XRP Price Steady for Now, But Buyer Activity Tells a Different Story

The Ripple XRP shows signs of weakening bull support while its price continues to move laterally with the main room, Bitcoin.

Although it has held its range since last Thursday, two key measurements on the channel decreased during last week. This decrease suggests cooling the interests of investors, increasing the risk of a drop -down potential movement.

The new portfolios disappear, the falls of the term volume

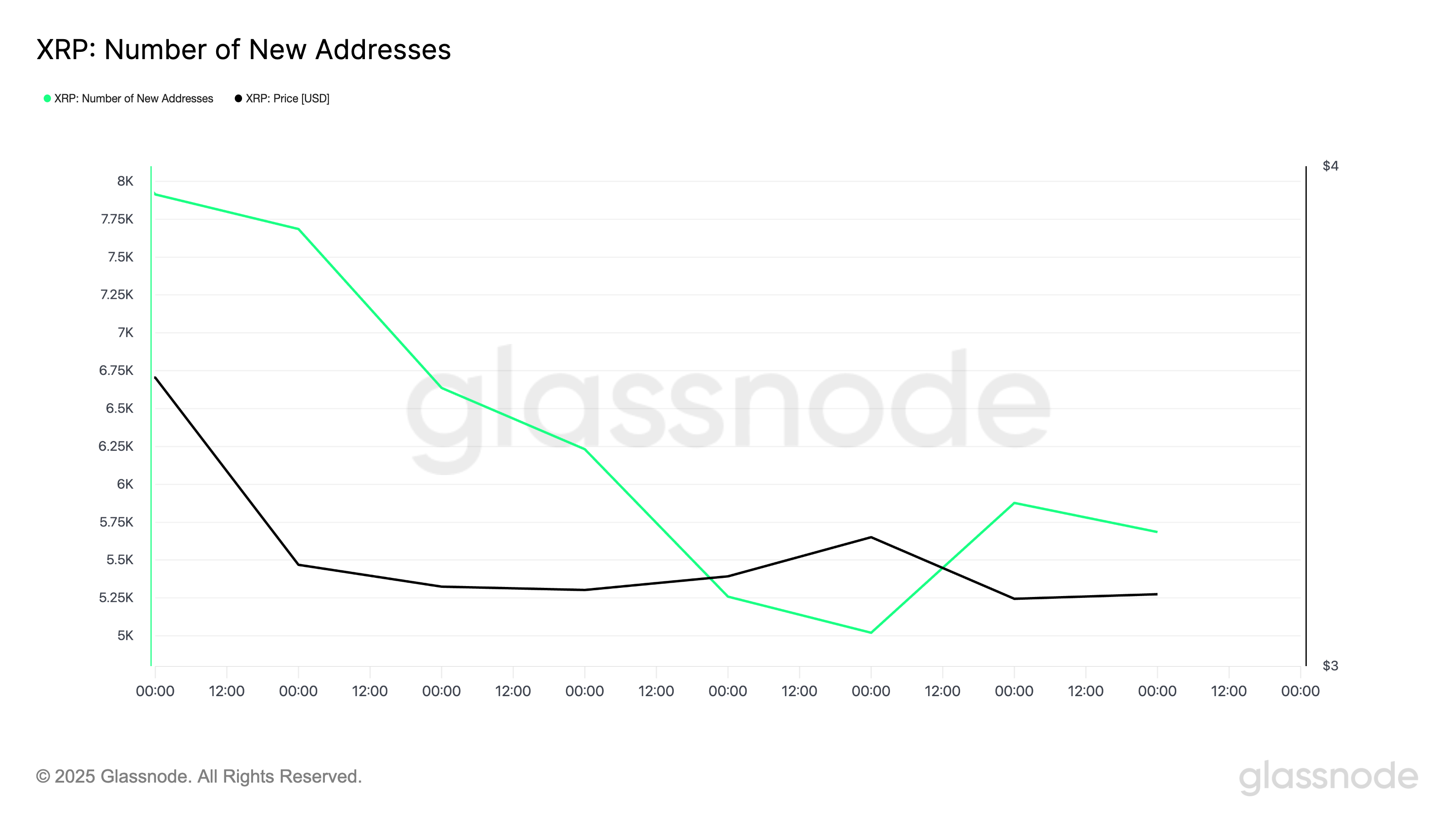

According to Glassnode, the new XRP request has dropped in the last seven days. Yesterday, only 5,685 new addresses made at least one transaction involving Altcoin, a drop of 28% compared to the 7,914 addresses recorded seven days ago.

