Celestia (TIA) Price’s 30% Crash Prolonging Could Bring Recovery

Celestia (TIA) has recently experienced a significant withdrawal, losing almost 30% of its value in the past two weeks. This drop was awarded to larger lower -lower market conditions, which caused panic among investors.

Consequently, many TIA holders have decided to draw their funds, adding to the drop pressure on the price.

Celestia holders choose to back down

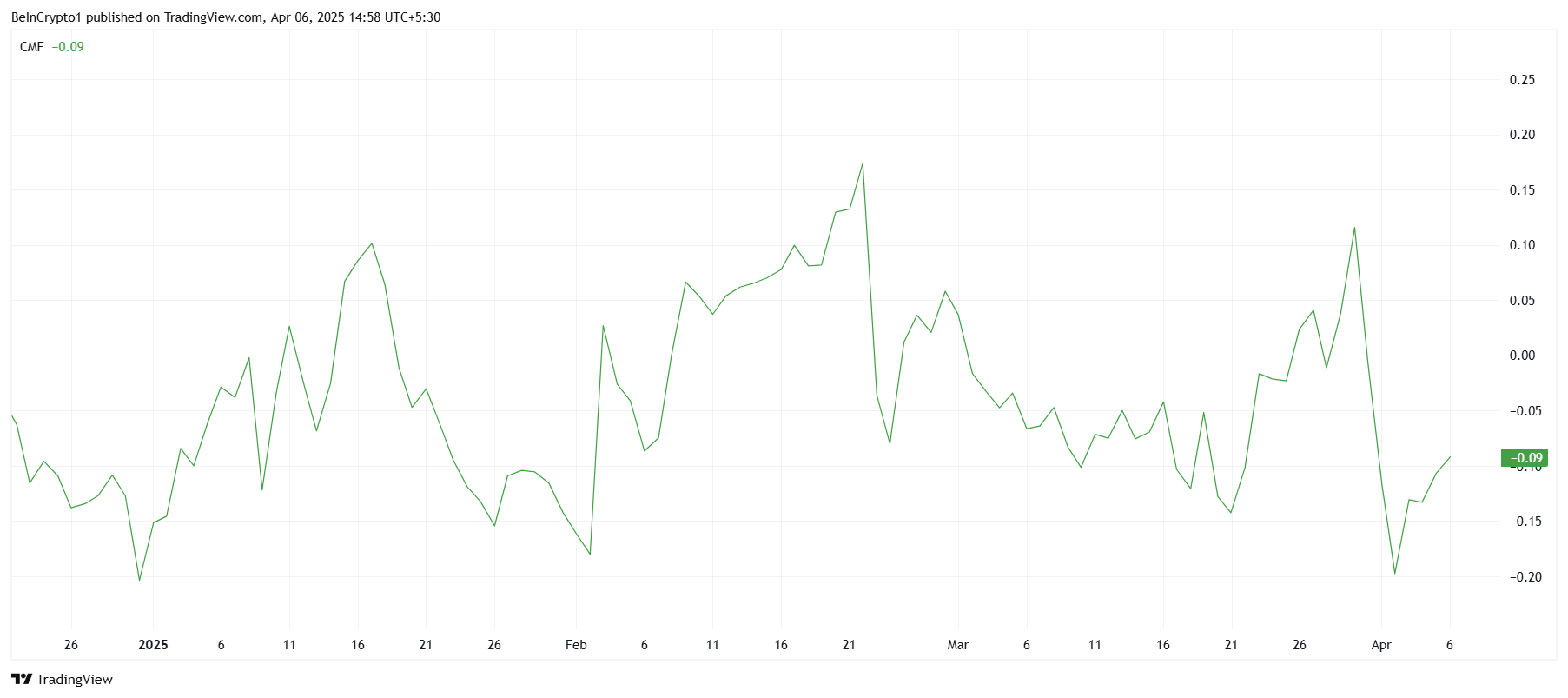

The Chaikin Monetary Flow indicator (CMF) has shown significant Celestia outings, marking the largest sales activity since the start of 2025. This has reflected the growing fear of investors after prices correction of 30%.

However, despite the negative feeling, there has been an increase in the CMF recently, indicating that some new investors are starting to see the value of low prices. These entries could potentially help stabilize the price and prepare the ground for a recovery.

