Crypto Market Slips as FOMC Meeting and FED Interest Rate Decision Loom

The crucial meeting of the Federal Open Market Committee is expected to be organized on Tuesday and Wednesday. In a recent speech, the President of the United States Fed, Jerome Powell, suggested that the organization would adopt a wait-and-see approach on interest rates, citing the pandemonium created in the American economic landscape by newly introduced economic policies, in particular the aggressive tariff policy. Uncertainty is looking at the American markets. Crypto investors reacted to market uncertainties. In the past 24 hours, the cryptocurrency market experienced a decrease of 3.1%. Bitcoin dropped by 1.7% and Ethereum by 2.3%. Let’s dive for more details!

Bitcoin and Ethereum Drop

Yesterday, the Bitcoin market showed a severe decrease by one day of 2.09%. At the time of the fence on March 16, the price was $ 82,577. 24. In the last 24 hours only, the BTC market fell by 1.9%. Currently, the BTC price is 82,888.44 – at least 0.37% above yesterday’s fence.

Yesterday, the Ethereum market increased from around $ 1,935.77 to $ 1,886.92, marking a severe decrease of a day of 2.52%. In the past 24 hours only, the ETH market has dropped 2.4%. Currently, the price of the ETH remains at $ 1,888.69 – slightly above yesterday’s fence price.

Experts believe that the sharp decline in the feeling of the market during the last weekend was due to economic and regulatory concerns.

Us Stock Futures & Federal Reserve Impact

At this week’s FOMC meeting, the Fed is less likely to modify interest rates. Currently, the rate of federal funds remains within a range of 4.25% to 4.5%.

