DeepSeek Turmoil Drains Liquidity—Crypto Inflows Take a Hit

Crypto entries experienced a significant slowdown last week, withdrawing $ 527 million in the midst of the volatile market feeling.

This marks a striking drop in entries in digital asset investment products compared to the following two weeks leading to the last.

Thickness in depth affects cryptography inputs

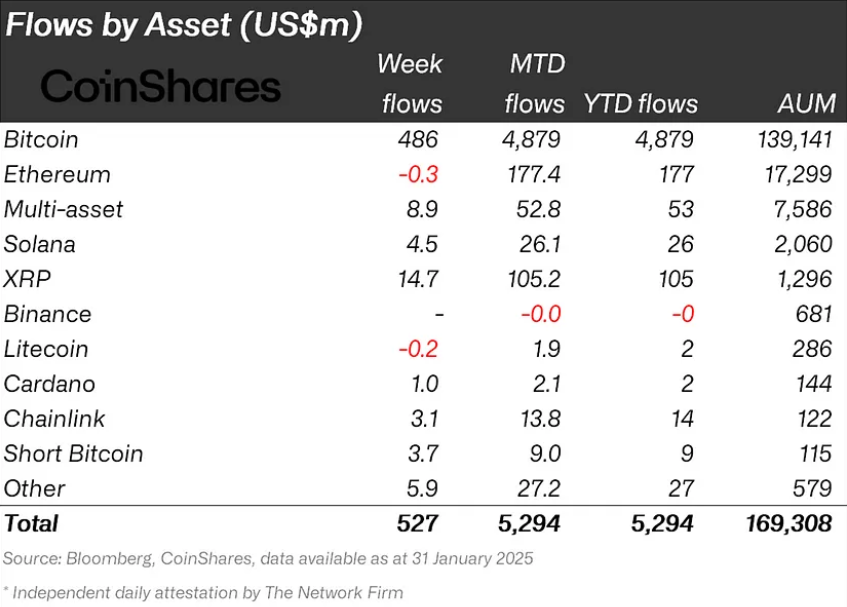

The latest Coinshares report indicates that crypto entries have only reached $ 527 million in the last week of January, reflecting the influence of larger trends on the feeling of investors. It marks a notable deviation from what has been seen in the previous weeks.

As Beincrypto reported, the two weeks leading to the last crypto entrances reached $ 1.9 billion and $ 2.2 billion respectively. James Butterfill de Coinshares attributes the retraction of crypto entrances to the media threw around Deepseek, the AI agent who recently aspired the liquidity of cryptographic and stock markets.

“Digital Asset Investment Products saw entries totaling $ 527 million last week. However, intra-nine flows reflect the volatile feeling of investors, strongly influenced by wider market concerns, such as The Deepseek News, which sparked $ 530 million in outings on Monday, “said an extract from the report.

The news on the Chinese AI platform sparked $ 530 million in outings on Monday. While the initial deeepseek frenzy led to a shortcut in crypto entries, the market rebounded later in the week. There were more than a billion dollars in entries. However, it was not enough to maintain the trend of entrances near the $ 2 billion mark, a threshold set in the second and third weeks of January.

Resilience to maintain positive flows suggests that, despite intermittent withdrawals, investors’ confidence in the cryptography sector remains relatively strong. Bitcoin (BTC) continued to attract the interests of investors, recording entries of $ 486 million last week.

A week ago, Euphoria linked to Deepseek led to $ 1 billion in cryptographic liquidations in one day. This exacerbated the dominant uncertainty of the industry. In addition, its impact extended beyond digital assets, wrapping stocks of cryptographic minors, actions linked to artificial intelligence such as Nvidia and AI tokens.

“Deep vibrations definitively shake things up,” said Emily, a popular user on X.

These remarks reflect generalized uncertainty permeating industry. However, the industry has seen signs of recovery, in particular among the AI agent parts, which have rebounded in response to the misfortune of Deepseek.

Beyond the setbacks induced by the depths, wider economic concerns, such as trade tensions and American job data, could influence the entries in digital asset investment products this week.

As BEINCRYPTO reported, trade tensions are pushing new prices from President Donald Trump have already caused more than $ 2 billion in liquidations. According to Coringlass data, more than 730,000 merchants were stunned out of the water Monday.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.