China’s 100K TPS blockchain, Japan’s Minna Bank eyes Solana: Asia Express

Beijing’s state media are gathering behind Chang’an Chain, a local blockchain infrastructure hailed as a solution to the “root problem” of digital sovereignty of China.

A profile on Qianlong.com attributes to researcher Dong Jin and his team for the construction of a blocchain battery entirely open-open and supported by the state now feeding national digital projects. Although little known outside of China, the Chang’an channel has known 21 iterations over six years and now claims to manage more than 100,000 transactions per second – a reference often cited by new generation blockchains aimed at equaling the scale of traditional financial networks.

It would be used in the real estate registration system at the national level of China and by companies to digitize supply contracts, allowing banks to verify relations with suppliers and to accelerate loan approvals.

The profile comes just when the giants of Chinese technology put pressure for the right to issue stablescoins supported by the Yuan in Hong Kong. But Beijing sends a different message at home.

In particular, the Qianlong function does not mention a crypto or stablecoins once. Instead, it strengthens the long-standing vision of China’s blockchain as a state-controlled infrastructure for the exchange of confidence data and not as a digital or speculation platform.

While Hong Kong has deployed cryptography regulations to position itself as a regional center for digital assets, continental China continues to prohibit trade in cryptocurrency, mining and exchange. But the recent increase in global cryptography markets has rekindled speculation about a possible change in policy. So far, Beijing has not moved.

Support for blockchains supported by the state in continental China has remained stable. In 2019, President Xi Jinping raised blockchain to national priority status, calling it “basic revolution technology”. Although the blockchain is not listed among the seven “border technologies” highlighted in the 14th five -year plan – which includes AI, quantum IT and the merger of comparing the brain – it remains an essential element of the wider digital strategy of China, in particular in finance, governance and supply chains. The plan development period ends in December, with a final performance examination which will be awarded by the Council of State at the National Popular Congress during the annual legislative session in March 2026.

Quantum IT, one of the priority border fields, has been identified as a potential threat to blockchain and bitcoin safety because of its ability to break the encryption.

Last week, the South China Morning Post reported that Chinese researchers have developed blockchain storage technology that can withstand quantum computer attacks

Stablecoin Solana study in Japan

The Japanese Bank only Digital Minna Bank launched a joint study with Solana Japan, Fireblocks and Tis Inc. to explore the emission of stablescoins and the integration of web3 portfolios.

The study will focus on the issuance of stablescoins on Solana blockchain, with potential applications, including real assets (RWAS) such as obligations and real estate, cross -border payments and financial services based on digital portfolios.

This decision is aligned with global trends, especially in the United States and Europe, where institutions explore the regulation of stablescoin and RWA tokenization. Japan was among the first countries to establish a clear legal basis for staboins supported by Fiat through revisions of the Payment Services Act, which entered into force in June 2023.

Minna Bank, which was launched in 2021 and exceeded 1.3 million accounts, possibly aims to integrate stable and web3 features in its main application as part of its bank offers as a service.

Read

Features

The old -fashioned photographers are struggling with NFT: new world, new rules

Features

Crypto-Sec: Evolve Bank suffers from data violation, Turbo Toad enthusiasts lose $ 3.6,000

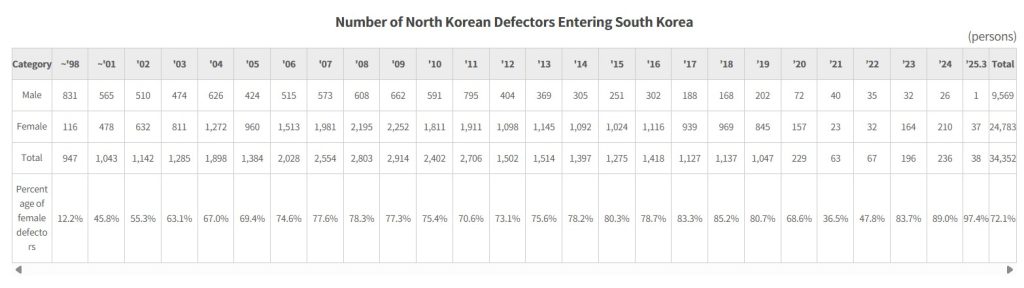

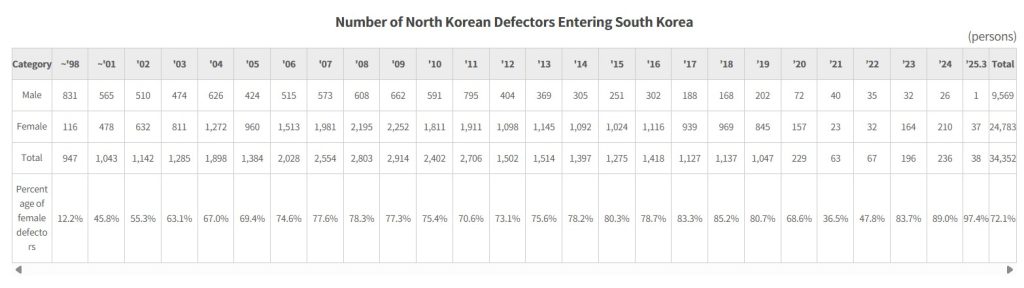

North Korean defectors falling for cryptographic scams

South Korean police investigate an alleged cryptocurrency investment scam which would have targeted the North Korean defectors.

According to local media citing police sources, 21 complaints were filed between July 4 and 8 against an anonymous suspect.

The suspect would have exploited an office in Siheung, a satellite city in Seoul, where he asked investments in cryptographic products via a specific platform. Investors say that their transferred funds have been converted and filed in platform accounts. Using a mobile application, the victims thought they were investing these funds in cryptographic products.

