Crypto Inflows Return with $644 Million Boost, Bitcoin Leads

The market is experiencing a renewal of optimism because crypto entries reached $ 644 million last week.

This is an important reversal after five consecutive weeks of outings, suggesting a notable change in the feeling of investors.

Crypto entries reach $ 644 million, the market feeling is recovered

The rebound follows a difficult period during which the feeling of investors remained cautious, causing substantial withdrawal from the market. With a total asset under management (AUM) increasing by 6.3% since March 10, the latest data suggests a decisive change in market confidence.

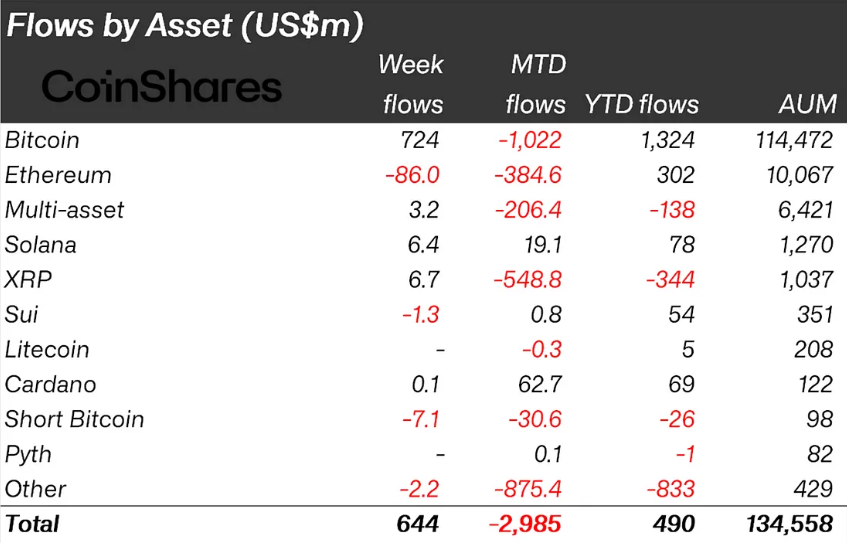

According to the latest Coinshares report, Bitcoin has become the main engine of the market resumption. The crypto pioneer attracted $ 724 million in entries, effectively putting a five -week exit sequence totaling $ 5.4 billion.

The sharp increase in entries reflects the growing confidence of investors in Bitcoin, which had previously experienced supported withdrawals in a broader uncertainty of the market. While Bitcoin experienced a strong recovery, the Altcoin market experienced a mixed performance.

Ethereum faced the heaviest outings, with $ 86 million out of the asset. On the other hand, Solana recorded $ 6.4 million in entries.

The divergence in the feeling of Altcoin stresses that investors remain selective on the place where they distribute the capital. More specifically, they focus on projects with solid fundamentals perceived. Although the data indicates continuous prudence of investors concerning Ethereum (ETH), this also indicates that investors see a strong potential of Solana (soil).

Meanwhile, most of last week’s signation in the United States, which has seen $ 632 million entering digital asset investment products.

Reverse the negative trend of February

The return to entries follows a difficult February and early March, during which crypto outings increased. A week earlier, crypto outings totaled $ 1.7 billion, Bitcoin exceeding the worst withdrawals.

Before that, the outings reached $ 876 million, led by American investors discharging digital assets in the middle of a downward trend. Consequently, the last influx of capital suggests that the feeling can be turned, possibly motivated by a renewed institutional interest and a more stable macroeconomic perspective.

Strengthening the market rebound, the Bitcoin ETF (negotiated funds on the stock market) have also experienced a strong capital of capital. After five consecutive weeks of outings, Bitcoin ETF recorded $ 744 million in entries last week. This indicates increased institutional participation.

The recovery is aligned with the broader market resurgence of Bitcoin and suggests that investors regain confidence in crypto -based financial products.

“I bet BTC reaches $ 110,000 before it hates $ 76,500. For what? The Fed goes from QT to Qe for treasury bills. And prices do not matter because of transient inflation, ”wrote the founder of Bitmex Arthur Hayes.

Meanwhile, Beincryptto data show that BTC was negotiated at $ 87,720 when writing this article. This represents a overvoltage of almost 4% in the last 24 hours, the crypto pioneer regularly praising the psychological level of $ 90,000.

“Bitcoin exceeded $ 87,000 on Monday, its highest since March 7, after having dived at $ 76,000 earlier this month. The rally intervenes when the reports suggest that the Trump prices to come, fixed for April 2, will be more targeted and less disruptive than fearing,” observed the expert in finance Walter Bloomberg.

Trump prices to come, scheduled for April 2 and nicknamed “Liberation Day”, should be less disruptive than expected. This could strengthen investor confidence in risky assets such as Bitcoin. The plan of the White House for reciprocal prices aims to equalize commercial barriers, Trump not emphasizing any exceptions but offering “flexibility” not specified for certain nations.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.