Bitcoin Holds Steady as U.S. Loses Perfect Credit Rating

Bitcoin (BTC) faces a mixture of bruise signals and short -term uncertainty. Moody’s recent demotion of the American credit rating increased the long -term brute feeling around the BTC, strengthening its role of coverage against the increase in debt and budgetary uncertainty.

Meanwhile, data on the chain show a drop in Bitcoin supply on exchanges, which suggests that investors are looking at detention rather than sale. Despite these bullish fundamentals, the BTC remains in a short -term consolidation phase, with a price action requiring new momentum to break.

Moody’s Downragrade ends with a sequence of a perfect credit rating of a century of a century

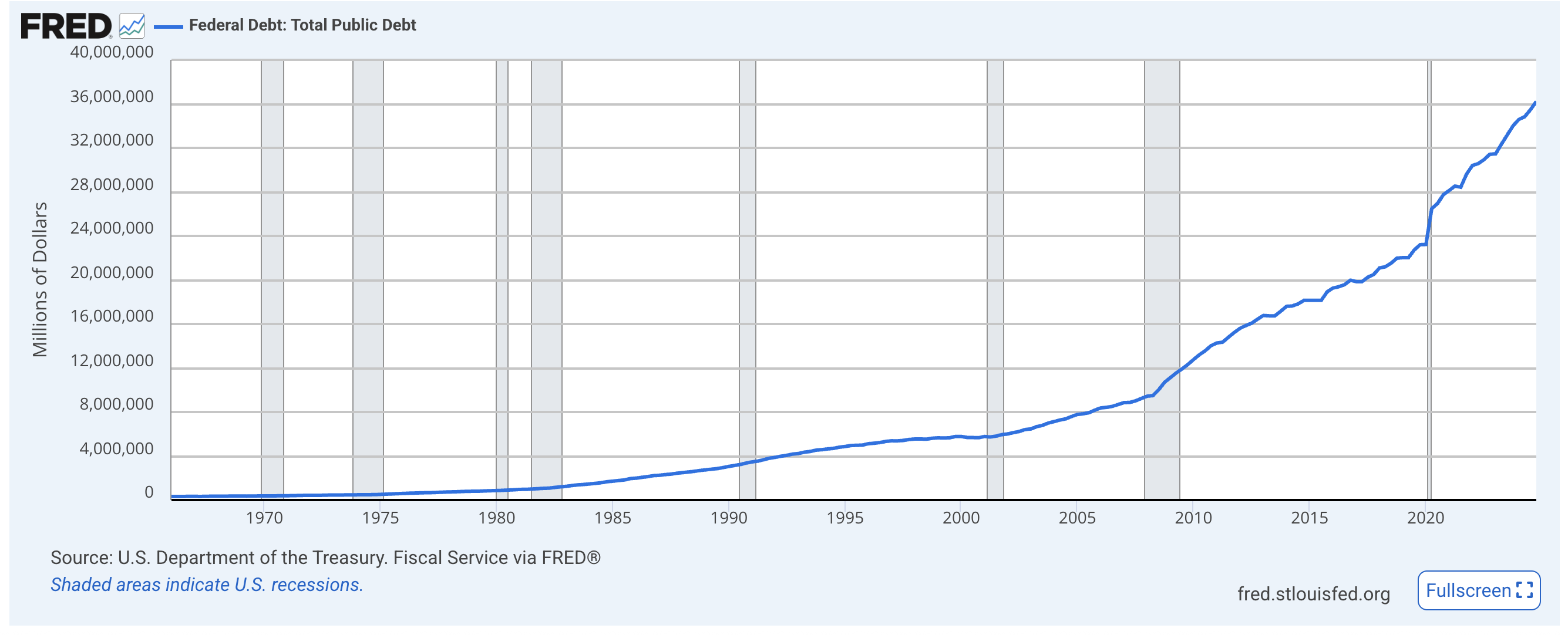

Moody’s lowered the American credit note from AAA to AA1, removing the country’s last perfect score among the main credit agencies.

It was the first time in more than a century that the United States has lacked a high-level note of the three, after demarcations of S&P in 2011 and Fitch in 2023. An increase in deficits, increasing interest costs and the absence of credible tax reforms have led the decision.

The markets reacted quickly – the yields of the treasury increased and the contracts on the actions have slipped. The White House rejected demotion as politically motivated, the legislators still negotiating a tax and expenditure package of 3.8 billions of dollars.