For TA tokens and market updates: Do you want more symbolic information like this? Register for the publisher Daily Crypto newsletter Harsh Notariya here.

A drop in the new request reporting the interest of new capital and new market players, both essential to support the upward momentum in any active. In the case of XRP, this lack of new capital leaves the active more vulnerable to lowering pressures, which could trigger a rupture below its close price range in the short term.

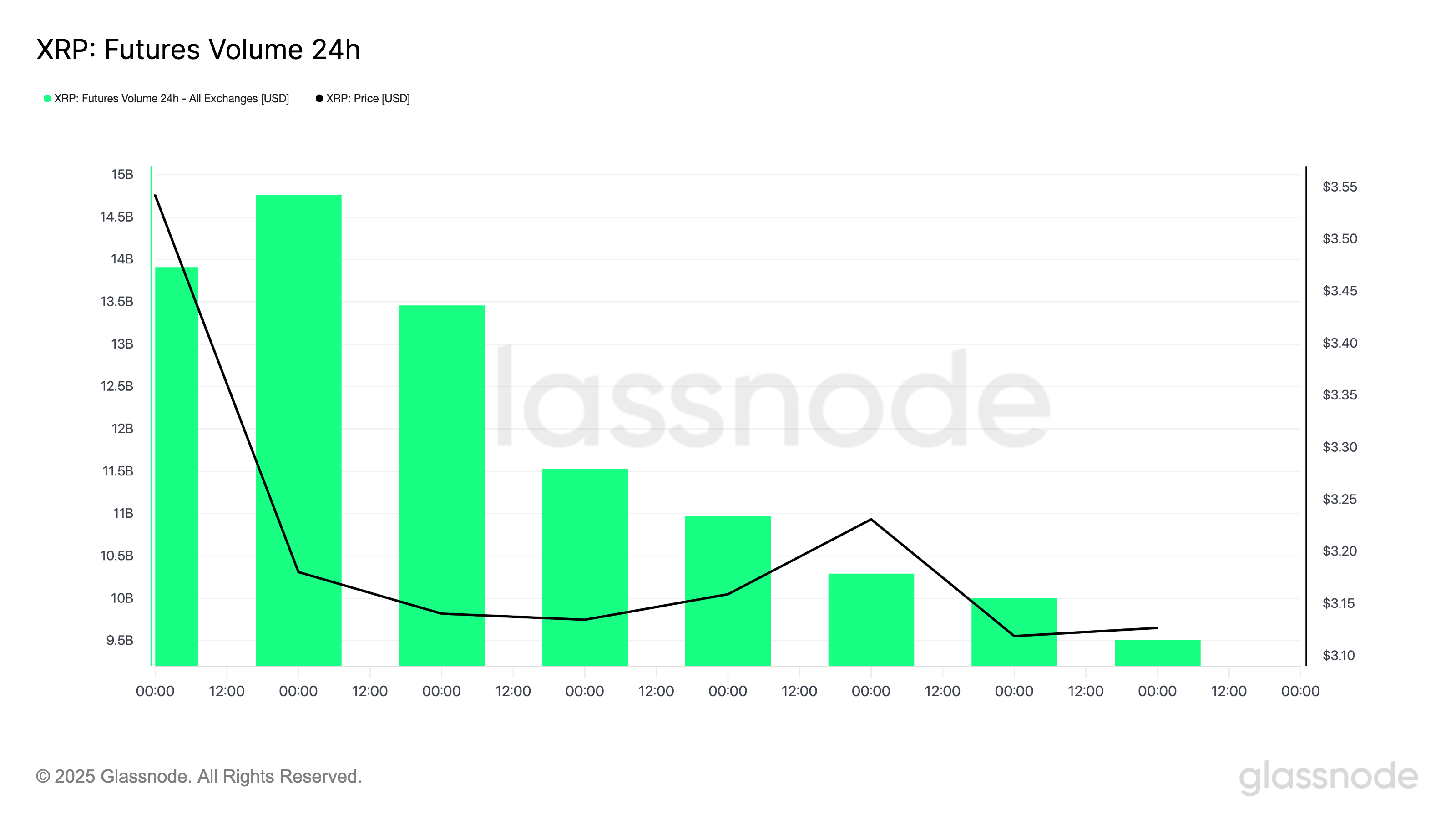

In addition, the activity of the long -term market has experienced a notable decline, pointing out more momentum. According to Glassnode, the total daily volume of XRP term contracts – was measured using a seven -day mobile average – plunged more than 30% last week.

This suggests that leverages, often the main engines of short -term volatility and prices discovery, take a step back. When the long -term volume drops while the cash price moves to the side, it points to market indecision and a lack of conviction in both directions.