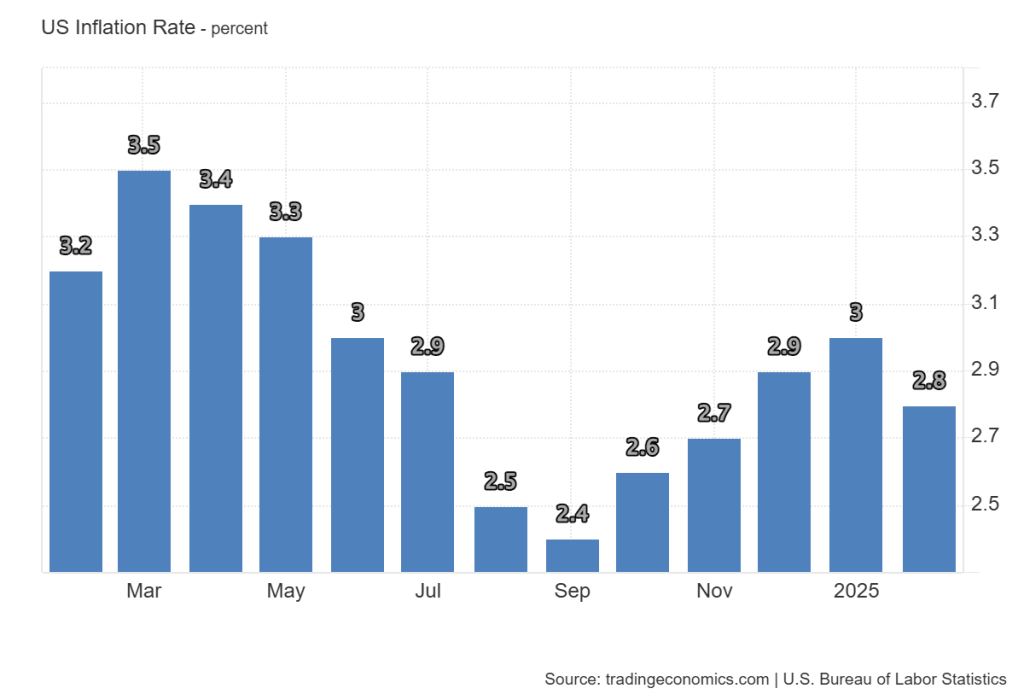

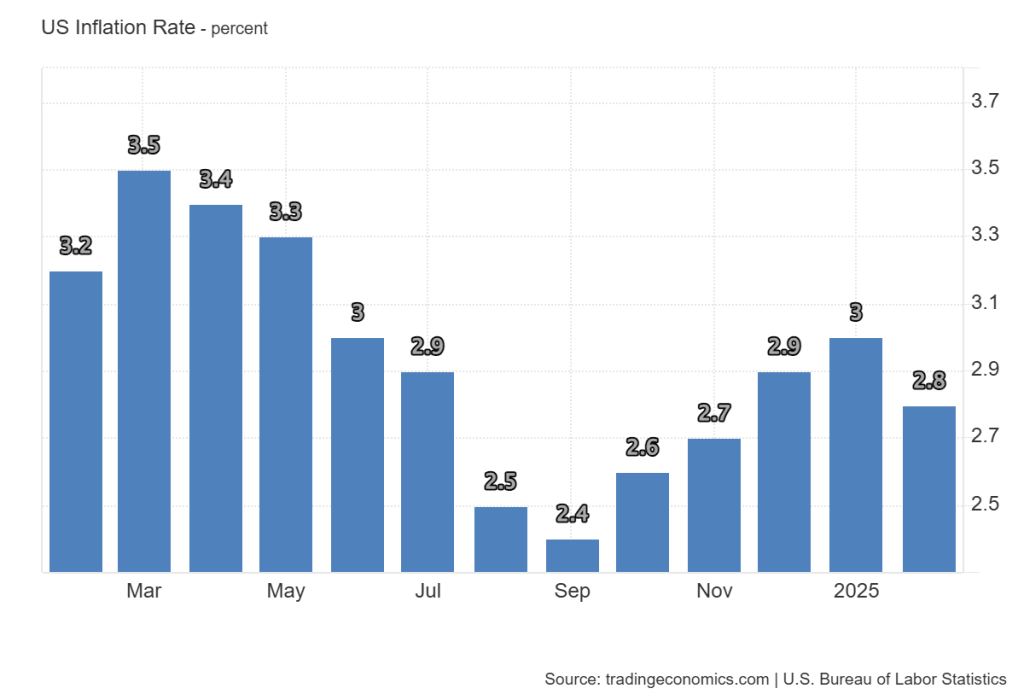

In February, the American inflation rate increased from 3% to 2.8%. According to Teforcast, it should fall to 2.5% in March.

US President Donald Trump

Donald Trump Donald Trump is a former politician, businessman and American media personality, who was the 45th President of the United States between 2017 and 2021. Trump obtained a baccalaureate in economics in the University of Pennsylvania in 1968. Trump Hillary Clinton as losing republican popular vote. As president, Trump ordered the ban on traveling to citizens in several Muslim majority countries, has diverted military funding towards the construction of a wall on the American-Mexican border and has implemented a policy of separation of families. Trump has remained an eminent figure of the Republican Party and is considered a probable candidate for the 2024 presidential election President Import prices recently imposed on China, Mexico and Canada. He has already announced his intention to expand the scope of his aggressive pricing policy.

Donald Trump Donald Trump is a former politician, businessman and American media personality, who was the 45th President of the United States between 2017 and 2021. Trump obtained a baccalaureate in economics in the University of Pennsylvania in 1968. Trump Hillary Clinton as losing republican popular vote. As president, Trump ordered the ban on traveling to citizens in several Muslim majority countries, has diverted military funding towards the construction of a wall on the American-Mexican border and has implemented a policy of separation of families. Trump has remained an eminent figure of the Republican Party and is considered a probable candidate for the 2024 presidential election President Import prices recently imposed on China, Mexico and Canada. He has already announced his intention to expand the scope of his aggressive pricing policy.

Many believe that the Fed is unlikely to make a decision on interest rates until the American economy completely absorbs the impact of the aggressive tariff policy.

There is a chance that pricing policy will increase inflation on the American market.

Uncertainty is looming in the American markets. Dow Jones, S&P 500 and Nasdaq Future composite decreased, reporting a careful feeling for investors.

- Read also:

- Key economic events in the United States this week: how they could have an impact on cryptographic markets

- ,,

Cryptographic derivatives and market trends

The cryptocurrency market has dropped 3.1% in the last 24 hours. During the period, almost all the upper cryptos experienced decreases. Bitcoin dropped by 1.9%, Ethereum by 2.4%, XRP by 1.9%, Solana of 4.6%and cardano by 3%.

The reports indicate that the lever effect remains high in the Crypto term markets despite $ 253 million in liquidations in the last 24 hours.

The funding rates stabilized in neutral, showing a mixed feeling on the market.

In conclusion, crypto traders are looking for a catalyst, such as the Fed’s political decision or an institutional investment signal, to determine the next market management.

Never miss a beat in the world of cryptography!

Stay in advance with the news, expert analysis and real -time updates on the latest Bitcoin, Altcoins, DEFI, NFTS, etc. trends