Is Tether Dropping Its US Market Ambition for USDT?

Tether has published his certificate report for T2 2025, showing a spectacular reduction in bond purchases from the US Treasury. The company spent $ 7 billion for them in the last quarter, compared to $ 65 billion in the first quarter.

Although the company buys bitcoin and gold and makes investments in businesses, all its “cash equivalents”, such as bond buying agreements and non -American treasure bills, have barely increased or fell. This can complicate the conformity of genius acts.

Why didn’t the ties want treasury bills?

Tether, the largest stablecoin transmitter in the world, recently made very diverse investments. According to a recent report, the interest of the US Treasury obligations of the company allowed him to invest in more than 120 companies.

Today, Tether has published his T2 2025 certificate report, confirming a slight increase in treasure titles.

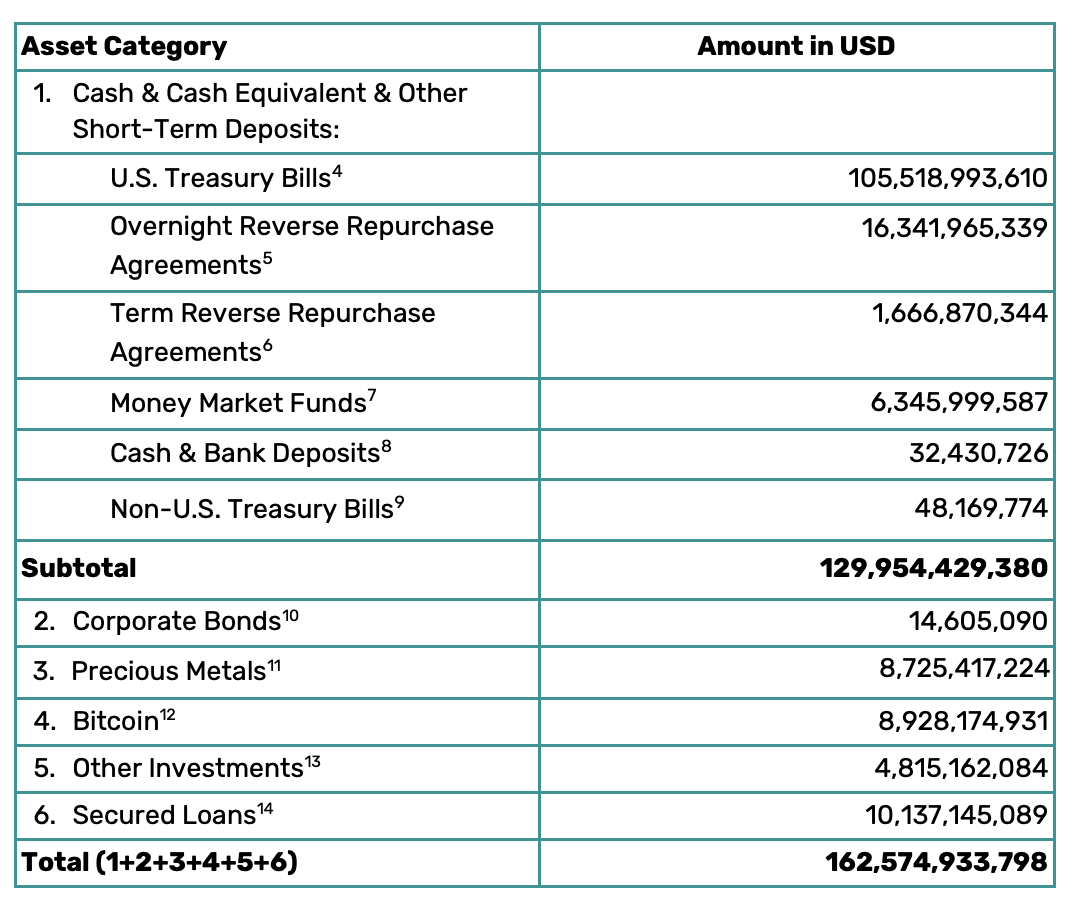

According to the report, Tether currently has $ 105.5 billion in US Treasury Bonnes and an additional $ 24.4 billion in indirect exposure. This includes inverted night redemption agreements and non -American treasury bills, which can refer to EU’s obligations for compliance with mica.

There is a simple reason why Tether has bought as many cash obligations: Stablecoin regulations. The law on engineering requires that stablecoin issuers have asset reserves in treasury bills, which can cause business problems.

However, the attachment was pressure to adopt this legislation, so it seems likely that it is ready to achieve conformity.

However, there is an interesting data element here. Since the Mica entered into force, Tether bought astronomical quantities of cash bonds.

In the fourth quarter of 2024, he bought $ 33 billion and added $ 65 billion in the first quarter of 2025.

Today’s report, however, shows an increase of $ 7 billion in direct treasures throughout the T2.

Tether’s non -American treasury assets have decreased by around 17 billion dollars, and all the other “cash equivalents” have dropped or increased by less than $ 1 billion.

Of course, the company bought gold, bitcoin and these investments in various companies, but its rampant hunger for treasury bills seems to shrink. Tether’s assets are increasing, but its strategy is changing.

We don’t know what to do with all of this. According to the post of CEO Paolo Ardoino, Tether has issued more than $ 50 billion in USDT tokens more than the corresponding American treasury bills. Couldn’t that cause problems with the conformity of the future genius of genius?

In the end, it is difficult to say if the potential emissions of the bond market have caused this change of tactic. It could be very important, however.

The post abandons its American market ambition for the USDT? appeared first on Beincrypto.

(@paoloardoino)

(@paoloardoino)