Without a speculative interest in pushing higher prices, the XRP risks escape from its current beach in a drop, especially if the sales pressure increases.

XRP feeling becomes a drop

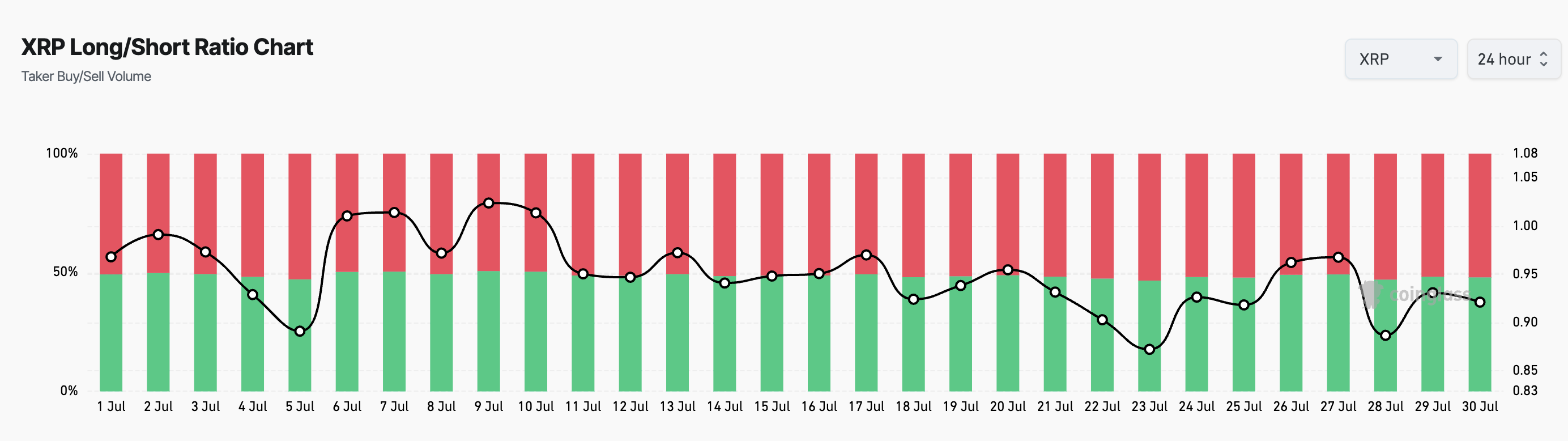

Unfortunately, the desire to push higher XRP is not the dominant feeling on its long -term market. This is reflected by its long / short ratio, which is currently 0.92.

The long metric / short measures the proportion of Paris long to those short on the long -term market of an asset. A report higher than one indicates that there are more long positions than the shorts. This indicates a bullish feeling because most traders expect the value of the asset to increase.

On the other hand, a long / short ratio less than 1 means that more traders bet on the price of the assets to decrease than those who expect it to increase.

Consequently, the current long / short ratio of XRP suggests that most traders are positioning themselves more and more for a drawback, confirming the lowering prospects in its punctual markets.

