Chainlink Price Drops 7.77% Amid Oracle Glitch, Will LINK Price Go Back Up?

ChainLink, often considered a pioneer in the Oracle sector, is under the spotlight for bad reasons. A recent number with an Oracle Chainlink update has resulted in more than $ 532,000 in user funds in just 180 seconds. The incident triggered criticism and questions around the price of the short -term chain. From a price point of view, the link price lost 7.79% in one day at $ 14.54. In response, investors are considering data on the chain and a chain prices analysis to determine where the link could then be directed in the middle of this turbulence.

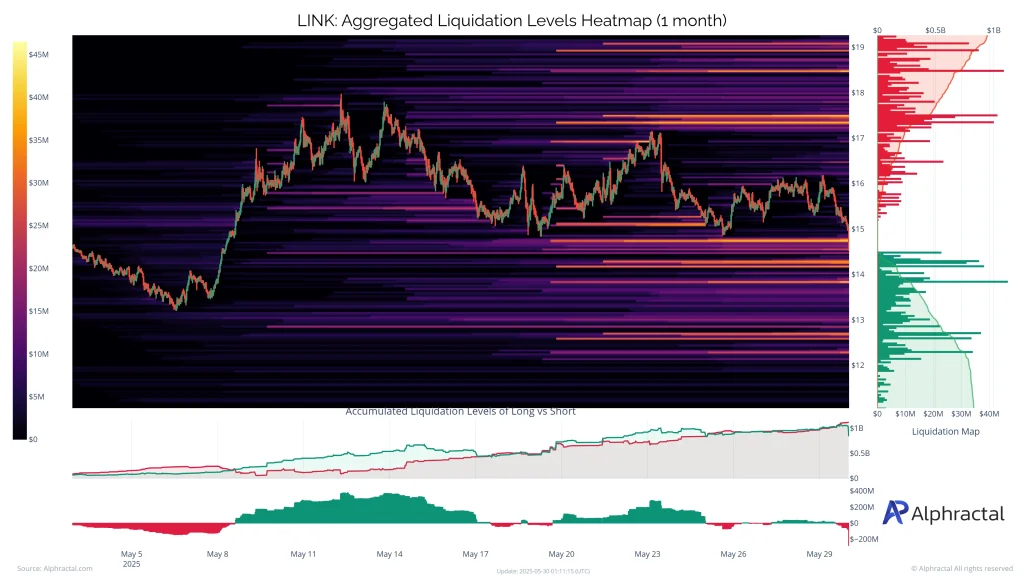

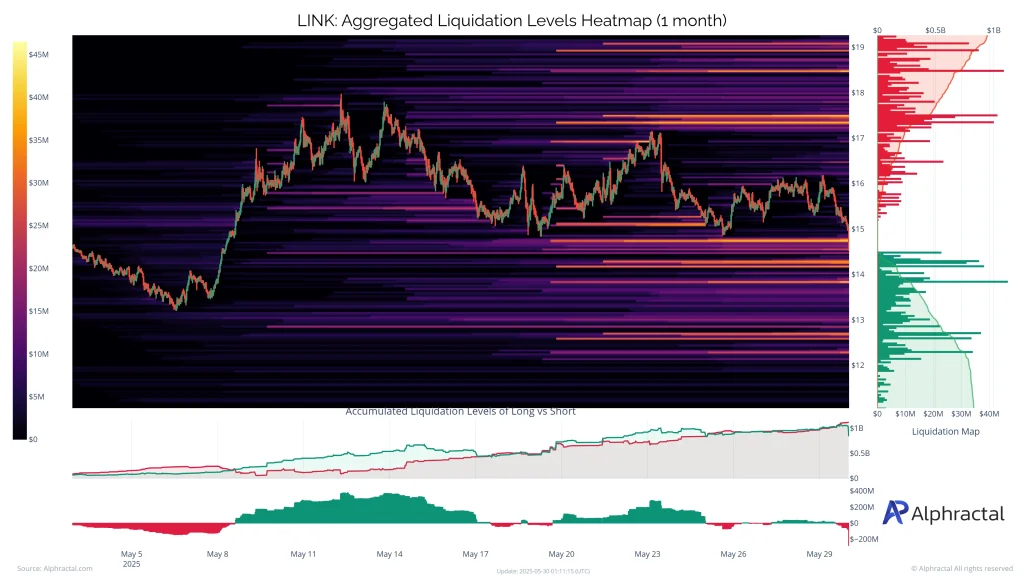

What does the thermal liquidation card say?

The recent thermal liquidation map of the Alphractal paints a turbulent image for the link. The card shows a clear point in long liquidations during last week. This is often associated with the capitulation phases, where the excessive lever effect on the long side is destroyed. Interestingly, to date, that is to say on May 30, the concentration of liquidation has moved, most of the remaining potential liquidations is now in the short term.

Successively, when short liquidations become predominant, they can act as a catalyst for prices overvoltage. Historically, long -scale long liquidations often mark local funds, leading to price rebounds. Therefore, if the link can maintain its land near the current levels, a short compression scenario could quickly push the liaison token upwards.

Also read our Prix prediction ChainLink (link) 2025, 2026-2030!

Link price analysis:

Chainlink’s negotiation price is currently about $ 14.54, with an intra -day drop of 7.77%. The market capitalization of the token now oscillates approximately $ 9.56 billion, accompanied by a negotiation volume of 24 hours of $ 598.92 million. Link’s trading range for the last day shows a minimum of $ 14.46 and a summit of $ 15.91.

Technically, ventilation below the current level could trigger a fall at the next crucial support area at $ 13.86. Conversely, if the bulls manage to recover the level of $ 16, a test of $ 17.4 could be in the cards. This area acted as a strong resistance earlier, and the rupture could renew the bullish momentum in the medium term. Above that, $ 19.8 is a more distant, but critical resistance.

Faq

An update of defective chain oracle has sparked forced liquidations totaling more than $ 532,000, which prompted the market to the panic of the market and a drop in prices.

The chain price is down 7.79% to $ 14.54.

Link’s crucial support is $ 13.86, while the resistance is $ 16 and $ 17.4.