However, the application suddenly ceased to operate earlier this month, leaving users unable to withdraw their money. Total losses required so far amounted to around 1 billion Koreans (about $ 720,000).

Some complainants said the suspect had presented himself as a North Korean defector and had other defectors and knowledge to join the program. Others have allegedly alleged that the suspect was not the brain but one of the many agents in different cities and has won commissions by recruiting new members.

The victims believe that many other people have not yet been presented, suggesting that real losses could be higher.

Read

Features

Real cases of use of AI in crypto, n ° 3: intelligent contract audits and cybersecurity

Features

Fans tokens: Day trading your favorite sports team

Indonesia licensed scholarship lists for public trade

Indokripto Koin Semesta has become the first Indonesian Crypto exchange operator to be made public, registering the purse in Indonesia under Ticker’s play, the same symbol used by Coinbase on the Nasdaq.

The shares jumped 35% during the beginnings of July 9.

Indokripto is the parent company of Central Finansial, an enforced crypto exchange, and Kustodin Koin Indonesia, a digital active guard.

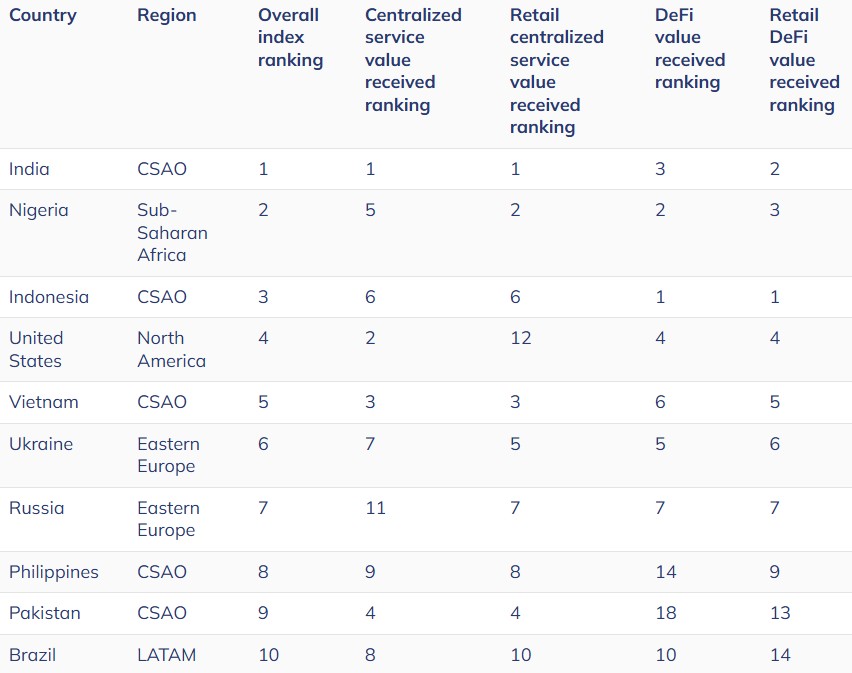

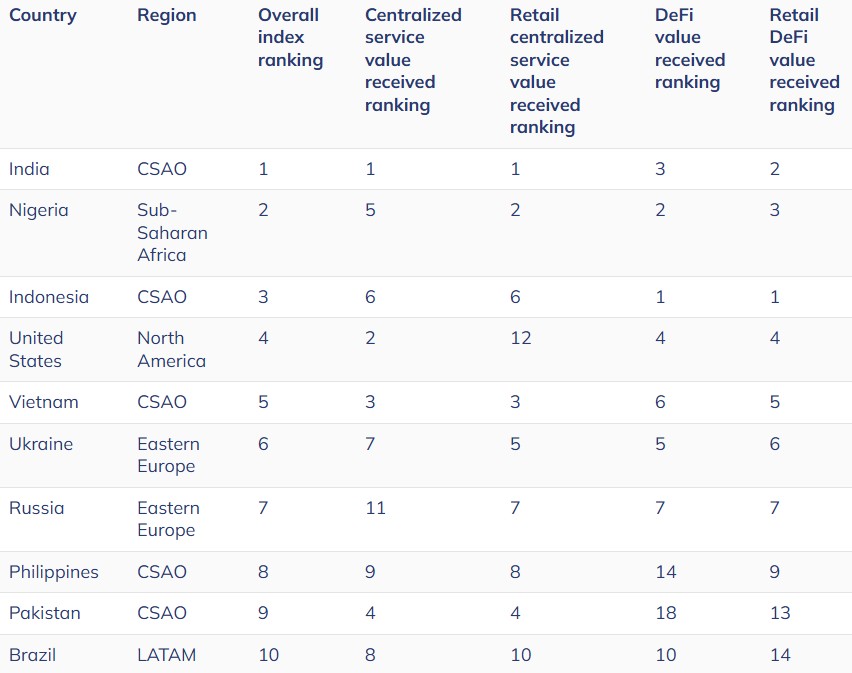

Although often neglected in global discussions, Indonesia plays a major role in the adoption of cryptography. In 2024, he ranked third in the world adoption of the cryptography of Chainalyysys and the first in value defined.

Earlier this year, Indonesia appointed the Financial Services Authority (OJK) as an official regulator of cryptographic assets. Until now, a single exchange – under the umbrella of Indokripto – has received a crypto license.

Get down

The most engaging can be read in the blockchain. Delivered once a week.

Yohan Yun

Yohan Yun has been a multimedia journalist covering the blockchain since 2017. He has contributed to Crypto Media Outlet Forkast as an editor and covered Asian technological stories as an assistant journalist for Bloomberg BNA and Forbes. He spends his free time cooking and experimenting with new recipes.