Crypto ETF Exodus: Record Outflows Signal End of Q2 Rally?

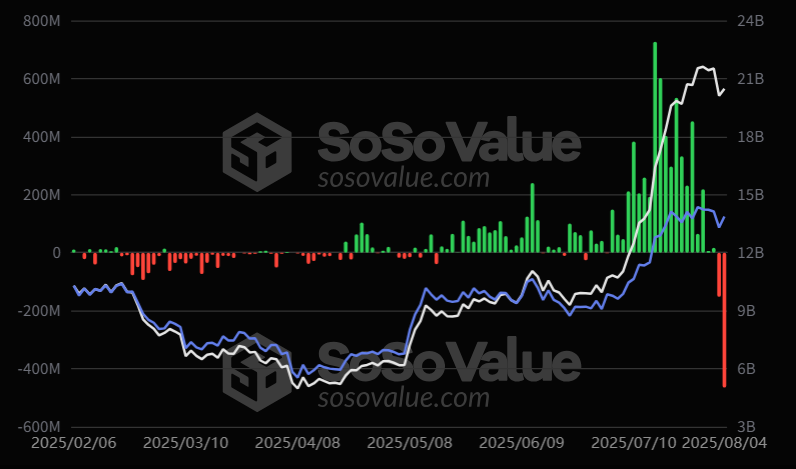

US SPOT ETF The entries – A key engine behind the Bitcoin and the Ethereum Q2 rally – are strongly reversed.

On Monday, the FNB Bitcoin and Ethereum ETHEREs underwent record outings of $ 333 million and $ 465 million, respectively.

The biggest outing of all time from ETF ETF ETF

According to the Crypto Sosovalue Crypto Data Platform, the US Spot FNB Bitcoin had a net output of $ 333.19 million.

In particular, Blackrock’s Ibit, the largest ETF Spot -Holding Bitcoin, recorded a net output of $ 292.21 million – the largest since May 30. Ibit has been the highest Bitcoin prices, buyers in the past two months during market slowdowns.

The situation was even worse for us, the Etf Ethereum. Total net outings have reached $ 465.1 million, the largest since the launch of these products in July 2024. This ends its entry sequence of 21 days and reduced 3% of its Holshot of ETH.

Despite record outings, Bitcoin and Ethereum increased by 1% and 5% respectively, supported by a rebound in the three main American stock markets that day.

The request of the ETFs, alongside institutional purchases, was a key factor in the Crypto Q2 rally. We do not know if the output trend will continue the next day or the week. If FNB entries continue to slow down, however, the two largest cryptocurrencies could cope with increasing drop in the coming weeks.

Investors are confused because the markets seemed to stabilize as soon as the US employment data on last week shock.

According to Fedwatch, a tool for predicting the CME group rate, the probability of a drop in the Fed rate in September increased to 95%. Goldman Sachs expects the federal reserve to lower rates three times in a row from September.

Trump is expected to announce a new member of the Federal Reserve Board of Directors and the next head of the Bureau of Labor Statistics (BLS) later this week.

The Post Crypto ETF ETF: Save the End signal outputs from the Q2 rally? appeared first on Beincrypto.