Moody’s also warned that the extension of tax reductions in the Trump era could deepen the deficits, pushing them around 9% of GDP by 2035 – a scenario that could strengthen the attraction of crypto, in particular bitcoin, as a cover against long -term budget instability.

Bitcoin Consolidats: Falling Exchange Supply Meeting Ichimoku Indecision

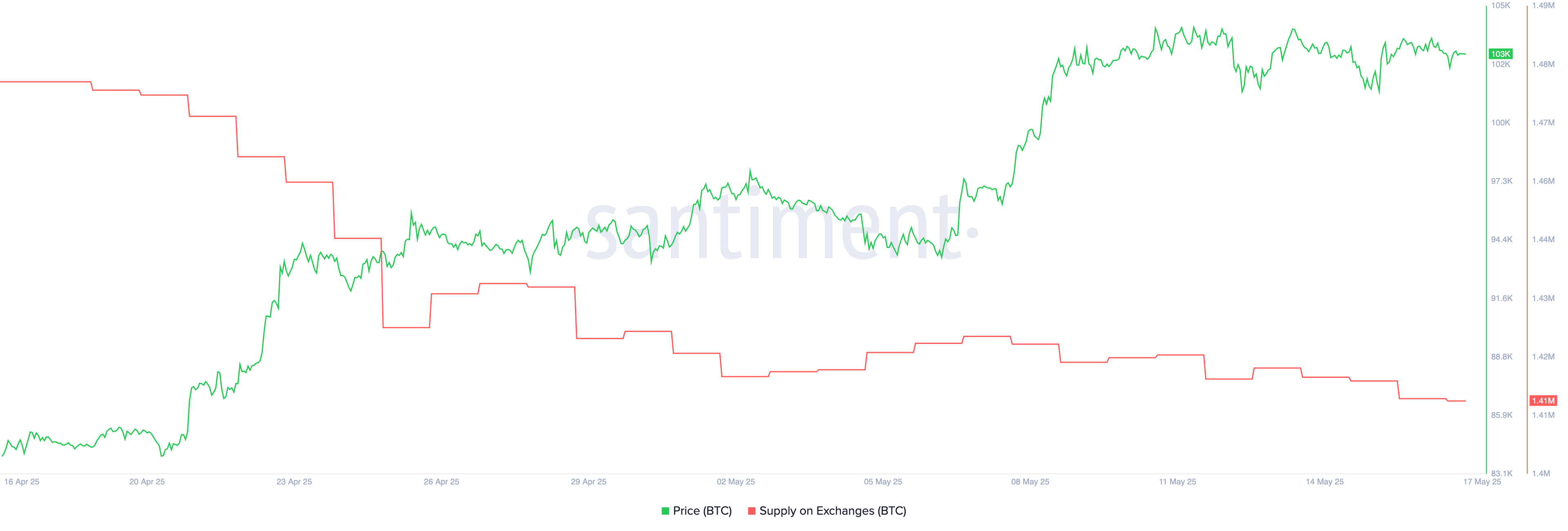

After having briefly increased from 1.42 million to 1.43 million between May 2 and 7, the offer of Bitcoin on exchanges decreases once again.

This short increase followed a greater drop between April 17 and May 2, when the exchange offer increased from 1.47 million to 1.42 million. Today, metric has resumed its downward trend, currently 1.41 million BTC.

Bitcoin offer on exchanges is a key market indicator. When more BTC is maintained on exchanges, it often signals potential sales pressure, which can be down.

Conversely, a drop in exchange sales suggests that holders move their coins to cold storage, reducing short -term sales pressure – a bull signal. The current drop strengthens the idea that investors can prepare to hold rather than sell.

