Crypto Inflows Hit $286 Million as Ethereum Dominates Demand

Ethereum (ETH) Investment Products has recorded its sequence of the highest in six weeks since December 2024. With this influx, crypto entries reached $ 286 million last week.

The new capital brings the total of seven-week entries to a remarkable $ 10.9 billion, signaling a renewal of the optimism of investors despite macroeconomic uncertainty and regulatory tensions in the United States.

Ethereum dominates crypto entries

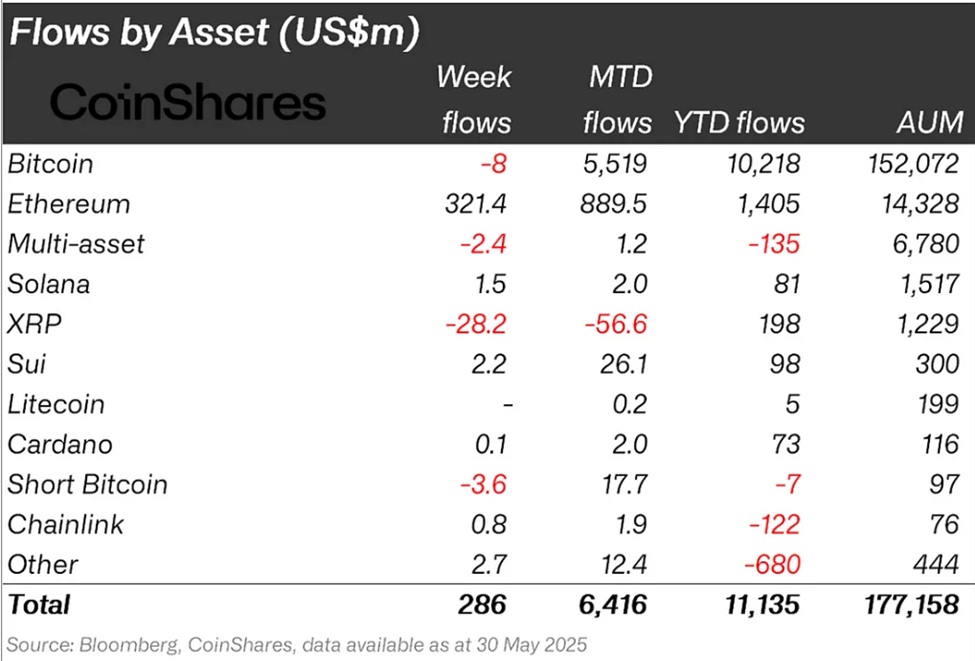

According to the latest Coinshares report, Ethereum represented $ 321 million in crypto entries last week. With this, the second largest Altcoin on market capitalization measures achieved the largest week -long gain in 2025.

This comes in the growing confidence of investors in the giant of intelligent contracts. This momentum follows six consecutive weeks of entries totaling $ 1.19 billion.

While Ethereum jumped, the Bitcoin trajectory flicker. The crypto pioneer initially saw strong entrances at the start of the week, but the feeling turned after a federal court ruled illegal American rates, contributing to macro-motivated volatility.

“The assertion by the president of the authority of the prices in this case, unlimited, as by any limitation of duration or scope, goes beyond any tariff authority delegated to the president under the ieepa”, determined the judges.

Bitcoin Products ended the week with $ 8 million in outings, marking the first drop after six weeks of intrigue which brought in $ 9.6 billion. Other altcoins have shown mixed results. XRP underwent its second consecutive week of outings, losing $ 28.2 million.

According to Butterfill, this is referring to a story to weaken investors in the middle of the continuous regulatory ambiguity.

At the regional level, the United States has remained the largest contributor to entries with $ 199 million, but market interests are visibly diversified. Hong Kong has displayed its strongest entries ($ 54.8 million) since its launch just over a year ago.

Despite the impressive launched ignition sequence, the total assets under management (AUM) for Crypto investment products fell to $ 177 billion. This indicates a correction, against a peak of $ 187 billion, the Coinshares report citing short -term price weakness on the main tokens.

In particular, the entries last week followed a record period. Two weeks ago, crypto entries reached $ 3.3 billion, the highest annual total. As Beincrypto reported, it took place in the midst of fears of the fragility of the American market after Moody has downgraded the prospects of American credit.

ETH newspapers have been the best sequences since 2024 in the midst of the hopes of the pectra and ETF Élan

Optimism can be STII will drive high after the successful upgrade of Ethereum Pectra in May, which improved the effectiveness of implementation and long -term scalability.

Beincrypto recently pointed out that Pectra upgrade had seen Ethereum entries with $ 205 million during the week ending on May 17, the fork resulting in a change of feeling.

“Ethereum was the out-of-competition interpreter, with $ 205 million on entry last week and $ 575 million YTD, indicating a renewal of investors optimism after Pectra’s successful upgrade and the appointment of the new Co-Executive Director Tomasz Stańczak,” said Butterfill at the time.

Institutional interests also seem to increase, with reports that surface that Blackrock is preparing for the dry of the United States (Securities and Exchange Commission) to approve an Ethereum ignition ETF in the next two weeks.

“Blackrock would have put pressure on the dry to approve the FNB Eth Slake in the next two weeks. If that happens, Ethereum could teleport directly to $ 12,000,” noté Coinvo, a merchant and founder of Crypto.

Such development could considerably increase traditional adoption. The addition of fuel to the Haussier d’Ethereum story is the supply of falling exchange. The data on the chain reveal that Ethereum exchange sales are now at their lowest levels in seven years,

“The ETH provides an incoming shock. Ethereum’s exchange balances collapse, now at their lowest levels in 7 years, ”noted Coin Bureau.

This suggests a tightening of liquid supply as long -term holders accumulate.

With Ethereum leading the entries, the increased institutional appetite and the supply of supply of the supply, the configuration suggests a potential escape scenario. However, this can be subject to the regulatory alignment of the rear winds.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.