XRP Price Eyes Uptick as Network Activity Hits Monthly Low

The XRP price has not increased by 2% in the last seven days, fighting to maintain levels above $ 2.50 in recent days. Its market capitalization has now fell to 140 billion dollars, and its negotiation volume increased by 47% in the last 24 hours, reaching $ 5.6 billion.

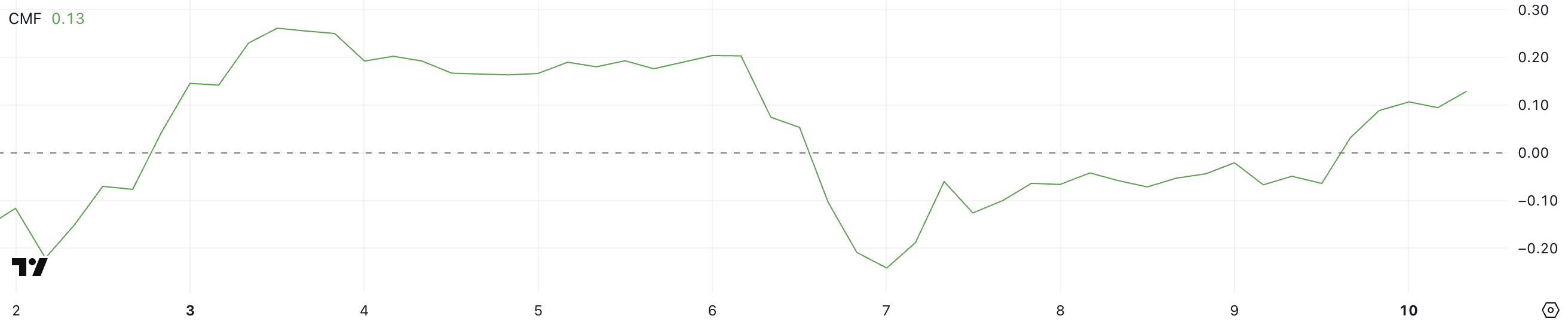

While the monetary flow of Chaikin (CMF) has become positive, indicating an increase in purchase pressure, the activity of the network has decreased. Meanwhile, XRP EMA lines always indicate a downward configuration, with traditional prices in a key range that could determine if it bounces around $ 3 or faces a 26%correction.

XRP CMF increases quickly

XRP Chaikin Money Flow (CMF) is currently at 0.13, a strong increase compared to -0.06 just a day ago. This quarter work marks a return to a positive territory after having remained negative for three consecutive days, indicating an increase in the purchase pressure.

A passage from the negative to the positive suggests that more money takes place in XRP rather than outside the outside, potentially signaling a renewal of the interest of buyers.

The CMF measures the weighted silver flow as a function of the volume in or outside an asset, ranging from -1 to 1. The values above 0 indicate an accumulation, while the negative values suggest the distribution.

With XRP CMF now at 0.13, the purchase of pressure has returned, which could support price stability or even increased movement if sustained. However, if CMF does not hold above zero, the sale pressure could resume, weakening the bullish momentum.

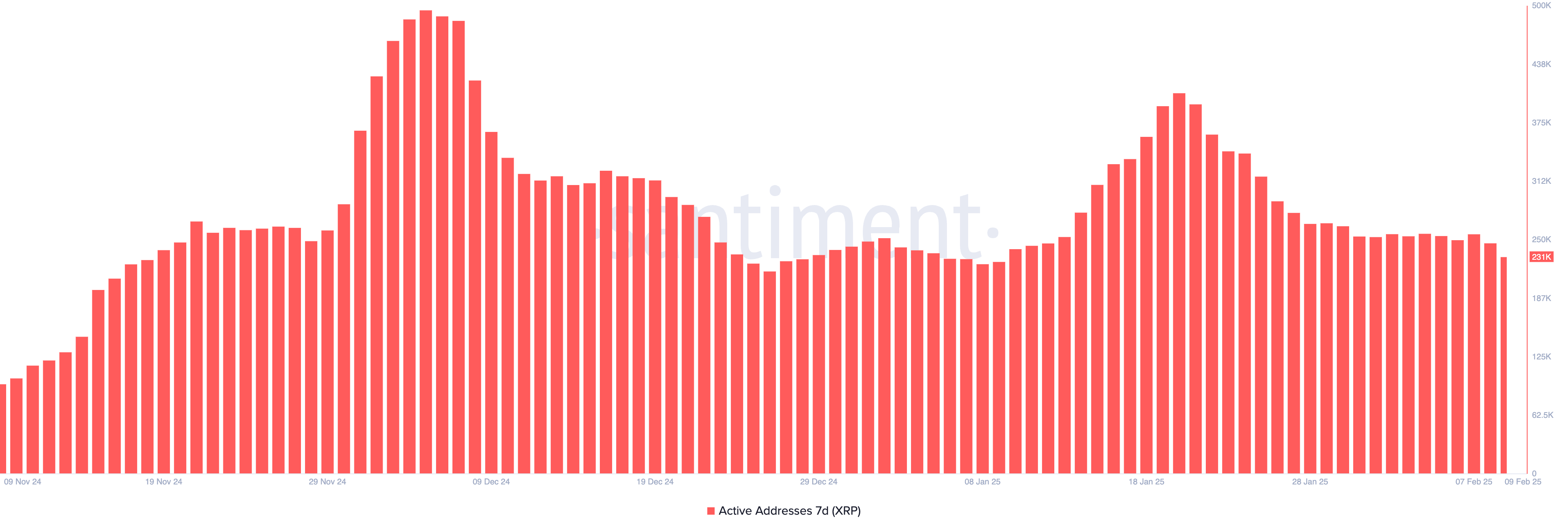

XRP active addresses simply have a month-long

Active 7 -day XRP addresses recently culminated at 495,000 on December 5, 2024, before decreasing. Another increase occurred in mid-January 2025, reaching 407,000 on January 20, but activity has regularly decreased since then.

