CLARITY Act Changes The Game for Crypto

Welcome to the morning briefing of the US Crypto News – your essential overview of the most important developments in the crypto for the coming day.

Take a coffee to read how cryptographic markets are entering a new phase, Washington legislators approaching the definition of the regulatory future of industry.

Crypto News of the Day: Clarity Act can create an assessment of the crypto in the race as obligations, Matt Hougan

Two historic bills adopted the American house on Thursday. The first, the Clarity Act, creates clear definitions of digital assets and divides regulatory monitoring between the SEC and the CFTC.

Meanwhile, the second, the law on engineering, is the first federal law of cryptography in the history of the United States, establishing national standards for the issue and monitoring of stables. Institutional investors and market analysts are starting to reinvent the way in which digital assets will be appreciated, exchanged and structured in the future.

After the votes, the director of investments in Bitwise Matt Hougan weighed on the implications for the digital asset market. According to Hougan, the Clarity Act, in particular, could inaugurate a new price dynamic for cryptographic assets, similar to the way in which obligations are evaluated in traditional finance (tradfi).

“The Clarity Act and generic list standards for ETP Crypto will create an evaluation element” on the race / out of the race in crypto “, published Hougan on X (Twitter).

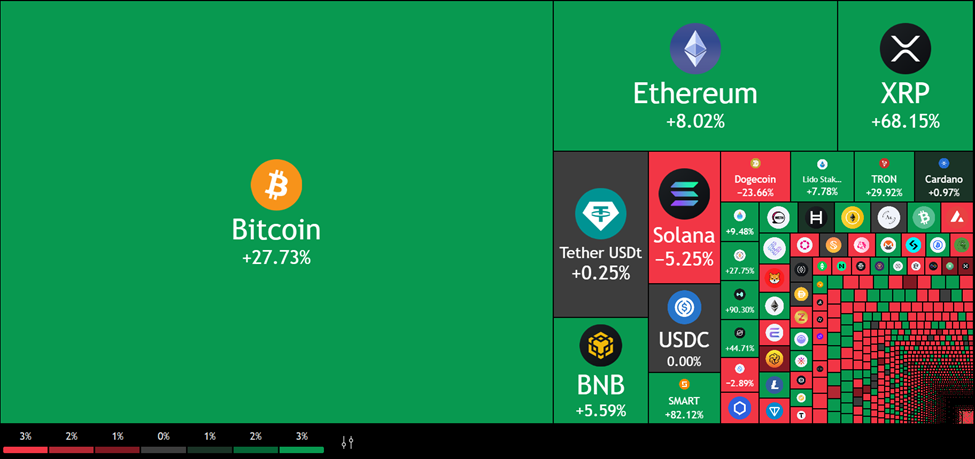

According to the Bitwise executive, this already happens, with the thermal card of the year at the beginning of the year (YTD) showing large markets of market capitalization outperforming small tokens.

The push of great capitalization cryptos like Bitcoin, Ethereum and XRP intervenes while investors promote regulatory clarity compared to risky altcoins.

In the fixed income markets, the titles on the race refer to assets recently issued and liquid. These assets, including the latest obligations of the US Treasury, are often negotiated with a bonus, as indicated by a recent publication of news from American crypto.

FNBs and institutional flows target

Hougan suggests that a similar structure emerges in the crypto, where high -level tokens like Bitcoin and Ethereum could control higher assessments and greater liquidity due to favorable regulatory treatment and institutional inclusion in ETF.

Indeed, since the beginning of 2025, the regulatory impulse in the United States has contributed to arouse institutional interest in digital assets with large capitalization, leaving smaller altcoins.

A recent American publication of Crypto News said that public companies growing Ethereum to new heights. This bifurcation can widen with the introduction of clearer registration standards and definitions at the federal level. Such a result would benefit tokens perceived as “security of regulation”.

After concluding its longtime case with the American sec, the Ripple XRP could well hold in this fold.

The position of the Senate on these bills remains uncertain. Notwithstanding, the industry leaders consider the passage of the chamber as a significant step towards unlocking wider capital flows and traditional adoption.

“… He laid the foundations for institutional quality cryptographic finance,” wrote a user in an article.

The Clarity Act could become a basis for the future development of crypto products, the expansion of ETFs and the evaluation models which reflect the tradfi instruments if they were adopted.

Graphic of the day

This graph shows the daily performance of the prices of major cryptocurrencies, with Bitcoin, Ethereum, XRP and Dogecoin gains. Meanwhile, the smaller capitalization tokens have mixed or sub-performative movements across the market.

Alpha the size of an byte

Here is a summary of more news from crypto in the United States to follow today:

Presentation of the actions of the crypto-actions

| Business | At the end of July 17 | Preview before the market |

| Strategy (MSTR) | $ 451.34 | $ 452.07 (+ 0.16%) |

| Coinbase Global (Coin) | $ 410.75 | $ 419.36 (+ 2.10%) |

| Galaxy Digital Holdings (GLXY) | $ 26.04 | $ 28.84 (+ 10.75%) |

| Mara Holdings (Mara) | $ 19.97 | $ 20.10 (+ 0.65%) |

| Riot platforms (riot) | $ 13.33 | $ 13.44 (+ 0.83%) |

| Core Scientific (Corz) | $ 13.47 | $ 13.52 (+ 0.37%) |

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.