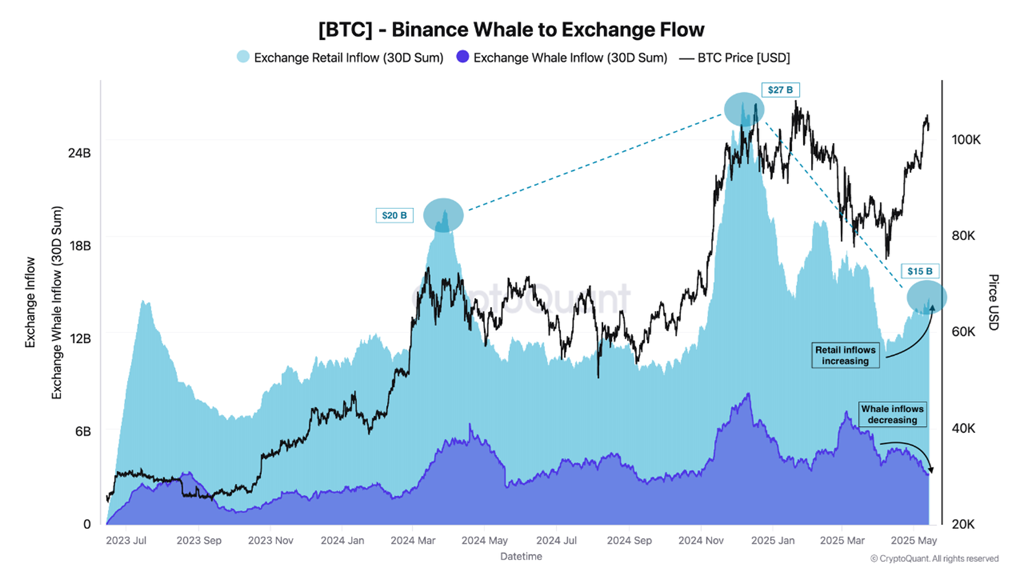

The third reason comes from small investors. Although a new wave of retail investors has not yet emerged entirely, cryptocurrency reports that the volume of retail on Binance – the largest crypto exchange in the world – began to bounce after a period of decline.

In addition, Carmelo Alemán, analyst at Cryptochant, also observed that although the retail volume has not yet increased, he has shown positive signs.

“In the coming months, as retail participation increases, we can expect to see the growth of active addresses, the number of UTXOs and measures such as new addresses and a transfer volume, reflecting the sustained expansion of the cryptographic ecosystem,” predicted Alemán.

The fourth reason for which analysts are looking at is closely the correlation between the price of bitcoin and the global money supply of M2.

According to the crypto expert, Colin speaks of crypto, M2’s growth – a measurement of the money supply of central banks such as the Fed, the BCE and the BOJ – predicted the Bitcoin rise from $ 76,000 to $ 105,000 since April 8. Based on this trend, Colin plans that Bitcoin could reach $ 120,000 in May.

“Bitcoin is still on the right track with Global M2. $ 120,000 + at the end of May?” Said Colin.

This correlation is not new. Historically, Bitcoin tends to benefit and increase sharply when global liquidity increases. Given the current macroeconomic conditions, expanding the money supply can continue to feed the growth of Bitcoin.

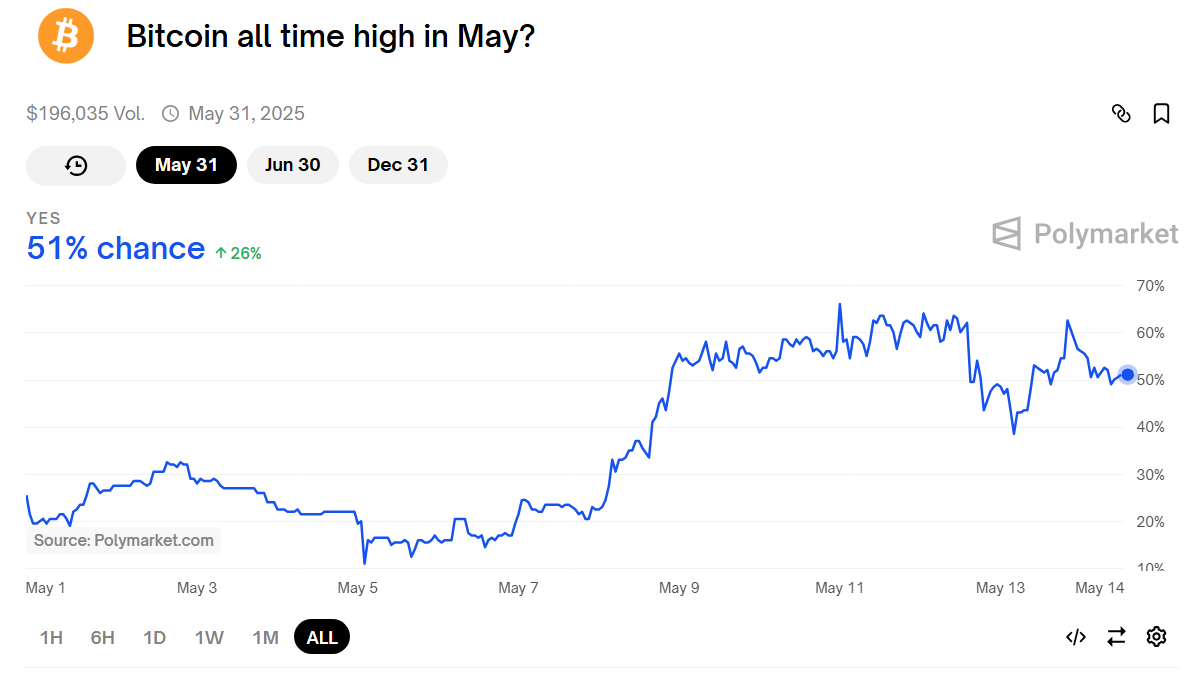

Finally, the prediction market market shows that the probability that Bitcoin reaches a new ATH in May has increased from 11%to 60%, currently at 51%. Polymarket allows users to bet on future events, and this change reflects growing optimism in the community.

As confidence in the ascending potential of Bitcoin increases, it could trigger an FOMO effect (fear of missing). This can attract more investors and push even higher prices.

In fact, Bitcoin has already struck new ATH in countries like Turkey and Argentina, where local currencies have been strongly deemed. Experts like billionaire Tim Draper predict that Bitcoin will reach $ 250,000 by the end of 2025. In addition, Bitcoin Standard Charter forecasts could reach $ 120,000 in the second quarter.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.