Crypto Outflows Surge to Record $3B—What’s Driving the Selloff?

The cryptography market continues to deal with the sales pressure while digital asset investment products have recorded their largest weekly outings.

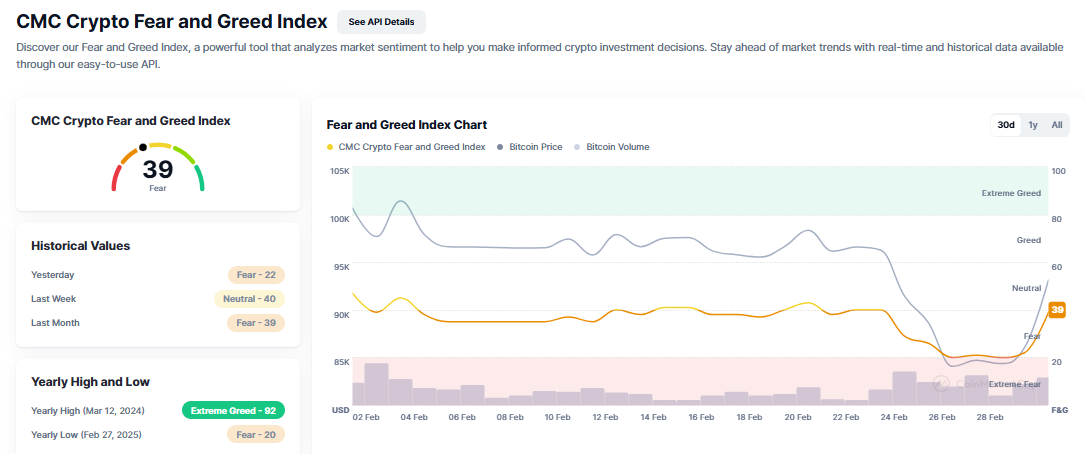

The feeling remains sour, the Bitcoin (BTC) barely holding above the psychological level of $ 90,000 despite the crypto reserve policy of President Donald Trump.

Cryptography outputs see new recordings

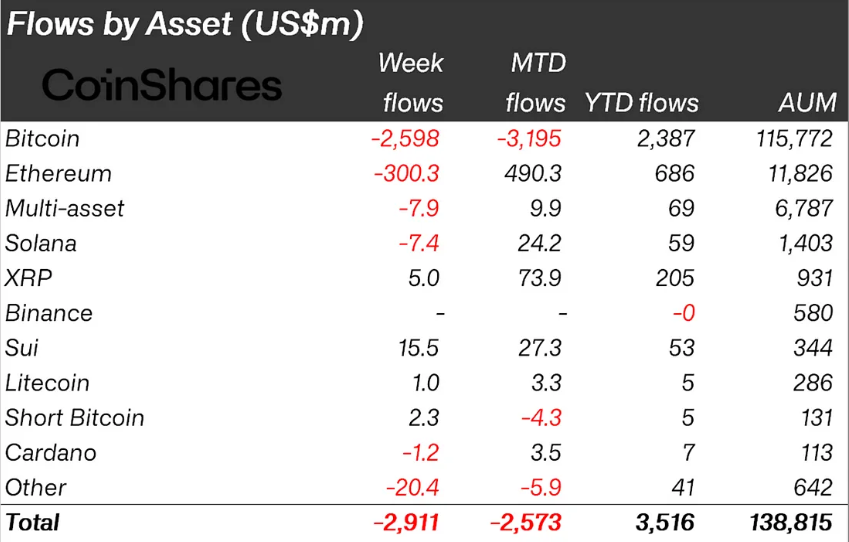

During last week, crypto outings reached $ 2.9 billion dollars, bringing the three -week total to $ 3.8 billion. This marks the third consecutive week of capital that emerging from the cryptography sector, and it is a striking contrast with the entry sequence of previous 19 weeks, which saw $ 29 billion paying on the market.

The latest Coinshares report attributes negative flows to weaken feeling in the cryptography market. He cites factors such as recent relay hacking among key factors contributing to mounting outings. Others include a more bellicist position of the federal reserve and wider macroeconomic concerns.

“We believe that several factors have contributed to this trend, including the recent hack Bybit, a more fellow federal reserve and the entry sequence of 19 previous weeks totaling $ 29 billion. These elements probably led to a mixture of feeling of profit and to weaken towards the asset class, “read an extract in the report.

As Beincrypto reported, the hack, which resulted in millions of stolen dollars, has shaken investors’ confidence. This strengthens fears about security vulnerabilities in cryptographic space. In addition, the latest comments from the Federal Reserve reported a prudent perspective on American inflation and GDP, leading to a broader uncertainty of the market and a drop in risk appetite.

In this context, the researcher from Coinshares, James Butterfill, highlights Bitcoin as the hardest part by the lowering feeling, experiencing outings of $ 2.59 billion last week. Ethereum also suffered, recording its highest weekly outings at $ 300 million. Other major altcoins have followed suit, Solana with $ 7.4 million outings.

Nevertheless, short Bitcoin positions have seen minor entries totaling $ 2.3 million, suggesting that some investors position themselves for more decline.

Despite the overall negative feeling, some digital assets have seen entries. Suis has become the best performer, attracting $ 15.5 million, while XRP followed $ 5 million in entries. These gains suggest that if the wider market is under pressure, some projects continue to arouse interest in investors.

For XRP, the feeling remains optimistic, led by the growing anticipation of an American DEC decision (Securities and Exchange Commission) on an XRP ETF. The deadline for the SEC approves or rejects certain ETF applications began. Investors hope that XRP will obtain regulatory clarity. Including XRP in Trump’s crypto reserve in the United States could improve this feeling.

Notwithstanding, the latest series of outings follows a worrying trend developed in recent months. The previous week has seen crypto outings of $ 508 million, more exacerbating investor fears. Before that, the bellicist rhetoric of the federal reserve and the data on the consumer price index (IPC) had already triggered the first crypto outings of 2025, with 415 million dollars that came out of the market.

This series has led some analysts to highlight the macroeconomic factors as the main engine of the sale, the feeling of investors always showing fear.

However, others argue that external policies such as President Donald Trump’s prices have contributed to the uncertain market environment, attaching fears of inflation and making risks like the crypto less attractive.

A competing perspective suggests that structural changes, including trading species and strategies, can contribute to the recent Bitcoin volatility.

When writing these lines, Bitcoin was traded at $ 93,095, up more than 8% since the opening of the session on Monday.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.