Ethereum Whale Sell-off 20,000 ETH, Traders’ Eyes on $2,200

In the midst of the uncertainty of the current market, cryptocurrencies seem uncomfortable, as evidenced by their recent actions. On February 14, 2025, the Blockchain Lookonchain Transaction Tracker shared an article on X (formerly Twitter) revealing that a giant whale had poured 20,000 Ethereum (ETH), worth $ 52.84 million in Kraken Crypto-Monny Exchange.

Whales pour 20,000 Ethereum (ETH)

With this dumping ground, the whale currently has 50,874 ETH worth $ 134.80 million. However, looking at the post, it seems that it is not the first time that this whale has thrown Eth. The most recent discharge was noted on January 16, 2025, when Kraken witnessed a sale of 20,000 ETH worth $ 67.60 million.

https://twitter.com/lookonchain/status/1890047743273623629

On the cryptocurrency market, such a emptying of any active has the potential to create sales pressure and reduce prices.

Price momentum ether

However, Ether’s price seems to be affected because it is currently down 1.10% in the last 24 hours, negotiating near the level of $ 2,655. Coinmarketcap data reveal that this substantial dump, as well as the continuous feeling of the market, seems to have an impact on market players, resulting in a 10% drop in the volume of negotiation.

Currency lowering positions

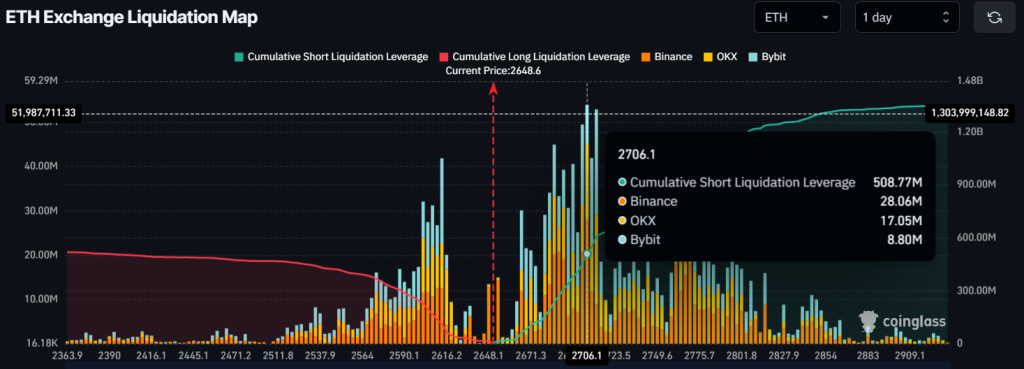

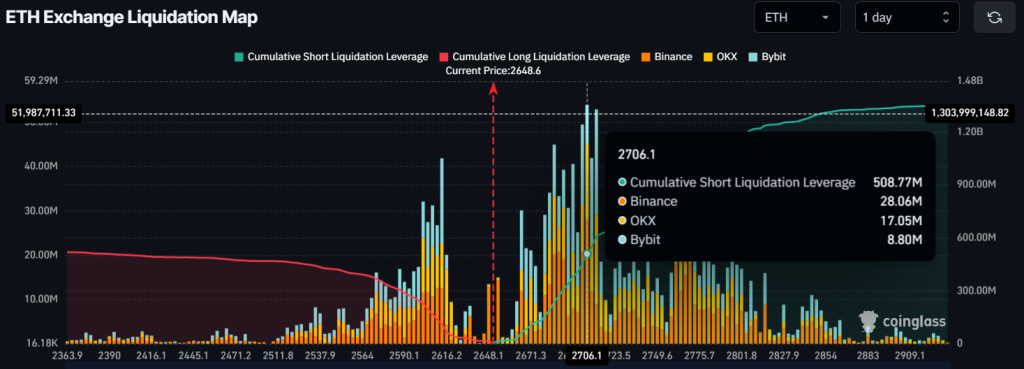

With this downward perspective, traders are betting strongly on the decline, believing that the price will not increase in the coming days, as reported by the Coinglass chain analysis company. Data from the ETH exchange liquidation card show that traders occupying short positions dominate the assets, with overexcreed positions at $ 2,700, totaling $ 510 million.

Meanwhile, merchants occupying long positions are over-leveled at $ 2,615, with $ 109 million in open positions. These long and short positions will be liquidated once the price will move in both directions.

During the combination of significant whales and traders’ discharge bets, it seems that bears are currently dominating, increasing the probability of a significant negative impact on the price of assets.

Ethereum (ETH) Action of upcoming prices and levels

According to an expert technical analysis, ETH is currently consolidating in a tight range at a level of crucial support close to $ 2,550.

Based on recent price action, if ETH holds this support, there is a strong possibility that the asset can increase. On the other hand, if ETH does not hold this level and closes a daily candle below $ 2,500, it could drop by 10% to reach the level of $ 2,220 in the near future.