China mocks US crypto policies, Telegram’s new dark markets: Asia Express

China broadcasts an American cryptographic satire of 30 minutes

CCTV, the oral tip of China’s state broadcasting, broadcast a half-hour special on cryptocurrencies and how the United States tries to solidify the domination of the dollar with stablecoins.

The dissemination of July 27 framed the new Stablecoin American law on American stable, as a geopolitical turning point. Video monitoring estimated that the new rules explicitly prohibit a digital currency from the central bank issued by the reserve (CBCD) while allowing Stablecoins to export American debt in digital form.

The diffuser said that the stablecoins supported by the US Treasury obligations represent the third phase of the hegemony of a dollar after Bretton Woods gold and the oil from the Middle East. In this model, crypto users around the world become indirect holders of the American government’s debt, while stablecoin issuers are emerging as the next generation of super-bondus. The program warned that this digital infrastructure could move lower currencies.

The program linked the legislation to Trump and passed part of his presentation dissecting his conflict with the president of the Fed, Jerome Powell, painting a dysfunctional scene while depicting cryptocurrencies as elite tools of interest. CCTV quoted an article from Reuters to say that cryptographic companies have funded the president’s debt of the family’s debt for a Wall Street office building.

Reuters’ real relationship did not experience a simple crypto. He reported: “Golf and resort companies of the president have performed well in recent years, taking off a lot of money. In recent months, his family business has concluded lucrative license agreements with developers and has opened several bridge traits in cryptocurrencies, who have given hundreds of millions of dollars in fees and other income.”

A piece of special television focused on cryptographic crime, such as social engineering scams, identity attacks and high -level digital bars. These were presented as symptoms of lax surveillance and deregulation. China is also confronted with a scandal of crypts of 1.8 billion adult dollars, which was not discussed in the broadcast.

The special also omitted the CBDC project of China, its cryptography prohibitions or the regulation of the stablescoin of Hong Kong, which should take effect on August 1.

In a separate report Thursday, the National Business Daily, supported by the State, published an interview with Song Ke, the executive dean of the social sciences of the University Renmin. KE said that the stables of Chinese CBDC and Hong Kong can reduce dependence on dollars. He added that the new rules can open paths for the digital integration of the Yuan in the economy of Stablescoin.