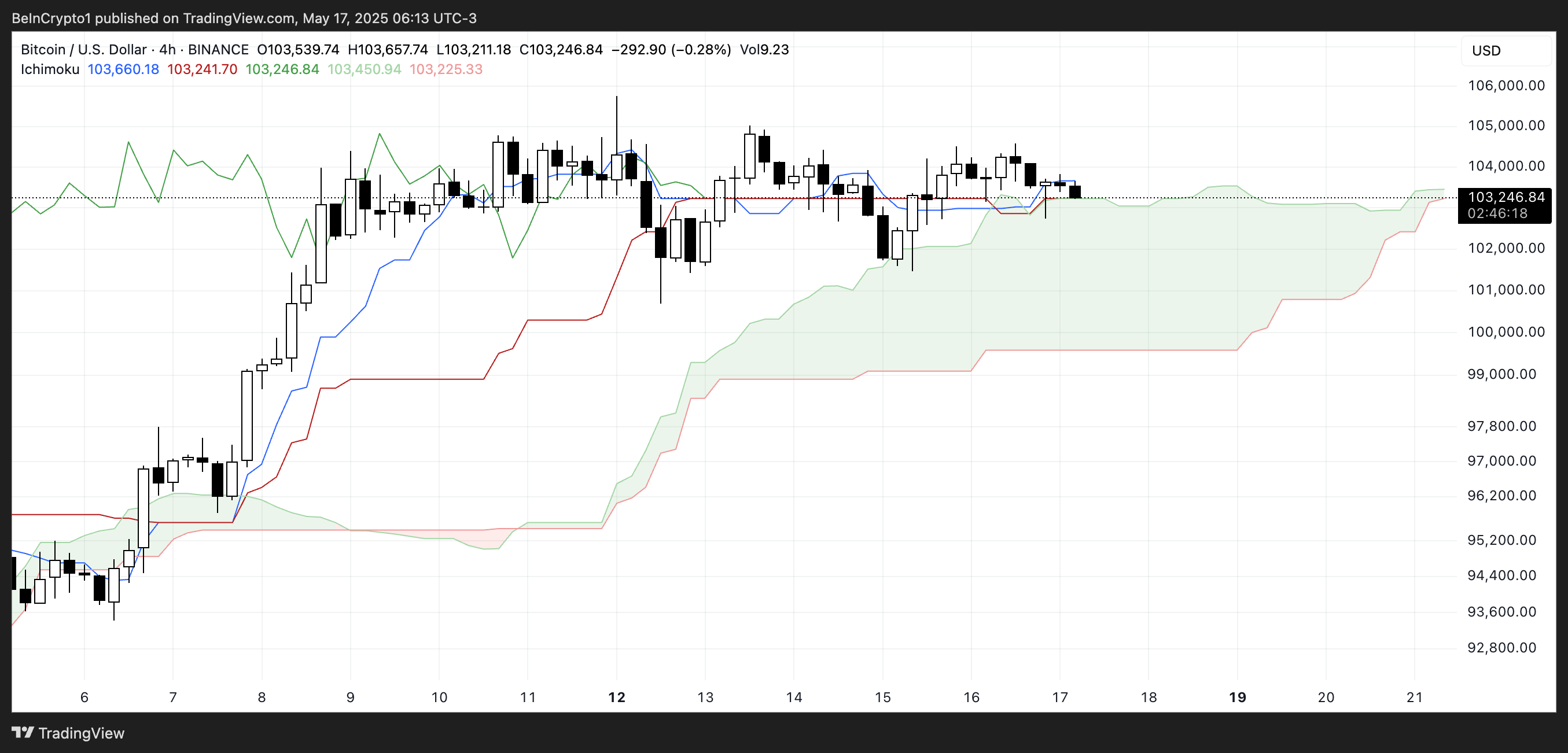

The Ichimoku cloud table for Bitcoin shows a consolidation period with neutral bleeding signals. The price is currently sitting just around the Kijun-Sen (red line) dish, indicating a strong lack of momentum in both directions.

Tenkan-sen (Blue Line) is also flat and closely follows the price, strengthening this lateral movement and short-term indecision.

The Senkou Span A and B lines (which form the green cloud) are also relatively flat, suggesting balance on the market. The price moves near the upper edge of the cloud, which generally acts as a support. However, as the cloud does not develop and has a flat structure, there is no strong trend confirmation at the moment.

The Span Chikou (green offset line) is slightly higher than the price candles, referring to a slight biased bias, but overall, the graph indicates the indecision and the need for a break to confirm the next direction.

Moody’s demotion strengthens the long -term bitcoin bull case in the middle of short -term consolidation

The United States losing its last perfect credit rating after the Moody’s gradient could be a major long-term catalyst for Bitcoin.

Although it cannot trigger an immediate price action, the demotion strengthens the account of increasing budgetary instability and the concerns of debt – conditions which strengthen the Bitcoin call as a decentralized and styled active.

