Cardano’s Long/Short Ratio Slips — Is a Drop Below $0.70 for ADA on the Horizon?

Cardano (ADA) shows signs of weakness as its long / short ratio decreases, reporting an increase in sales volume. This metric suggests that more traders are betting against the price increase. In addition, the drop in other measures on the chain could push the price of ADA downwards. With this change, investors are now wondering if ADA could slip below the level of key support of $ 0.70. Could a greater price correction happen soon?

Cardano’s open interest decreases

Cardano (ADA) experienced an impressive rally in July, gaining almost 30% in value – one of its best performance in recent months. This thrust was largely stimulated by new favorable macroeconomics which have sparked a strong activity of purchase on the cryptography market.

However, despite the high price performance, recent Correglass data reveals signs of market instability. Cardano has experienced more than $ 7.79 million in total liquidations, with a major majority of approximately $ 7.54 million from long positions. This means that many traders who bet on the price continuing to increase have been forced to close their positions, probably due to sudden refusal of high prices or volatility.

In the short term, commercial activity remains strong, with a 12% increase in the volume 24 hours which pushed it to 2.54 billion dollars. But not all indicators are positive. The open interest, which shows how many term contracts are still active, has dropped 8%, now at $ 1.28 billion. This decline suggests that fewer traders keep open positions, possibly having low confidence in additional price gains.

Read also: Michael Saylor reveals the Bitcoin plan of $ 100 billion in strategy

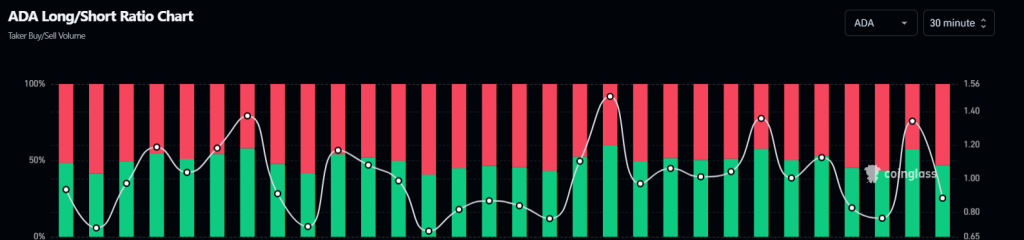

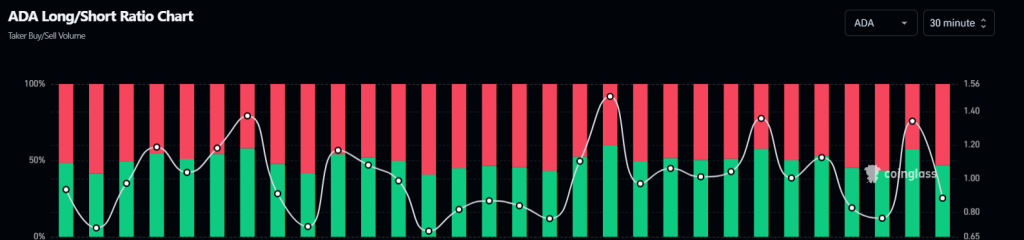

The long / short ratio slipped below 1 to 0.8829, which means that there are more short Paris than long. About 53% of merchants expect ADA falling in the coming hours. With the feeling becoming a lowering, the sales pressure increases and ADA is struggling to unravel its immediate resistance levels.

What is the next step for Ada Price?

Cardano (ADA) fell below its exponential mobile average (EMA) at $ 20 days at $ 0.76, a sign that sellers could take control. During the editorial staff, Ada Price is negotiated at $ 0.7272, decreasing by more than 4% in the last 24 hours.

There is a certain support around $ 0.67, but if it fails, the price could drop more to $ 0.51 and perhaps up to SMA of 50 days almost $ 0.339. This suggests that ADA could be stuck in a wider negotiation range between $ 0.4 and $ 0.5 for a while.

A break and close above the 20-day SMA would be the first sign of force, showing that the sellers lose momentum. If this happens, buyers can try to push the price in front of the key resistance around the descending descending line.

A break above the trend line could send the ADA price. A push above the resistance line could start an upward trend around $ 1 for the price of Cardano. With the RSI level which is now approaching the region of occurrence at level 32, an increased correction should take place.