The metric is currently at 231,000, marking its lowest point in a month. This decrease suggests a slowdown in network engagement, which could have implications for price movement.

The follow -up of active addresses is crucial because it reflects the participation of users and the overall demand for the assets. A sustained drop in active addresses often indicates a reduced transaction activity, which can lead to a lower liquidity and lower purchase pressure.

With active XRP addresses now to a monthly stocking, this suggests that it is decreasing, which potentially limits price growth unless the activity is backing again.

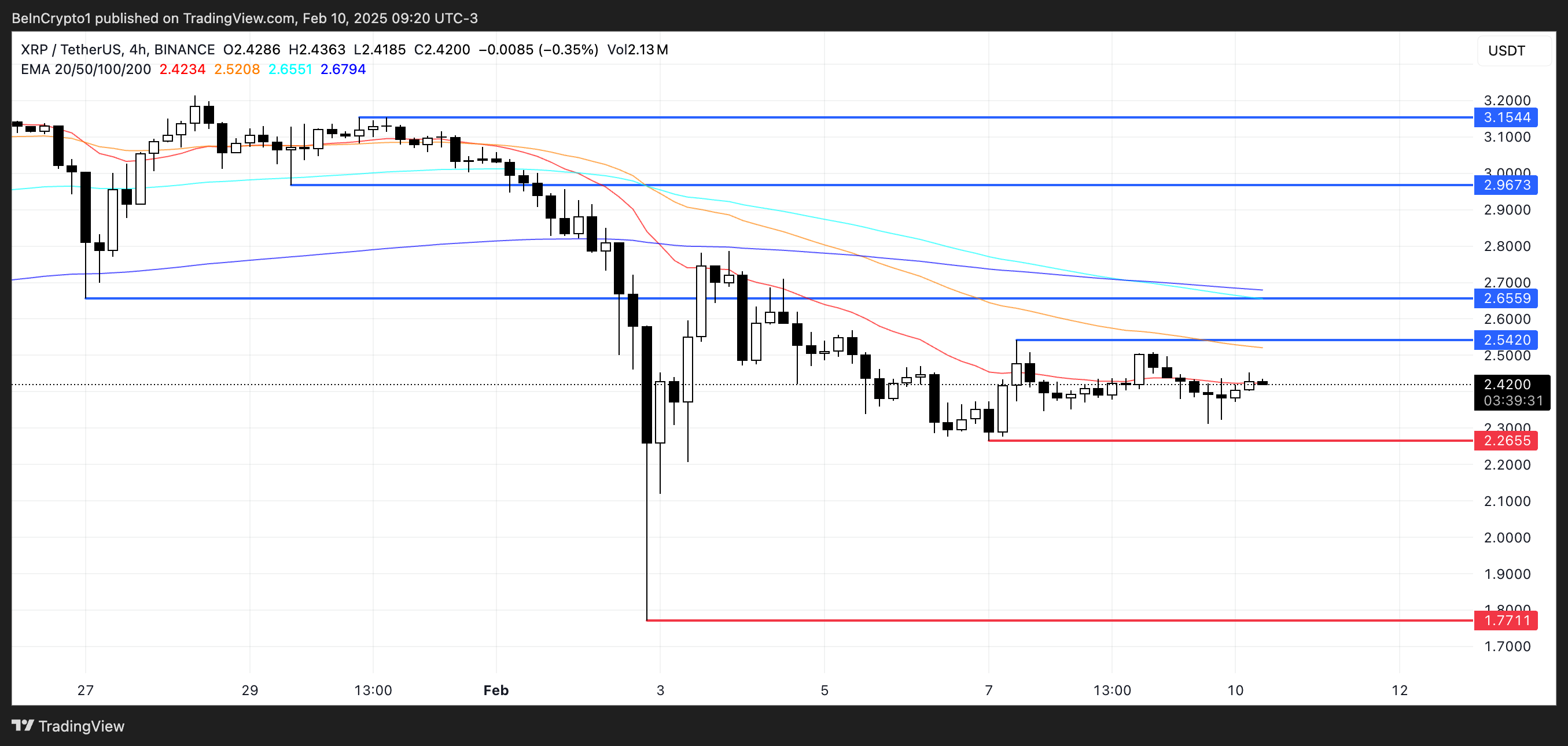

Price prediction XRP: Will XRP be corrected by 26% in February?

XRP EMA lines continue to show a downward configuration, with short -term mobile averages positioned below those in the long term. The price is currently negotiated between a level of support at $ 2.26 and resistance at $ 2.54, indicating a critical range.

If the lower time increases and the support of $ 2.26 fails, the XRP price could see a significant drop to $ 1.77, which represents a potential correction of 26%.

However, if the purchase of the pressure is strengthened and a rise in trend emerges, the XRP price could push towards the resistance of $ 2.54. An escape above this level could open the door to a test of $ 2.65. If Momentum continues, XRP can even challenge $ 2.96.

An increased network activity would further support the bullish momentum, as well as the ETF XRP which is ultimately approved, potentially allowing XRP to exceed $ 3 and test the next major resistance at $ 3.15.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.