Trump Tariffs, XRP ETF, and More

This week, the cryptography market has recorded several important developments, American trade policies and lists of tokens with blockchain and regulatory advances. The strong points display how the global cryptocurial ecosystem continues to progress.

The following is a gathering of crucial developments that have occurred this week, but will continue to shape the sector.

Trump prices shake the world markets

US President Donald Trump sparked the global trade market earlier this week, offering prices against Canada, Mexico and China. This new series of commercial restrictions aimed to protect the national industries.

After the initial announcement, Canada and Mexico pushed, causing temporary delays in certain price requests. Mexico, in particular, obtained a short -term stay while the two nations entered new negotiations with the United States government.

“We had a good conversation with President Trump with great respect for our relationship and sovereignty; We have reached a series of agreements. Our teams will start working on two fronts today: security and trade. The prices will be interrupted in a month, “said Mexican president Claudia Sheinbaum on X (Twitter).

In this context, analysts observed the premium Bitcoin bitcoin index reaching a summit in 2025, indicating increased demand in North America. Investors seem to move to Bitcoin as coverage against possible economic instability caused by these commercial policies.

Meanwhile, China has retaliated, imposing a 10% price on American crude oil and agricultural machinery to exports to the United States. Although these fears revived from another prolonged trade war, some analysts argue that the last tariffs in China may not have an impact as serious as it was originally fearing it.

United Arab Emirates Shiba Inu

Beincryptto also pointed out that the United Arab Emirates (water) advanced its aggressive thrust to become a world leader in the adoption of web3. This week, Shiba Inu (Shib) was selected to join the blockchain in various government services. Partnership will facilitate blockchain -based solutions in the sectors, improving efficiency and safety.

“By adopting emerging technologies, we aim to define a global reference for innovation, to provide transformative solutions that benefit our citizens and the community in the broad sense”, its excellence in energy and under-secretary infrastructure In the United States at the Emirards Urbas Ministry of Energy and Infrastructure, said.

Beyond this collaboration, the United Arab Emirates remain one of the most user-friendly jurisdictions, reinforced by its fiscal exemption policy for digital asset companies. Without corporate taxes taken from cryptographic companies, the country attracts companies and world blockchain’s global talents, positioning itself as a pivotal player in the digital economy.

The price of Shiba Inu has briefly increased after the announcement. At the time of the press, the same piece was negotiated at $ 0.0000,1563.

Coinbase reflects two altcoins for the list

Coinbase, the largest American crypto exchange, added two new altcoins – ether.fi (ethfi) and Bittensor (TAO) – to its inscription roadmap. After the announcement, the values of the tokens increased by almost 40%, reflecting the typical price action observed when the assets gain visibility on major exchanges.

Historically, the tokens listed on Coinbase or Binance Exchange tend to attend a significant assessment of prices due to increased accessibility and liquidity. For example, the recent addition by Binance d’Altcoins fueled by AI has led to price peaks in the sector. Likewise, the Toshi token has climbed on the announcement of the Coinbase list.

Consultant of these participations, investors often monitor these registration announcements in an attempt calculated to capitalize on the expected gains.

Reallow of dry litigants

The United States Securities and Exchange Commission (SEC) has recently reassured one of its main arguments to the agency’s IT department. What was surprising, however, is that the litigant Jorge Tenreiro was essential in the high -level Ripple case (XRP).

Ripple was in a legal battle with the dry on the classification of XRP as security. Reallow suggests a possible change in regulatory concentration. More specifically, he fueled speculation that the dry could back from his aggressive approach to XRP. This also meant a possible imminent end in the longtime case.

Indeed, the Commission gave several clues that it will abandon the Ripple case. More recently, the SEC has completely deleted the trial of its website. Tenreiro’s reallocation to an unrelated to Crypto also suggests that the trial could end.

These changes follow the recent resignation of the former SEC president, Gary Gensler. In his place, the SEC Commissioner, Mark Uyeda, intervened as an acting president, potentially laying the bases of Paul Atkins.

UBS brings gold trading on the blockchain

Adding to the list of interesting things that happened in Crypto this week, UBS has unveiled a new initiative. Beincryptto reported that the Swiss banking giant has joined the gold trade with blockchain technology.

