3 US Crypto Stocks to Watch Today: CORZ, HOOD, MSTR

Core Scientific (Corz), Robinhood Markets (Hood) and Strategy Incorporated (MSTR) attract attention today. Corz increased after appointing Elizabeth Crain to her board of directors and strengthened his change to IA infrastructure.

Hood has confirmed an acquisition of CAD of 250 million dollars from Wonderfi, developing in Canada and competing with Wealthsimple. MSTR bought 7,390 BTC for $ 765 million, increasing its total assets to more than 576,000 BTCs, while facing a collective appeal on its Bitcoin -based strategy.

Core Scientific (Corz)

Core Scientific (Corz) closed yesterday with a modest gain of 0.65% and is already up 5% in pre-commercial trade, after the appointment of Elizabeth Crain to his board of directors.

Crain provides more than thirty years of experience in the investment bank and investment capital, after having co-founded Moelis & Company and occupied senior positions at UBS. She will also chair the audit committee, a key position as a scientific Core continues her strategic change towards the infrastructure linked to the AI.

His appointment, as well as Jordan Levy appointed president, marks a pivotal moment for the company while it improves its management team in the middle of a wider transition in commercial orientation and operations.

The graph of Corz shows renewed signs of force, with a potential golden cross forming on its EMA lines. The feeling of analysts remains extremely optimistic – 16 out of 17 analysts note the title as a “strong purchase” or a “purchase”, with a price target of one year on average of $ 18.28, representing a potential increase of 68.49%.

If the momentum is maintained, the next key resistance level is $ 13.18, which could be tested in the short term.

However, investors should monitor support at $ 10.34; If it fails, the action can trace $ 9.45, or even $ 8.49.

Robinhood (Hood)

Robinhood has officially announced its acquisition of $ 250 million CAD from Wonderfi, based in Toronto, reporting a major step in its Canadian expansion strategy.

The agreement, which offers a 41% bonus compared to the latest Wonderfi closing price, will bring the team of 115 people from Wonderfi and established crypto brands – Bitbuy, Coinsquare and SmartPay – under the umbrella of Robinhood Crypto.

The acquisition is expected to close in the second half of 2025 and should considerably strengthen the presence of Robinhood crypto in Canada.

Robinhood Crypto leader Johann Kerbrat recently underlined the company put by the company on tokenization and financial accessibility, stressing how fractionalized assets such as real estate can open markets previously inaccessible to daily investors.

The company has submitted a 42 -page proposal to the SEC to request a federal framework for the active world tokenized. It aims to provide traditional financial markets to the chain with a legally recognized asset token equivalence.

