Cardano(ADA) Loses 10% Amid Declining Whale Presence

Cardano (ADA) has decreased by almost 34% in the last 30 days and more than 15% last week. Its market capitalization is now $ 22 billion. It has been negotiated below $ 1 for more than a month, reflecting the persistent lowering feeling.

Technical indicators show a strong downward trend, ADX reaching 46.8, signaling intensified sales pressure. However, if the key support levels are maintained, ADA could reverse its trend and potentially exceed $ 1 in March.

Cardano Adx shows that the current downward trend is strong

ADA’s ADX is currently 46.8, increasing by 10.3 on February 23. The average directional index (ADX) measures the strength of a trend without indicating its direction.

It varies from 0 to 100, with values above 25 indicating a strong trend and values below 20 suggesting a low or non -resistant market. An ADX greater than 40 indicates a very strong trend, showing that market players are very confident in the current price movement.

With ADA’s ADX at 46.8 and the price in a downward trend, this indicates that the bearish momentum is gaining strength. This suggests that the sales pressure is intensifying, which more likely makes a continuation of the downward trend.

Unless the purchase of interest is increasing considerably, ADA could face a drop more. The high ADX value confirms that the current downward trend is strong and persistent, reducing the probability of a rapid reversal.

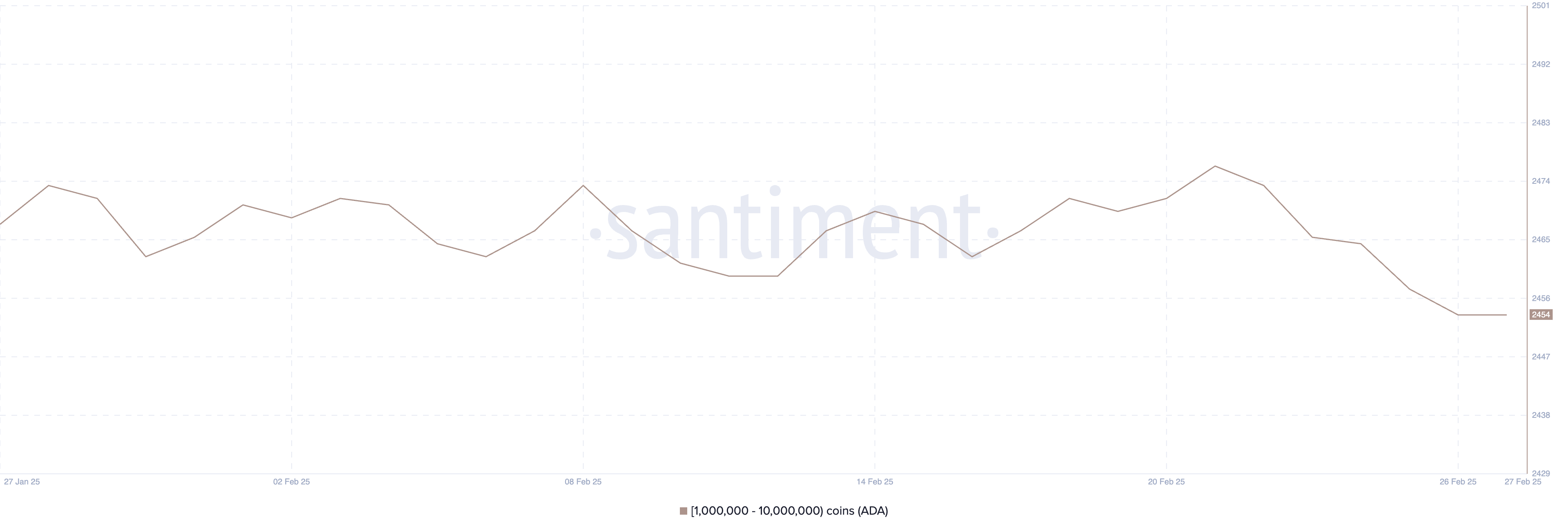

Ada Whales has just hit their lowest level since early January

The number of Cardano whales – deals with detention between 1 million and 10 million ADA – has continued to decrease in last week, from 2477 on February 21 to 2454 currently. It is the lowest level since January 9.

The follow -up of these whales is crucial because they represent large investors whose purchasing or sale actions can have a significant impact on market liquidity and price movements.

When the whale addresses decrease, this suggests that the main holders reduce their positions or distribute their assets, which may indicate a lower feeling.

This sharp decline in the number of cardano whales could point out an increasing sale pressure, which potentially leads to a new decline for the price of ADA.

As major holders reduce their exhibition, this can create more offer on the market, which has dropped the prices. In addition, a decreasing number of whales suggests a weakened confidence among large investors, which could trigger additional sale of small holders.

If this trend continues, Ada could face a momentum in the coming days.

Will Cardano come back to $ 1 in March?

ADA’s EMA lines are currently showing a downward configuration, with short -term lines positioned below those in the long term, indicating ignition down in progress.

ADA could test the level of crucial support at $ 0.5 if this downward trend continues strongly. If this support is lost, the price could decrease more to $ 0.32, marking its lowest level since early November 2024.

This downward configuration suggests continuous sales pressure, increasing the probability of the additional decline unless the purchase of interest resumes.

However, if the $ 0.5 support is tested and takes place, Cardano Price could find the strength to reverse its trend.

In this bullish scenario, Ada could get up to test the resistance at $ 0.65.

If this level is broken, the price could continue to climb $ 0.83 and even $ 0.90, potentially paved the way for a rally over $ 1 for the first time since the end of January.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.