The bank has taken advantage of the Zksync Du Ethereum layer to facilitate secure and transparent gold transactions on the blockchain. This marks another important step in traditional finance (tradfi) adopting a technology of great decentralized book.

UBS movement could improve the effectiveness of gold markets. More specifically, it could provide a more accessible and verifiable way to exchange the precious metal.

While more and more financial institutions explore blockchain for the tokenization of assets, Ethereum continues to establish itself as a preferred platform for institutional adoption.

XRP ETF EYES SEC Approval

In another major development for XRP, CBOE Global Markets filed an application 19B -4 to the SEC – The exchange options provides for a negotiated XRP fund (XRP ETF). If it is approved, this would mark an important step for the institutional adoption of XRP.

The approval of XRP ETF would provide investors with a regulated and practical means of exposure to assets, which could increase the liquidity and price stability for the XRP token.

Given the current legal battle between Ripple and the SEC, the approval process should face a meticulous examination. Nevertheless, market players remain optimistic about a favorable result after the eviction of peopleler.

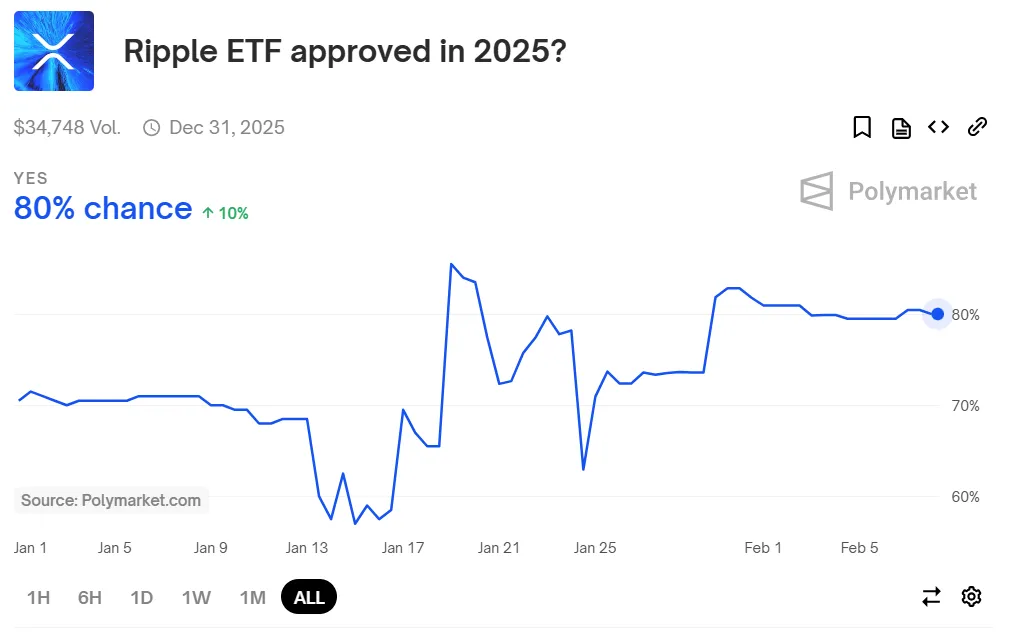

On the Polymarket prediction platform, the probability of an ETF XRP receiving approval in 2025 was surprisingly high. Chances were 80% notable at the time of this report.

Representation of microstrategys to the strategy

Microstrategy, one of the biggest Bitcoin companies holders, renamed this week, taking the nickname “strategy”. This decision is aligned with his commitment to the accumulation of Bitcoin and the adoption of blockchain technology.

“Strategy is one of the most powerful and positive words in human language. It also represents a simplification of the name of our company to its most important strategic nucleus. After 35 years, our new brand perfectly represents our continuation of perfection, ”explained the executive president of the company, Michael Saylor.

Under the direction of Michael Saylor, the company has always increased its Bitcoin titles, considering it as a long -term asset. The brand change strengthens its dedication to be taken advantage of Bitcoin for business treasures management and institutional investment strategies.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.