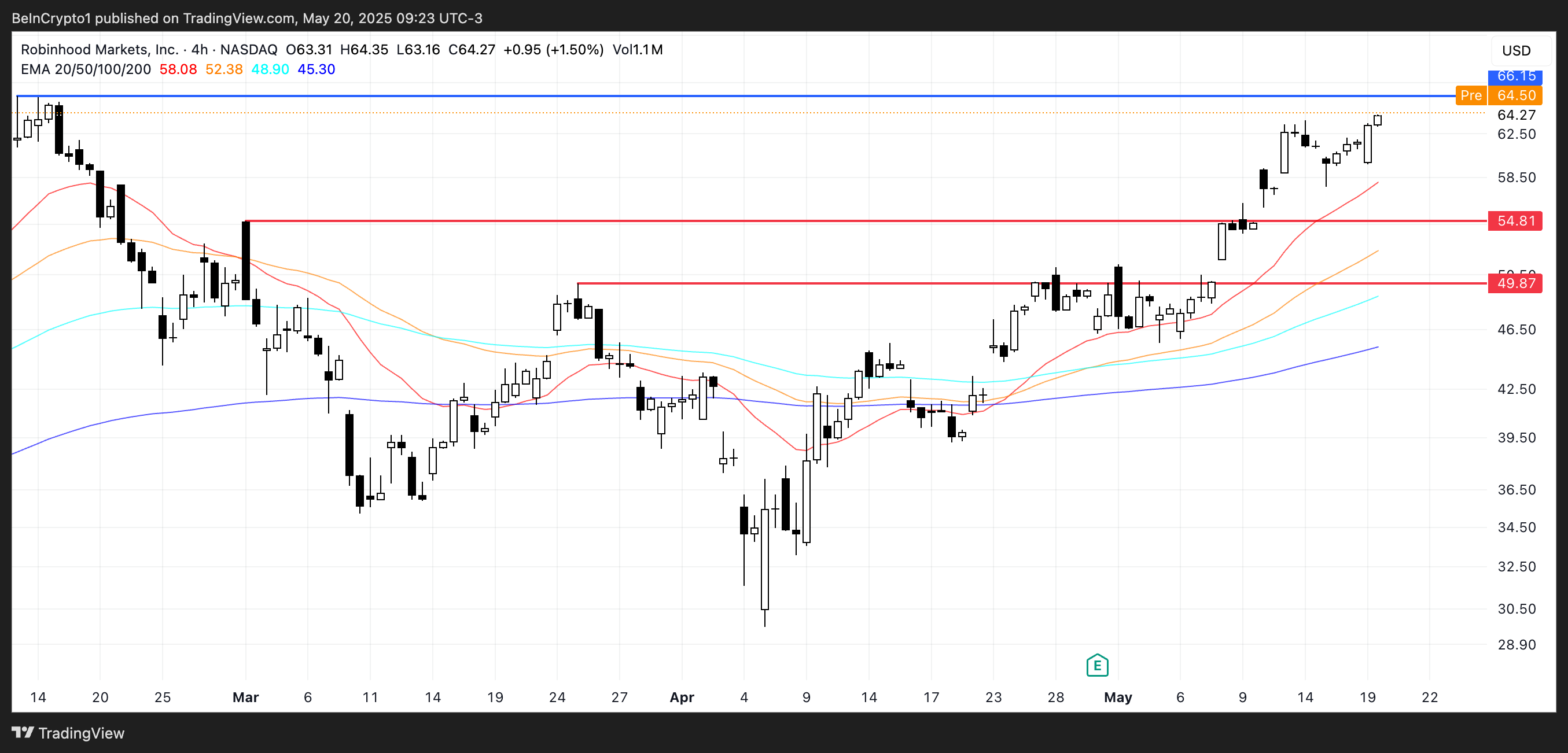

Hood’s shares closed up 4% yesterday and are slightly up in trading before the market, extending a remarkable 56% rally in the last 30 days. Technically, the graph of action shows a strong momentum, with its short-term EMA lines clearly above the long-term trend, which follows the sustained bullish feeling.

The next key resistance is $ 66.15; A clear break above which could push Hood in unexplored territory, exceeding the $ 70 mark for the first time and establishing new heights of all time.

Incorporated strategy (MSTR)

The strategy (formerly Microstrategy) added an additional 7,390 BTC to its business treasury, spending about $ 765 million while Bitcoin exchanged more than $ 100,000.

The latter accumulation brings its total assets to 576,230 BTC – acquired for $ 40.2 billion, now to more than $ 59.2 billion, reflecting an unable to gain around 19.2 billion dollars. However, the aggressive Bitcoin strategy continues to attract a meticulous examination.

The company and its leaders, including executive president Michael Saylor, were struck by an alleged collective appeal that they distorted the risks linked to their approach to Bitcoin investment.

The strategy is always the largest holder of the Bitcoin company, despite legal pressure. His Bitcoin Bitcoin approach has inspired similar cash strategies in Asia and the Middle East.

The MSTR closed yesterday up 3.4% yesterday and is down 0.47% in the pre-market. The action increased by almost 43% in 2025. It is negotiated near the key assistance at $ 404; If it is lost, it could fall at $ 383.

If Momentum returns, MSTR could reach $ 437. The feeling of analysts is solid – 16 out of 17, it is a “strong purchase” or “buy”. The average price of one year is $ 527, which implies an increase of 27.5%.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.