Tudou and Xinbi take the place of Huione fallen as leaders of the Darknet market

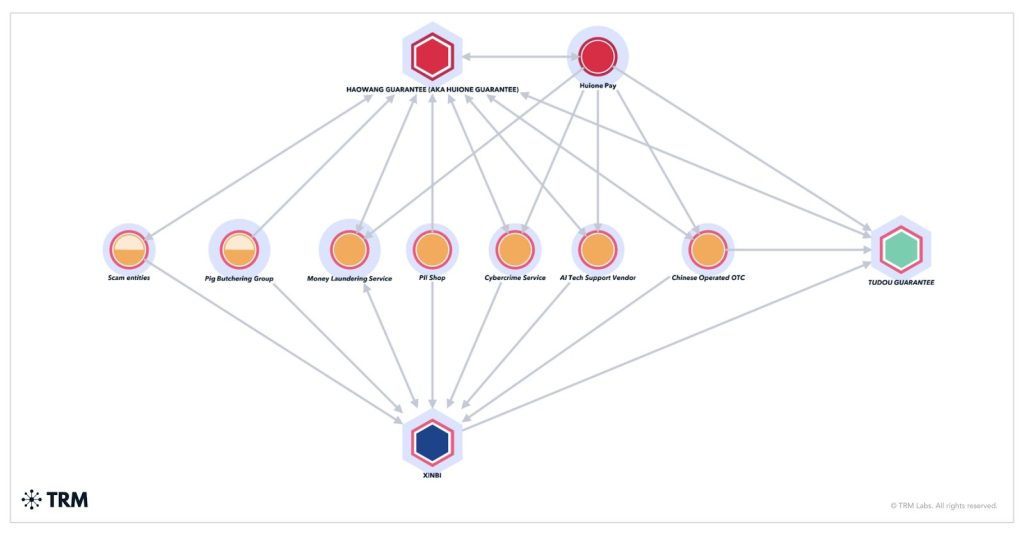

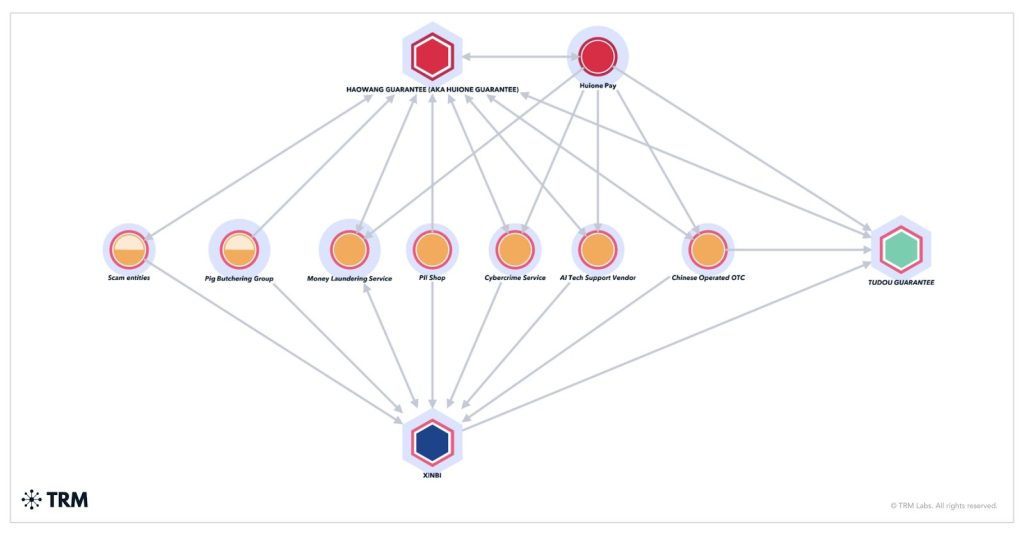

The Guarantee of Tudou and the Xinbi guarantee have become the new managers of the illegal crypto market of Southeast Asia, after the guarantee channels of May Takedown of Huione of Telegram.

The financial network of financial crimes of the American Treasury (Fincen) qualified the group Huione, which would have exploited the illegal telegram telegram platform Huione and the cryptographic payment platform Huione Pay, a main concern for money laundering by the network of application of the financial crimes of the American Treasury (Fincen) in May. The operation turned out to be linked to the HUN family in the power of Cambodia by the Elliptical Blockchain analysis platform in 2024.

TRM Labs said in a Wednesday report that the reshuffle had not dismantled the region’s underground financial system, but accelerated a quarter of work. The daily volume of Tudou transactions has jumped almost 70 times since May 11, when the guarantee of Huione has announced that it suspend its entire operations. TRM analysts found that sellers formerly active on Huione are now working on Tudou using the same portfolio infrastructure.

The Xinbi warranty also recovered quickly. After being briefly withdrawn from the telegram, he returned under the same identifier and saw an increase of 90% of the daily entries.

Meanwhile, Huione Pay, Huione’s payment arm remains active. After the ban, its average daily transaction volume increased by 50% before stabilizing about 10% above previous levels. TRM’s analysis shows the infrastructures that overlap between Huione Pay and the Huione warranty, with historic flows of the Huione Pay withdrawal portfolios in the deposit portfolios of the Huione warranty.

TRM said that repression had triggered “fragmentation, not collapse”. Despite sanctions and platform bans, Huione and its network continue to operate via Tudou and other affiliates, distributing risks while maintaining operations. Meanwhile, Xinbi seems to develop and benefit as an alternative platform after Huione’s stop.

Read

Features

Big questions: how can Bitcoin payments make a return?