In the medium to the long term, more investors can turn to BTC as coverage against sovereign risk and weaken confidence in traditional financial systems.

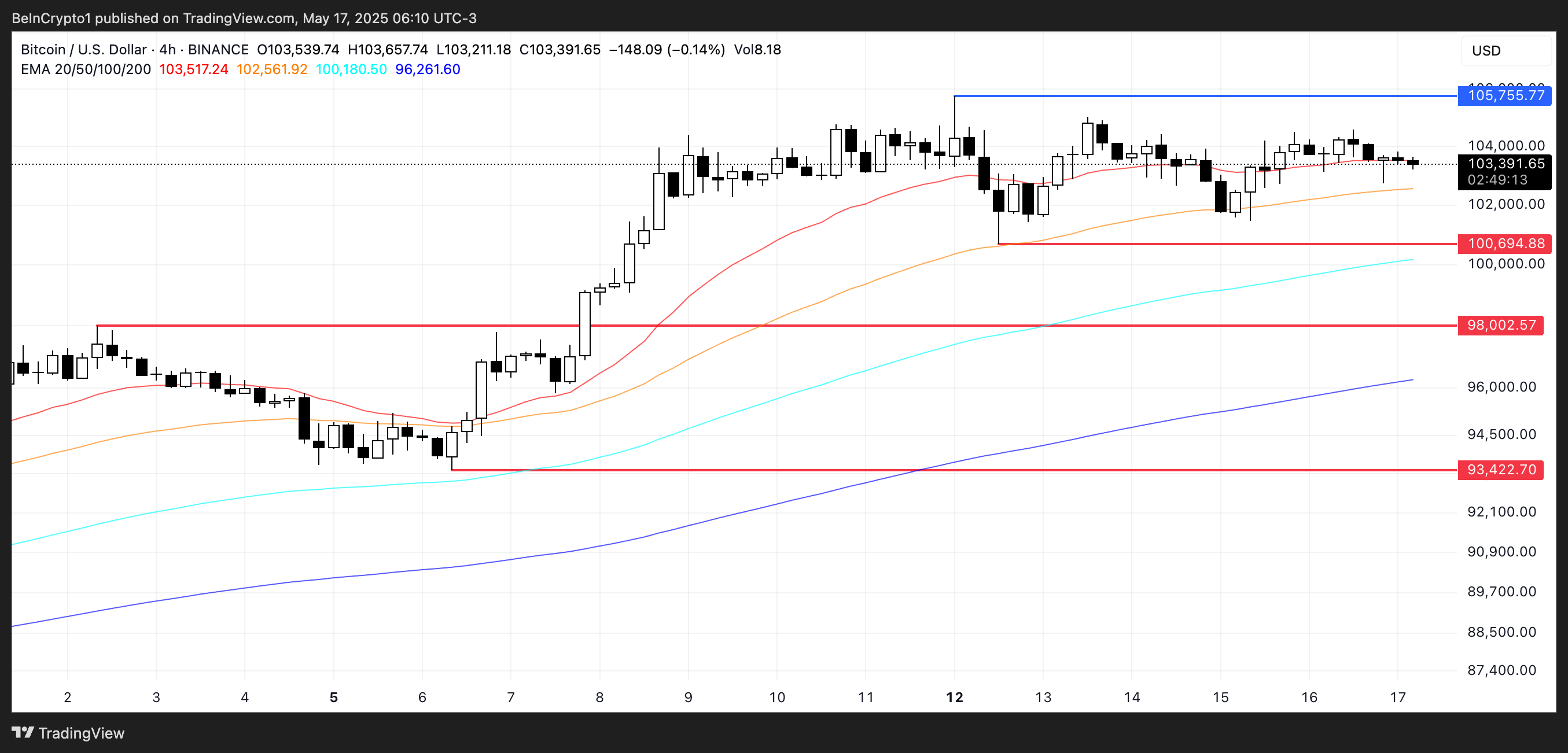

In the short term, however, the price of Bitcoin remains in a consolidation phase after exceeding $ 100,000. Its EMA lines are always optimistic, with short-term averages above those in the longer term, but they are flat.

For the bullish momentum, BTC should exceed the resistance of $ 105,755.

Rightly, maintenance above the support of $ 100,694 is crucial – the loss of opening the door to drops to $ 98,002 and potentially $ 93,422.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.