Crypto traders split on BTC’s next move: $88K breakout or $65K reset?

Bitcoin failed to exceed the resistance of $ 85,000 because the market remains without bull catalysts.

Since April 13, the flagship cryptocurrency has been negotiated in a narrow range of $ 83,000 and $ 85,000, with a price action awarded with a mixture of macroeconomic factors.

During writing, the weekly Bitcoin gains amounted to just over 4% while its market capitalization oscillated around 1.6 Billion of dollars.

What holds Bitcoin?

Copy the link to the section

This week, several lowering forces came into play, which prompted investors to adopt a more cautious position.

This is obvious from the index for fear of cryptography and greed, which hovers near the lower end of the fear zone at 30 years, at the time of the press.

A key factor weighing on feeling is the renewed geopolitical tension between the United States and China.

On Wednesday, the markets became opposed to the risk after the Trump administration introduced new borders on the exports of Nvidia fleas to China.

The move has shook global actions and fueled the fears of another escalation in commercial prices, resulting in the technological sector and the larger risk assets.

Adding to uncertainty, reports have surfaced that Chinese authorities can liquidate Bitcoin confiscated through offshore exchanges.

Although not confirmed, these reports tend to scare investors and added additional pressure to an already fragile feeling of cryptography.

No more pain followed because the president of the American federal reserve Jerome Powell reported a more bellicist position than the markets had provided it.

During his speech on April 16, Powell said the Fed was not in a hurry to reduce interest rates, strengthening an “waiting” approach in the midst of increasing economic uncertainty.

His remarks have further reduced the feeling of investors, especially after reporting the inflationary risks posed by the newly announced prices of President Trump.

Powell warned that the extent of the pricing increases was “significantly larger than expected” and could probably lead to “higher inflation and slower growth”.

What is the next step for Bitcoin?

Copy the link to the section

With a restrictive monetary policy likely to remain in place longer, the markets have had few reasons to return to risk mode.

For Bitcoin, this means a continuous removal around key resistance levels, as traders weigh broader economic perspectives before taking more exposure.

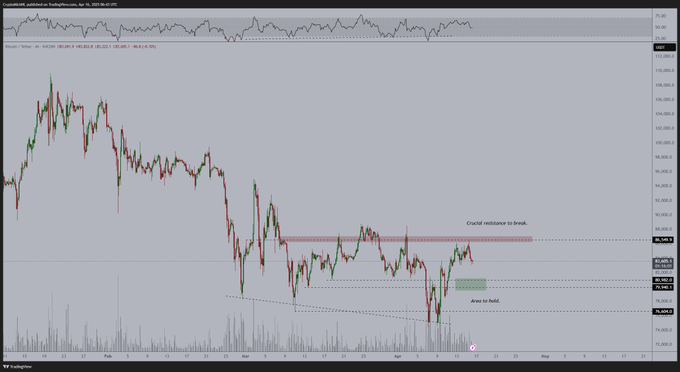

Technically, Bitcoin must return the resistance of $ 86,000 to support to revive the optimistic momentum to $ 90,000 and beyond.

According to market experts, BTC must first recover the EMA of 200 days at $ 87,740, a level it lost on March 9 for the first time since August 2024.

Declining, not recovering key levels opens the door to more pain. Bears are likely to defend the bar of $ 86,000 aggressively, potentially pushing the BTC below $ 80,000.

According to the founder of MN Capital, Michael Van de Poppe, the loss of this key medium could trigger the drop more, the prices likely to slide towards the range from $ 74,400 to $ 76,600, the last defense line before a deeper correction.

#Bitcoin is still stuck in the range, and as long as it remains above $ 80,000, I think everything will be fine with a higher momentum on it.

Additional weakness can even trigger a retest of the American school day at $ 67,817, erasing the earnings of the so-called “Trump pump”.

According to analyst James Check, the real low for Bitcoin is around $ 65,000 based on the average cost of active investors and a key long -term support area.

This represents the basis of the average cost of active investors, essentially reflecting the price at which most market players have acquired their BTC. As such, it serves as a critical long -term support area.

“$ 75,000 is the place where the bulls must defend. Otherwise, we return to Chop-and the flag of this sea of sand is $ 65,000,” he added.

A drop at $ 65,000 could restart the Haussier rally

Copy the link to the section

However, according to some, a correction towards the fork of $ 60,000 could be Shakeout’s Bitcoin to reset the feeling and feed the next leg.

Trader Altstein, for example, shared a counter-current view suggesting that a drop in the region from $ 69,000 to $ 65,000 could precede a renewed bull phase which could possibly send BTC up to $ 150,000.

BTC / USD Weekly Chart. Source: Altstein

While the objective of $ 150,000 may seem ambitious, the idea of a healthy correction before continuation aligns with wider market cycles.

Historically, Bitcoin has often revisited the main basic levels of the cost during periods of macro uncertainty before staging strong recovery.

Such a scenario would also line up with the underlying dynamics of the offer that are currently developing on the market.

Crypto data show that Bitcoin reserves on exchanges have continued to dive, now seated near multi -year stockings.

Historically, such conditions have preceded the main price rallies, in particular when associated with an increase in demand or a change of feeling of investors.

On the other hand, if Bitcoin avoids a deeper correction and maintains above the current support levels, the recent escape above the 2025 trend line could gain ground.

A fence greater than $ 88,000 would be the key, potentially preparing the field for a movement around $ 90,000 and beyond, as suggested by the pseudonym Crypto Caesar analyst in a recent post X.