Features

Secrets of Crypto Founders under 25 who make a bank

South Korea to let crypto exchanges freeze the suspicious funds

South Korea is preparing to give cryptocurrency exchanges the legal authority to freeze user funds suspected of being linked to phishing and other online scams, as part of a broader national thrust against digital crime.

The Financial Services Commission (FSC) revealed the plan on Wednesday during a high-level political meeting chaired by Prime Minister Kim Min-Seok. Reunion has focused on public security, with proposals aimed at braking scams and counterfeit products.

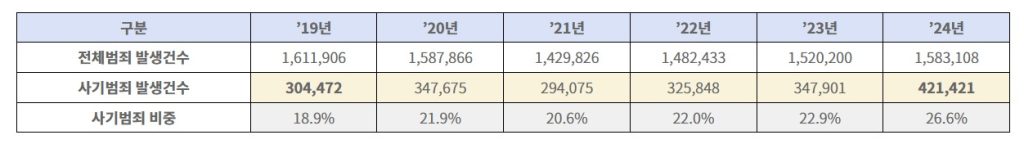

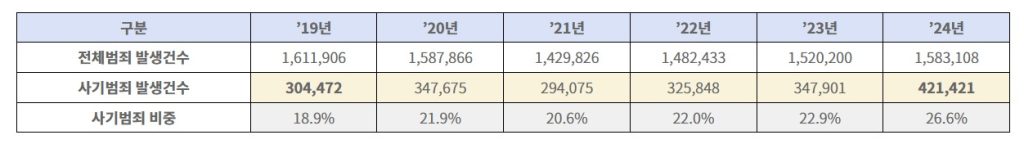

Scams now represent more than a quarter of all criminal affairs in South Korea, and fraud linked to the crypto has increased in tandem. Last year, the authorities broke out a 232 million dollars Crypto Pont program which included the arrest of 215 suspects.

Vocal phishing alone has increased by 39% in the past five years, with more than 421,000 cases reported in 2024.

As part of its response, the government says it will deploy an AI -based system to detect scams early and improve victims’ compensation procedures. The FSC has also said that it would publish new guidelines in the coming months describing the obligations of user exchanges and additional protections.

Read

Features

ZK-Rollups is “the end of the game” for the scale of blocks of blocks: Founder Polygon Miden

Features

The fan first approach to the singer truth of the web3, the NFTS music and the community building

Japan cryptographic industry pushes the tax reform plan

The main groups of the cryptographic industry of Japan have submitted a proposal for tax reform to the government, seeking to align the treatment of cryptographic assets with that of actions and other financial instruments.

