Chainlink (LINK) Poised for 22% Price Decline, Here’s Why

In the midst of the ongoing confusion on the cryptocurrency market, the native token bond of Chainlink has shown a lower price action and is ready for a drop. However, the current feeling of the market remains lower, the best assets like Bitcoin (BTC), Ethereum (ETH) and XRP also experience significant price reductions.

This slowdown potentially influences the global feeling of the market.

Technical analysis of ChainLink (link) and future

According to an expert technical analysis, Link seems to form a dual lowering top model over the four -hour period. Although this scheme is still complete, the graph also shows a downward divergence, more supporting this negative perspective.

Based on historical price dynamics, if the asset closes below the level of $ 16.15, there is a high possibility of a drop of 22%, which reduces it to $ 12.75 in the coming days. A downward divergence occurs when the relative resistance index (RSI) and the double roof pattern align, especially when the summits of the pattern are parallel while the summits of the RSI decrease.

Current price momen

After the formation of the model, the asset began to go down. Link is currently negotiating nearly $ 16.31 and has dropped 4.5% in the past 24 hours. At the same time, its volume of negotiation jumped 12%, indicating increased participation of merchants and investors compared to the day before.

The merchants are leaned

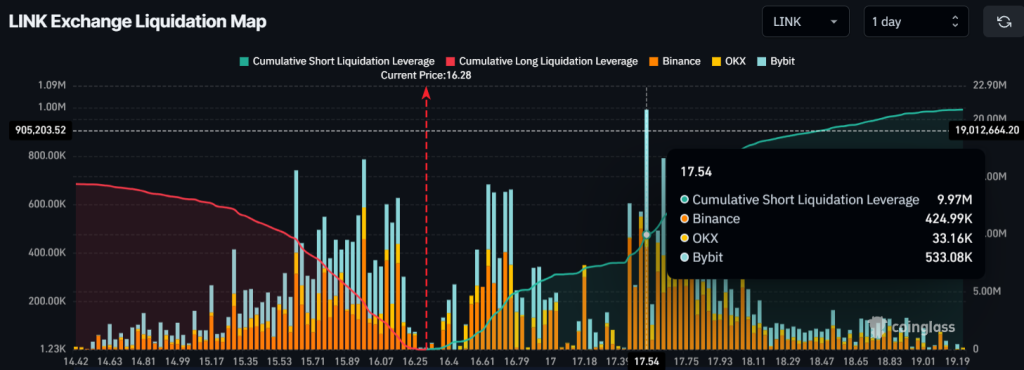

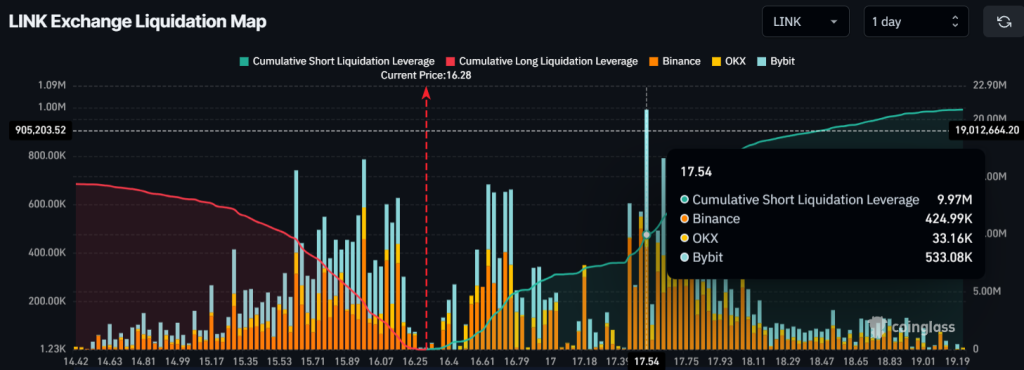

With the drop in current prices and the action of lower prices, intraday traders seem to follow the current feeling of the market, betting strongly on the lower side, as reported by the analysis company on the Corglass chain.

The data reveal that the traders are currently over-deposed, with key levels at $ 16 on the lower side and $ 17.50 on the upper side for bulls and bear. At these levels, they built $ 4 million in long positions and $ 10 million in short positions, which indicates that bears are currently dominating and could push the price of Link even lower.