Cardano Whales Sell Off as ADA Faces Market Uncertainty

Cardano (ADA) had trouble in last week, lowering more than 23% and remaining below $ 1 for more than seven days. Despite this down pressure, the technical indicators suggest that the current downward trend can lose resistance.

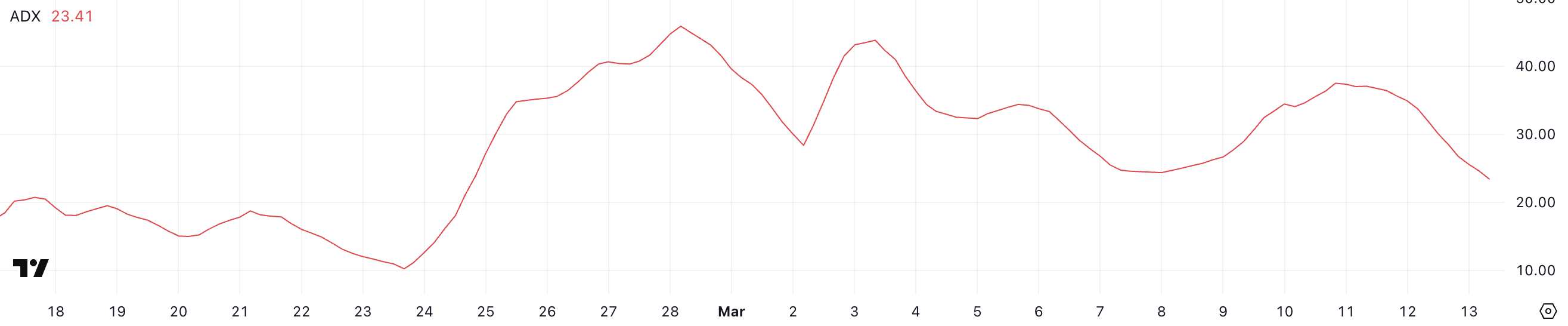

The ADX readings show that the sale of the momentum is unleashed, while the whale addresses continue to drop, indicating that large investors have unloaded their assets. Given these indicators, Ada Price could soon test key resistance levels at $ 0.64.

Cardano’s current downward trend fades

The average directorate of ADA (ADX) fell to 23.4, down 34 yesterday and 37 two days ago. ADX is a key indicator used to measure the resistance of a trend, whatever the direction, on a scale from 0 to 100.

Generally, readings above 25 indicate a strong trend, while values below 20 suggest low or consolidating market conditions. An ADX decline indicates that the current trend loses strength, even if the price movement continues in the same direction.

ADA’s ADX decreasing considerably, this suggests that the continuous decrease trend can weaken.

Since Cardano remains in a downward trend, the fall of ADX to 23.4 indicates that the lowering momentum slows down, although it has not completely disappeared.

If ADX continues to decrease and fall below 20, this suggests that the sales pressure fades, which potentially causes consolidation or reversal. However, for a real change of trend, ADA would need a purchase volume to increase in parallel with an increase in ADX, confirming renewed force.

If the ADX stabilizes near the current levels and returns again, the downward trend could resume the momentum, maintaining ADA under short -term pressure.

Ada whales are falling regularly in recent days

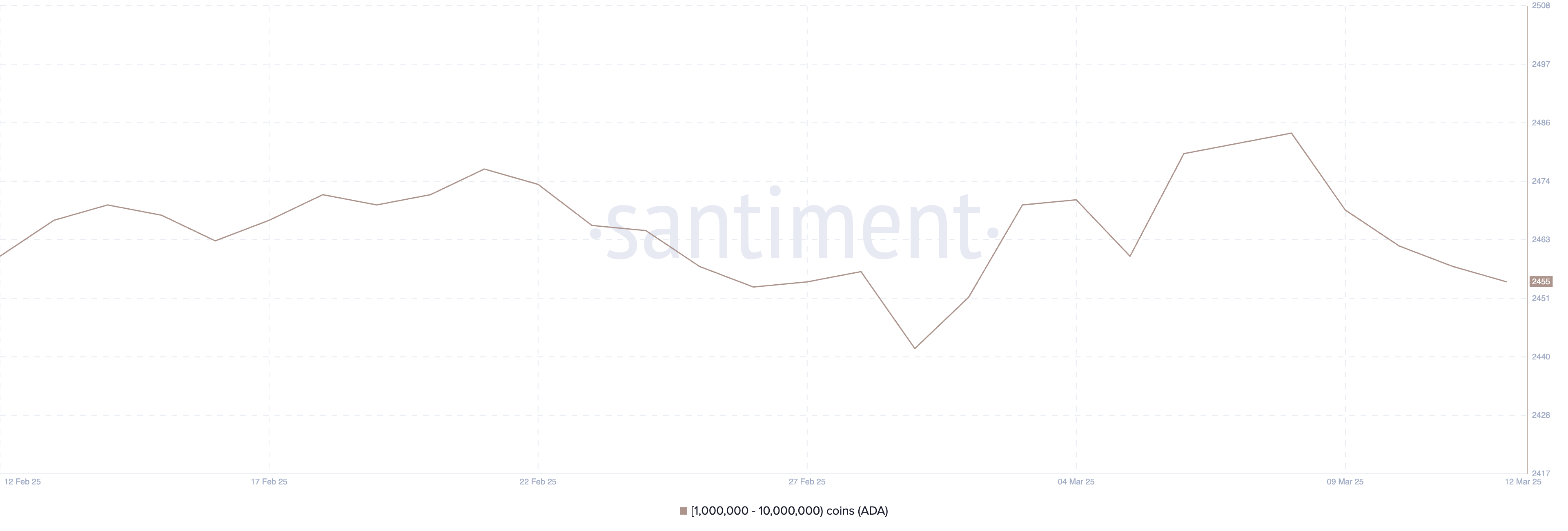

The number of Cardano whale addresses – those holding between 1 million and 10 million ADA – fell to 2,455, against 2,484 on March 8.

This constant decline suggests that large holders have unloaded their positions in the past few days. Monitoring the activity of whales is crucial because these high -value investors often influence market trends.

When whales accumulate, it signals confidence in the asset and can cause price increases, while the drop in whales suggest distribution, which can add sales pressure to the market.

With Ada Whale, addresses have now been at their lowest level since March 2, this trend could indicate a weakening of confidence among major holders despite the fact that Cardano is included in the American strategic reserve.

If this model continues, this can cause increased volatility, as small investors absorb the sale pressure. A sustained drop in whale titles could also suggest that ADA has no support for strong purchase at current levels, potentially extending its downward trend.

However, if the numbers of whales stabilize or start to increase, this could point out a renewed accumulation, potentially helping Ada to resume momentum.

Will Cardano soon return to $ 1?

ADA’s EMA lines indicate that Cardano is in the consolidation phase. The short -term EMAs remain lower than those in the long term, but their difference is not significant.

This suggests that the lowering momentum is not dominant and that a change of trend could occur if the purchase increased. If ADA can test resistance to $ 0.75 and establish an upward trend, it could climb to $ 0.81.

A stronger bullish escape could increase the price of Cardano. The upward potential objectives are $ 1.02 and even $ 1.17, if the momentum continues to build.

Lowering, if the sale of pressure is intensifying, ADA could test its key support at $ 0.64.

The loss of this level would weaken its structure and increase the probability of additional declines, which potentially sent the price to $ 0.58.

The relatively close EMA lines indicate that Cardano is in the central phase, during which a break or a failure could occur.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.