Corporate Treasuries Lead Bitcoin Accumulation Over ETFs in Q2

Public companies take a more aggressive position on Bitcoin (BTC) than even the funds (ETF) negotiated on the stock market. For the third consecutive quarter, they acquired more BTC than the ETF in T2 2025.

The trend indicates a broader strategic change between business treasury bills to adopt Bitcoin as a balance sheet active.

Corporate treasure bills take the lead in the accumulation of bitcoin

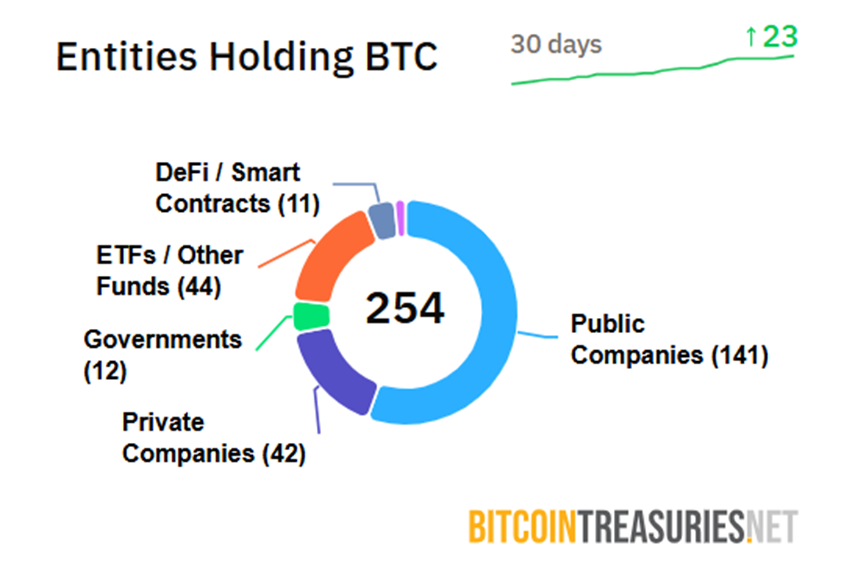

Barely a month ago, Beincrypto reported that more than 60 companies followed the Bitcoin game book from Microstrategy, the report before the end of the second quarter (Q2).

Based on the latest conclusions, public companies continue to maintain the Microstrategy game book, gradually managing the strategy in a friendly American regulatory environment.

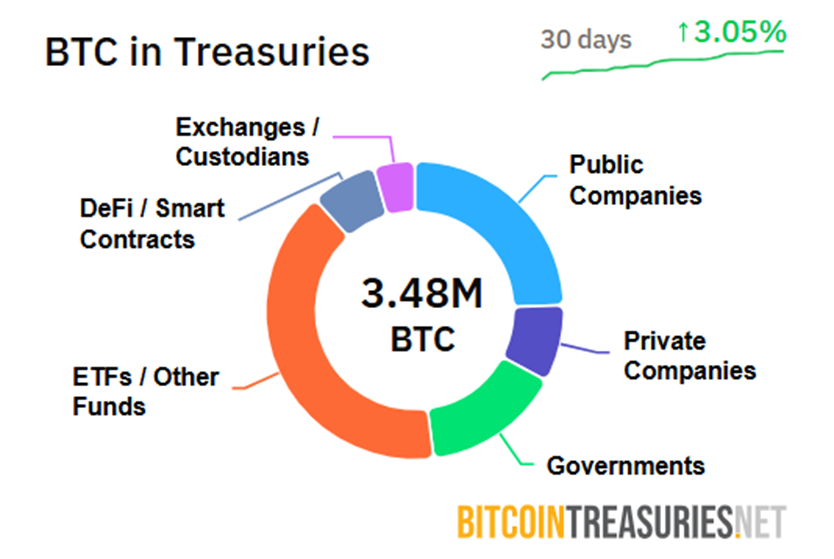

According to Bitcoin vouchers, public companies increased their BTC assets by around 18% in the second quarter, adding around 131,000 BTC.