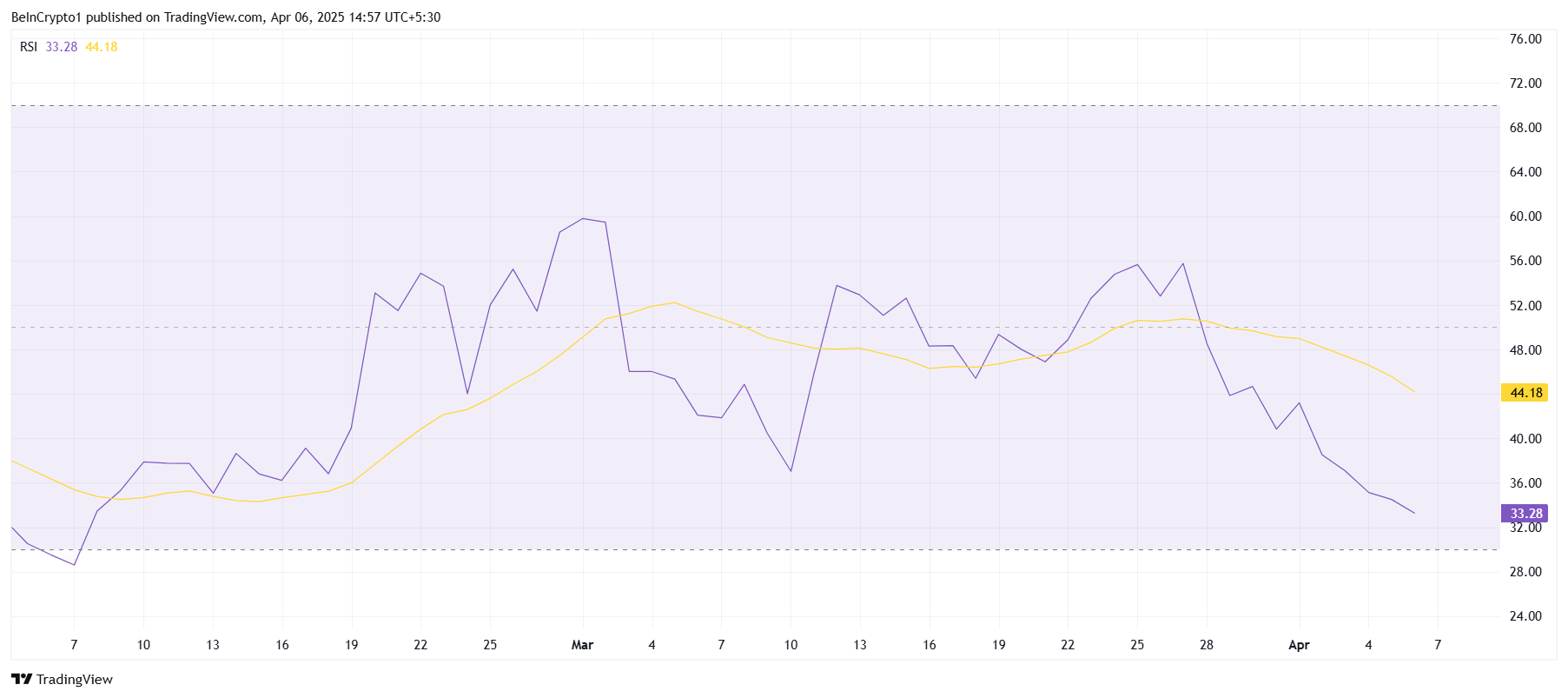

The relative force index (RSI) for Celestia shows that cryptocurrency is currently on a downward trend. Stuck under the neutral line at 50.0, the RSI approaches the threshold of occurrence of 30.0. Historically, when an asset reaches this level, it is considered a signal for a potential reversal, because the sale generally slows down and the accumulation begins.

If the RSI falls below 30, it could trigger purchasing interests, because many traders can consider low prices as an opportunity to enter the market.

The current state of the RSI suggests that if the lower time is still strong, the conditions are ripe for a reversal. If the sales pressure decreases and buyers are starting to intervene, the price of Celestia could find support and start an upward movement.

Tia Price could consider recovery

Celestia is currently at a price of $ 2.62, reflecting a drop of almost 30% in the past two weeks. It is just above the level of critical support of $ 2.53. If the feeling of the market improves and the RSI reaches the Surolon area, there is a potential for recovery.

The influx of new investors could provide the necessary momentum to increase the price.

A successful rebound in the level of support of $ 2.53 could see Celestia pushing through $ 2.73 and head to $ 2.99. This would point out the start of a recovery rally and could possibly prepare the way for an additional price assessment as market conditions improve.

However, if Celestia does not hold the $ 2.53 support, it could trigger a new drop to $ 2.27. This would invalidate upward perspectives, extending the downward trend and extending the losses of investors.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.