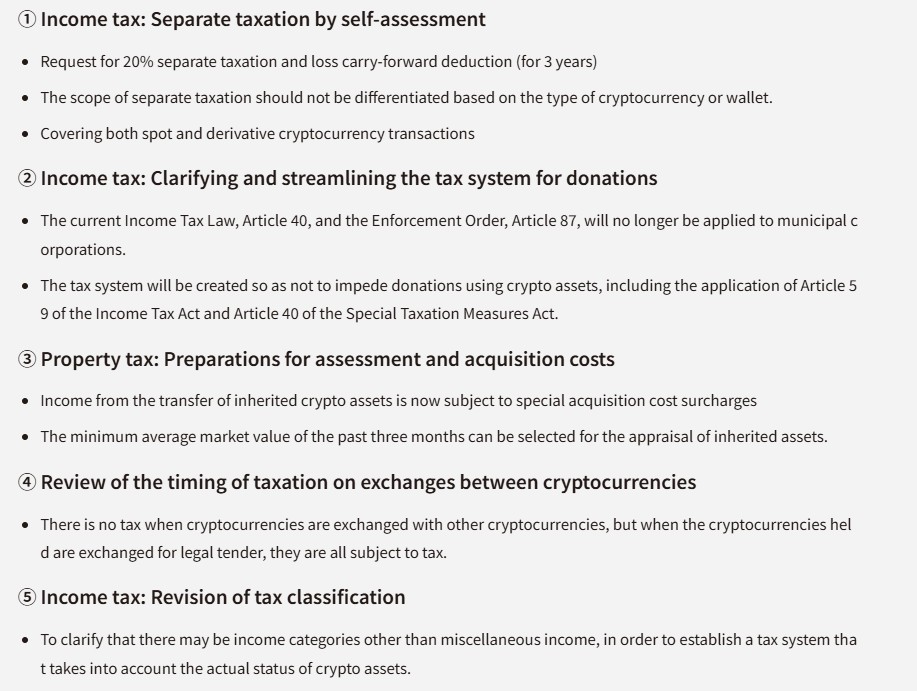

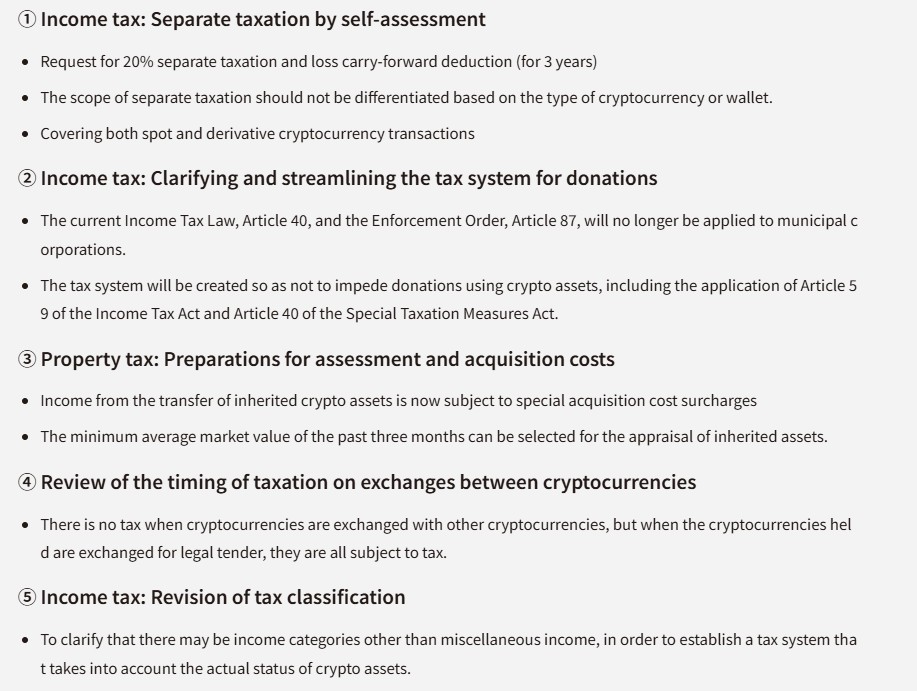

In June, the Japanese financial services Financial Agency offered reclassifying cryptocurrencies as “financial products” to align them with traditional financial assets. The agency also suggested a 20% tax on digital assets. Local groups in the cryptographic industry submitted their own proposal on Wednesday, including additional requests.

Japan Virtual Device Banges Association and Japan Cryptovise Business Association have jointly led to a distinct 20% self-assessment tax on cryptographic income, as well as transport losses for three years and consistent tax rules on different types of assets and cryptographic portfolios.

The proposal also urges the government to modernize the obsolete tax rules. More specifically, it requires exemptions from cryptography donations, the use of the lowest average market price in the last three months during the enhancement of the hereditary crypto and the difference in taxes on crypto-to-crying exchanges until the assets are converted to Fiat.

Get down

The most engaging can be read in the blockchain. Delivered once a week.

Yohan Yun

Yohan Yun has been a multimedia journalist covering the blockchain since 2017. He has contributed to Crypto Media Outlet Forkast as an editor and covered Asian technological stories as an assistant journalist for Bloomberg BNA and Forbes. He spends his free time cooking and experimenting with new recipes.