The funds negotiated on the stock market, in comparison, despite their popularity since the wave of US Bitcoin ETF approval in January 2024, have expanded their assets only 8%, or around 111,000 BTC, during the same period.

The trend marks a clear divergence in the behavior of buyers. While ETFs generally serve investors looking for an exposure to Bitcoin prices through regulated financial products, public enterprises acquire BTC with a longer -term strategic state of mind.

They aim to increase the value of shareholders by maintaining the BTC as a reserve asset or to acquire an exposure to what many consider digital gold.

This change is particularly important in the context of American policy. Since the re -election of President Donald Trump, the regulatory environment has moved to cryptographic industry.

In March, Trump signed an executive decree establishing an American Bitcoin reserve. This symbolic but powerful decision eliminated a large part of the risk of reputation associated with the corporate BTC holdings.

The last time the ETFs exceeded the companies of the BTC acquisition was in the third quarter of 2024, before the return of Trump.

New corporate entrants report a broader adoption of the Bitcoin Treasury Strategy

This overvoltage of T2 included high -level movements, including Gamesop. The electronics company, once at the Center for Retail Trade Frenzies, began to accumulate BTC after having approved it as a treasure reserve ratio in March.

Likewise, the Knilymd health company merged with Nakamoto, an investment company in Bitcoin founded by the lawyer of the crypto David Bailey.

Meanwhile, Procap, Anthony Poseliano’s new investment vehicle, announced its own BTC accumulation strategy while preparing to become public via SPAC.

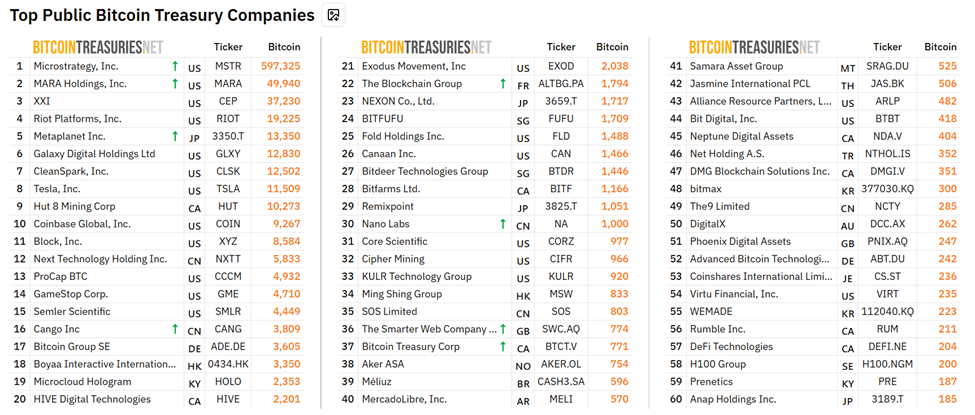

Nevertheless, the strategy (formerly Microstrategy) remains the undisputed leader in the Bitcoin de corporate race with 597,325 BTC under management. Mara Holdings follows, holding 49,940 pieces.

Combined public companies now hold around 855,000 BTC, or around 4% of the Bitcoin fixed supply ceiling of 21 million.

FNBs are always more in absolute terms (around 1.4 million BTC or 6.8%), but the corporate purchasing momentum was stronger in the last quarters.

Although the long -term sustainability of the rush to corporate bitcoin is ready to debate, the short -term momentum is undoubtedly.

As Bitcoin becomes more standardized, traditional institutional investors can bypass proxys such as Treasury ETFs, which ends up acquiring direct exposure through regulated channels. However, business treasury bills act as a new powerful mechanism to advance Bitcoin.

The regulatory climate Aligné and the stock markets offering new ways to access capital, companies take advantage of their balance sheets not only to cover themselves, but to outperform.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.