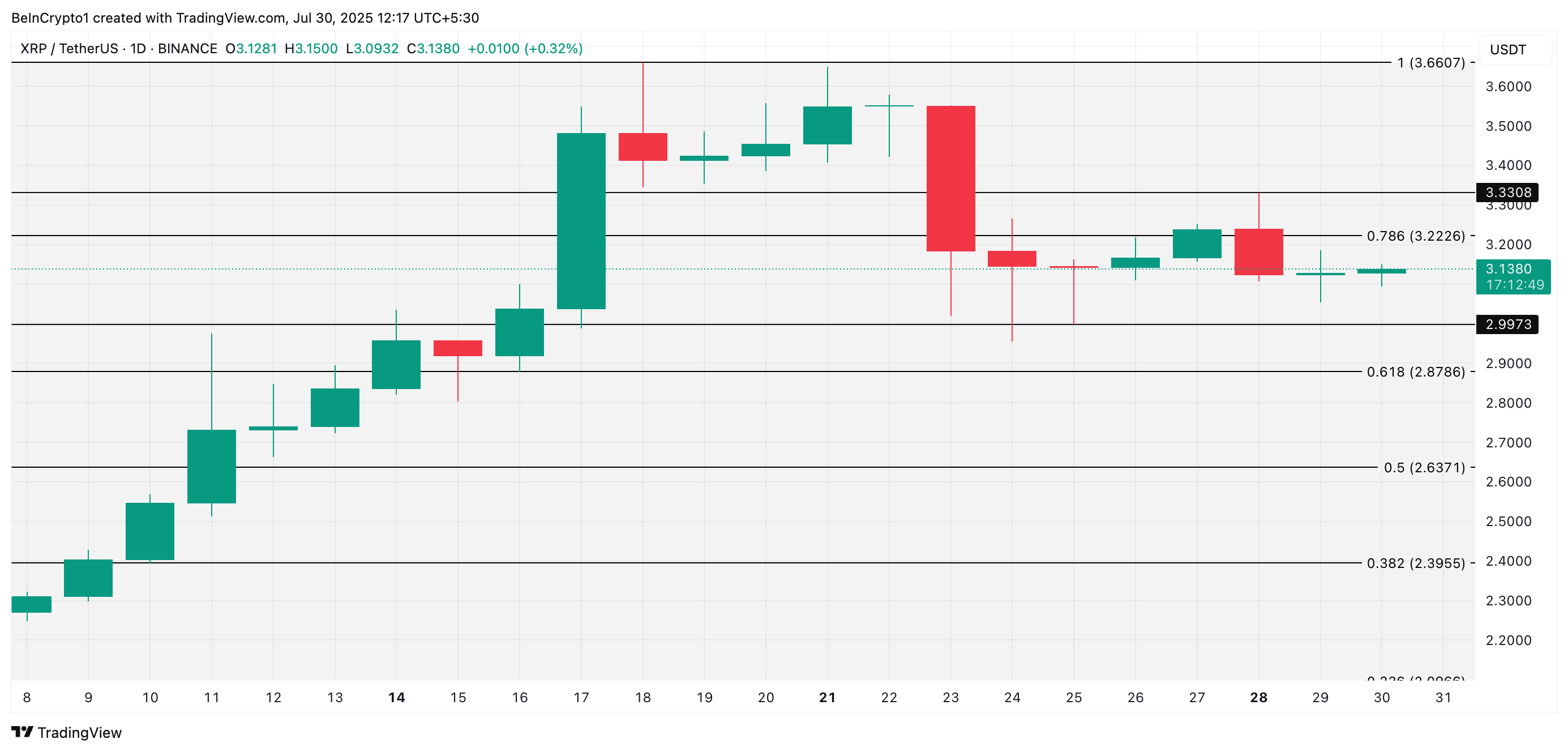

XRP is struggling to find buyers – will he get $ 3 or breaks?

To date, XRP is negotiated at $ 3.13, oscillating below the $ 3.22 mark, which is increasingly acting as a high level of resistance. If Sellofs intensifies and the token comes out of its lateral trend, its price could fall below $ 3 to reach $ 2.99.

Conversely, if a new request comes to the market, it could trigger a rally exceeding $ 3.22 and around $ 3.33.

The post XRP price is stable for the moment, but the buyer’s activity tells that another story appeared first on Beincrypto.